See also

30.06.2025 03:37 AM

30.06.2025 03:37 AMThe EUR/USD currency pair has been rising for five consecutive months. During this time, we've only seen a few minor downward corrections, each ending in another collapse of the U.S. dollar. Notably, the market isn't simply selling the dollar blindly due to the global fundamental backdrop. Almost every week, new developments arise that increase pressure on the dollar and provide the market with new reasons to sell it. Thus, over the next five days, the dollar is likely to continue declining due to both known and emerging factors and events.

The macroeconomic background continues to have only a local influence on the pair's movement. A single report might provoke a temporary strengthening of the dollar, but overall, the greenback can now only count on corrections. And each correction presents an opportunity to buy the pair at a more favorable price during a strong uptrend. Therefore, we continue to believe that until the global fundamental backdrop begins to shift, the dollar will remain under market pressure one way or another.

In the upcoming week, several new speeches by Christine Lagarde and her colleagues are expected, along with the publication of inflation data from the Eurozone. At this point, only the Consumer Price Index may have a slight impact on future European Central Bank decisions, but it's essential to note that the ECB has already largely completed its monetary policy easing cycle. As such, short-term inflation changes are now less relevant. Of course, if Donald Trump imposes new tariffs on EU imports starting July 9 and no trade deal is reached, this could trigger future price increases. However, the EU has already acknowledged that tariffs are unlikely to push inflation significantly higher and isn't overly concerned.

We expect the CPI to change only slightly in June. The current forecast suggests a year-over-year increase of 2%. Such a change in inflation would have little to no impact on the ECB's next decision. Most likely, we'll see a pause after eight consecutive key rate cuts. Still, in 2025, the euro has been rising regardless of news from the Eurozone. Even when the ECB was cutting rates, the euro continued to appreciate. Now that the end of the easing cycle is in sight, the euro may use this factor as another reason to continue its upward movement.

We do not expect any significant statements from Lagarde or her colleagues. Last week, Lagarde spoke three times, and none of her remarks brought new information to the market. Currently, traders remain focused on Trump and everything related to him. Therefore, approximately 80% of the EUR/USD pair's movement will depend on him—his decisions and statements—as well as on the U.S. labor market and unemployment reports, given that the Fed may resume monetary policy easing in the second half of 2025.

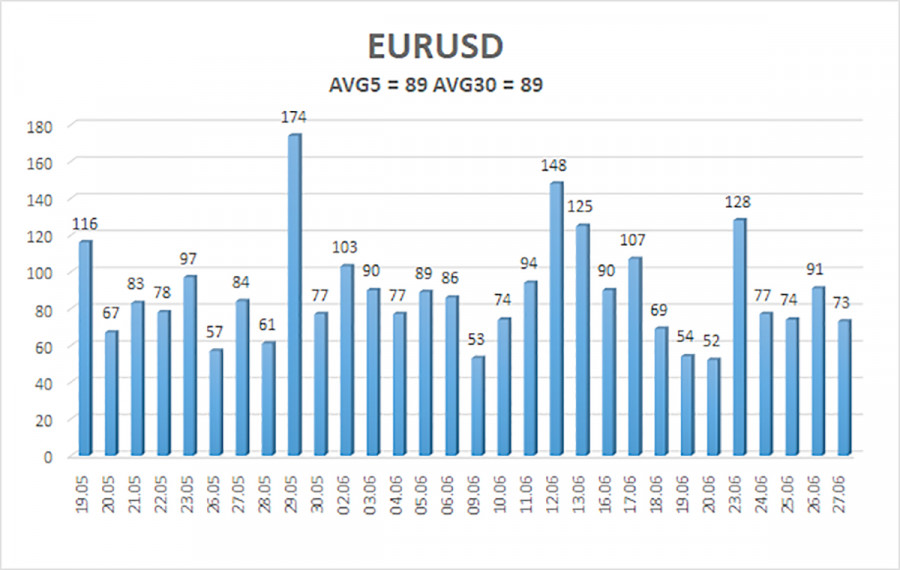

The average volatility of the EUR/USD pair over the last five trading days as of June 30 is 85 pips, which is classified as "moderate." We expect the pair to move between 1.1630 and 1.1808 on Monday. The long-term regression channel is pointing upward, indicating a continued uptrend. The CCI indicator has entered the overbought zone, again triggering only a minor downward correction. At the moment, the indicator is forming bearish divergences, but within the context of an uptrend, these merely signal possible corrections.

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

R1 – 1.1841

R2 – 1.1963

The EUR/USD pair remains in an uptrend. Trump's policies—both foreign and domestic—still exert a strong influence on the U.S. dollar. Additionally, the market interprets many reports unfavorably for the dollar or ignores them. We continue to observe the market's complete unwillingness to buy the dollar under any circumstances. If the price drops below the moving average, short positions may be considered with a target at 1.1475, but a sharp drop should not be expected under the current conditions. Above the moving average, long positions remain relevant, with targets at 1.1808 and 1.1841, in line with the ongoing trend.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The U.S. president is fully implementing his aggressive policy toward everyone and everything — both in foreign and domestic affairs. While his actions toward trade partners are more or less

There are relatively few macroeconomic reports scheduled for Friday, but all of them are quite important. In Germany, the IFO Business Climate Index will be released — the least significant

The EUR/USD currency pair continued to move upward on Thursday. There were several macroeconomic events scheduled for the day, and they did provoke a small market reaction

The results of the ECB July meeting provided slight support for the euro. However, contradictory macroeconomic reports and anticipation of the outcome of the US-EU negotiations played a restraining role

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.