See also

28.05.2025 09:43 AM

28.05.2025 09:43 AMHowever, today stock index futures corrected, and Treasuries halted a three-day rally amid lingering concerns over the fiscal health of the U.S. economy. Weak demand at a Japanese bond auction also weighed on sentiment.

Asian indices erased previous gains, slipping by 0.1%, with Hong Kong's index among the worst performers. Longer-dated maturities led to a drop in Treasury prices, while the auction of 40-year Japanese government bonds showed the weakest demand since July of last year.

Investors remain cautious about the fiscal outlook of the U.S., especially after President Donald Trump launched a trade war and pushed for tax cuts, sparking concerns about the nation's growing deficit. This uncertainty, combined with global economic headwinds—such as slowing growth in Europe and Asia—has created a challenging investment environment. As a result, investors are shifting toward safe-haven assets like government bonds and gold, while equities remain exposed to volatility.

One of the key factors influencing investment decisions remains the monetary policy of the U.S. Federal Reserve. High interest rates, aimed at curbing inflation largely driven by Trump's trade policy, may slow economic growth and reduce corporate profitability. Additionally, geopolitical tensions, including conflicts and trade disputes, continue to pressure global markets.

Today's Fed minutes are expected to reiterate recent statements that the central bank is waiting for additional evidence before moving to cut interest rates.

Concerns about governments' ability to finance massive budget deficits have also recently weighed on the bond market, pushing long-term U.S. Treasury yields to levels last seen in 2007.

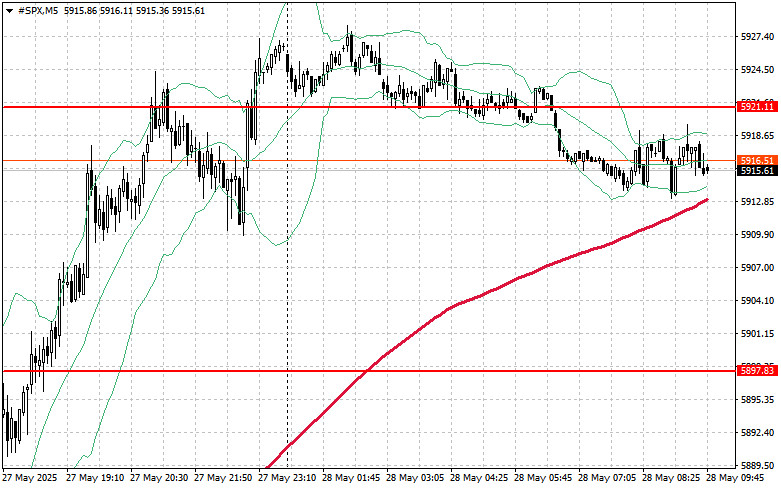

S&P 500 Technical Outlook

The main task for buyers today will be to break through the nearest resistance at $5921. This would support further upside and open the path toward a breakout to $5933.

An equally important goal for the bulls will be gaining control over the $5967 level, which would strengthen buyers' positions.

If the market declines amid a drop in risk appetite, buyers must defend the $5897 level. A break below this level would likely send the instrument down toward $5877, opening the door for a further slide to $5854.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.