See also

30.06.2025 11:15 AM

30.06.2025 11:15 AMThe end of June brought a spectacular rally for the S&P 500. Not only did the broad stock index hit a new all-time high for the first time since February, but it also managed to recover from a decline of at least 15% at the fastest pace in recorded history. Only 89 days passed between the two historic peaks. Investors embraced a "buy-the-dip" strategy—and were handsomely rewarded for it.

From its April lows, the S&P 500 has soared 24%, driven by a shift in investor sentiment. On America's Independence Day, markets bet that Donald Trump would push through tariffs like a bulldozer—head-on. In reality, the US president opted for a more conciliatory approach, which the markets welcomed. His policies of shrinking government bureaucracy and deporting migrants, combined with import tariffs, were expected to hurt the economy severely. However, the economy has remained surprisingly resilient.

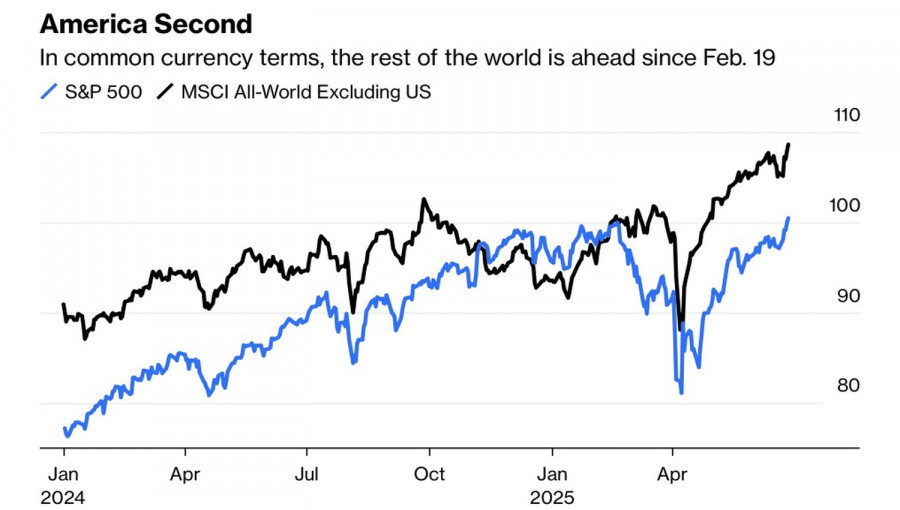

Performance of the S&P 500 vs. global stock markets

Yes, uncertainty over White House policies and fears of a recession put the S&P 500 at a disadvantage compared to other global indices. One of the reasons for capital outflows from the US to Europe and Asia was concern over proposed taxes on non-resident holders of US stocks. Currently, Congress is considering removing this clause from Donald Trump's much-touted tax reform bill.

Just like in the good old days, tech companies are leading the pack again. They are ahead of the curve and played a major role in driving the S&P 500 to record highs. Yes, their valuations are high—tech stocks are trading at a P/E ratio of 30, compared to 22 for the broader index. But as has often been the case in the past, this encourages investors to rotate into other sectors. Market breadth is expanding, which enhances the overall potential.

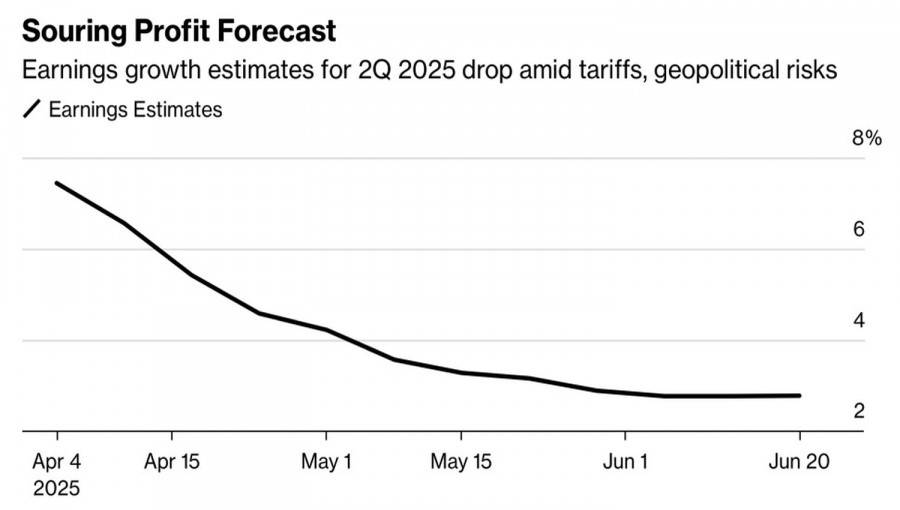

In addition to the high valuations, institutional investors are also concerned about weak earnings expectations. Wall Street analysts forecast just 2.8% earnings-per-share growth in Q2—the lowest projected rate in two years.

S&P 500 earnings forecast trends

"Smart money" also points to other risks: the approaching end of the 90-day tariff reprieve, geopolitical tensions, Donald Trump's attacks on the Federal Reserve, and the ballooning US national debt.

Ignorance is bliss. Retail investors—or the so-called "dumb money"—continue to dominate the US stock market. They buy every dip, and so far, in 2025, that strategy has paid off.

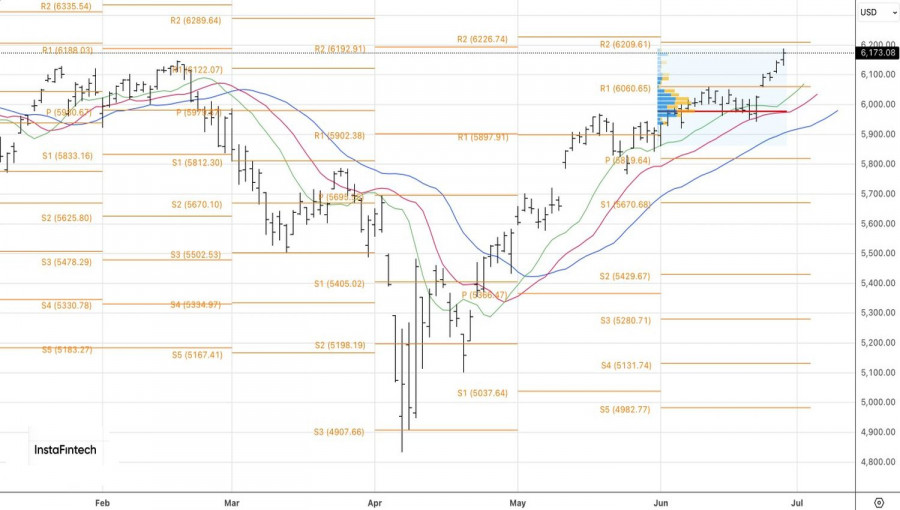

Technically, the S&P 500's daily chart shows a resumed uptrend. The next obstacle for the bulls lies at the cluster of pivot levels around 6,200. A breakout above this resistance could justify increasing long positions in the broad stock index.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.