See also

26.06.2025 09:04 AM

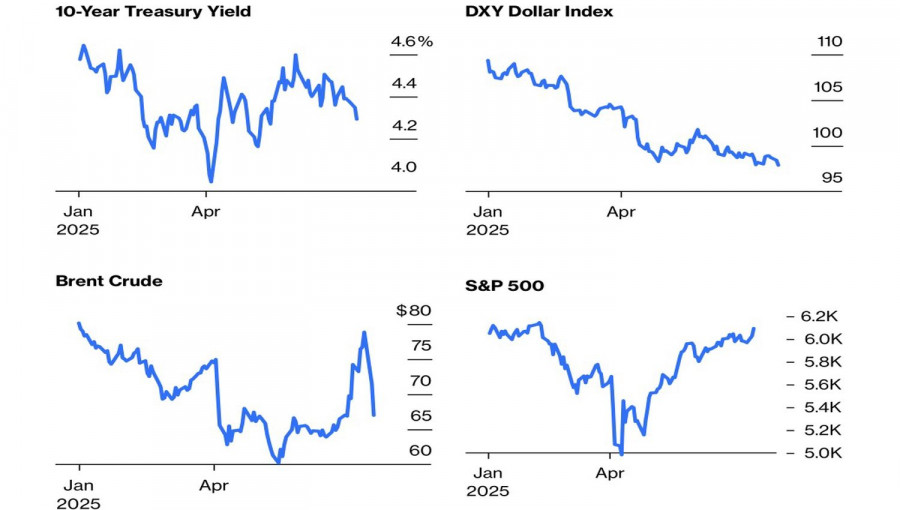

26.06.2025 09:04 AMIt seems that the heavens are aligned with Donald Trump's desires. The U.S. President's successes in the Middle East have led to a new perspective on the policies pursued by the American administration. It turns out—they are effective! Indeed, the Republican leader is highly responsive to stock market rallies, and the S&P 500's proximity to record highs certainly pleases him. Scott Bessent has repeatedly mentioned low bond market yields, low oil prices, and a weak dollar. All of these are becoming reality!

Credit must be given to the occupant of the White House for discovering a cure for all problems: social media! One would think that the highest U.S. tariffs since the 19th century, trade wars, the Federal Reserve's tight monetary policy, inflation fears, competition from European and Asian markets, and geopolitical tensions would create insurmountable barriers for the S&P 500's upward movement. Yet Trump manages to find the right words to calm investors and encourage them to buy American stocks.

Many are concerned about the S&P 500's overvalued fundamentals. The index trades at 22 times forward earnings—35% above its historical average. According to Bloomberg, corporate profits would have to grow by 30% to return to that average. This could be driven either by a strong economy or by aggressive monetary easing by the Fed.

Trump is pushing on both fronts. His "big, beautiful" tax cut project is making its way through Congress. Tariffs increase federal revenue, and the pressure on Jerome Powell is part of a broader plan to lower the federal funds rate. According to the President, the rate should be reduced by 200–250 basis points. In Trump's view, the current Fed Chair is performing terribly, and a replacement could be nominated as early as this fall.

The appointment of a "shadow" Fed Chair has strengthened speculation that a new cycle of monetary expansion could begin sooner rather than later. Derivatives are pricing in a 66 basis point rate cut in 2025, putting pressure on the U.S. dollar and supporting the S&P 500.

Goldman Sachs notes that the inverse correlation between the dollar and the stock index has reemerged due to the armed conflict in the Middle East. The bank explains this by pointing out that the epicenter of global panic currently lies not in the United States but in another region.

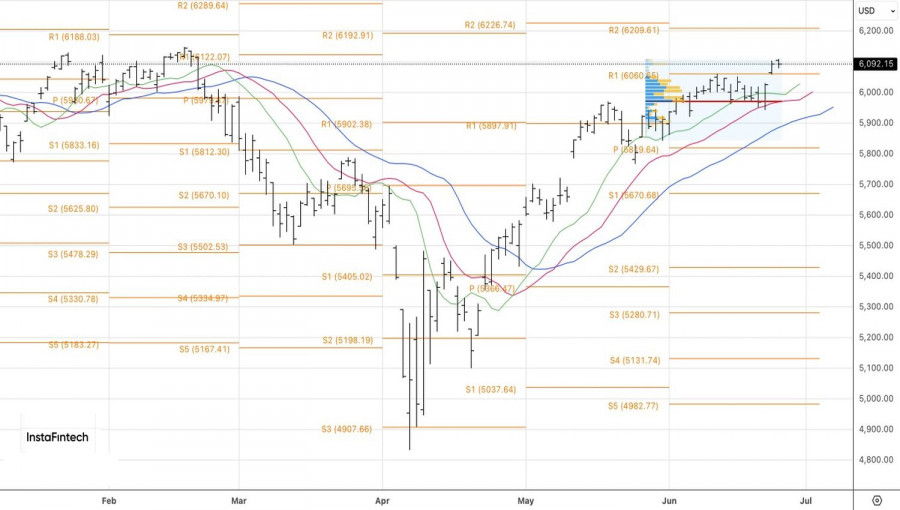

Technically, on the daily chart, the S&P 500 is showing a slight pullback after hitting a new local high. Theoretically, a reversal pattern like "Three Indians" could play out, requiring a break below the support levels at 6060 and 6000. As long as the broad stock index remains above the first level, the focus should remain on buying.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.