See also

17.06.2025 11:07 AM

17.06.2025 11:07 AMHistory is repeating itself. Ahead of America's Independence Day, many market participants were saying that Donald Trump's bark was worse than his bite — suggesting the US president issued many threats but took little actual action. Reality proved otherwise: back then, the S&P 500 suffered a significant decline due to large-scale tariffs. Now, the index risks falling into the same trap again. Investors seem to believe that geopolitical risks are all bark and no bite.

Rumors of Iran's willingness to resume negotiations over its nuclear program were enough for retail investors to step in and buy the dip in the S&P 500. According to JP Morgan, retail investors purchased $23 billion worth of US equities in May alone. In early June, some players began taking profits, resulting in net sales of $400 million. However, any fresh attempts by the broad index to resume its uptrend are likely to attract new bulls.

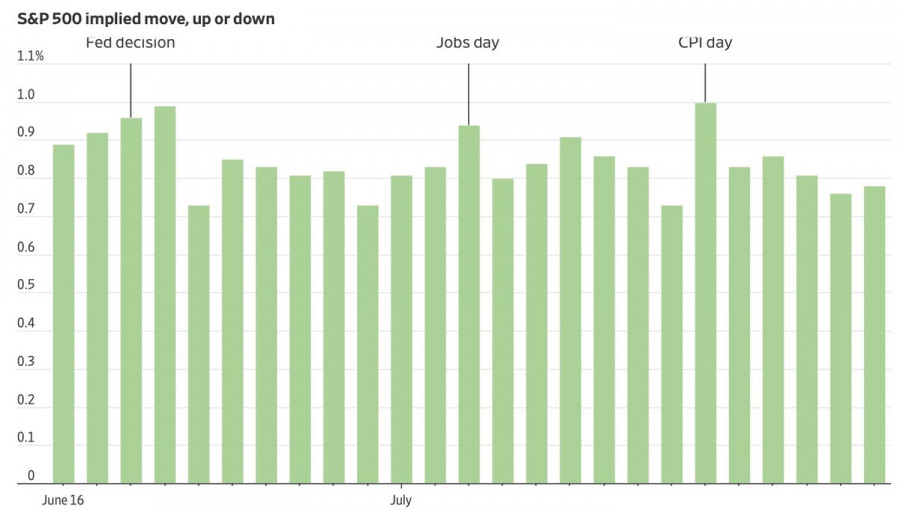

The fading enthusiasm may also be due to the typical summer lull in the stock market. Derivatives suggest that the S&P 500 is likely to trade within a daily range of less than 1% for most of July. Key catalysts that could trigger more significant moves include upcoming US labor market reports and the Federal Reserve's policy meeting.

Projected fluctuations in S&P 500

In reality, Iran's interest in negotiations does not guarantee the end of the armed conflict. Tehran hopes to avoid direct US involvement on Israel's side. It knows that Jerusalem is not equipped for a prolonged campaign and is stalling for time. According to RBC Capital Markets, the S&P 500 could drop by as much as 20% if the Middle East conflict spreads to other countries and drags on. Such a scenario would be a clear negative for US stocks, hurting consumer sentiment, the broader US economy, and potentially prompting a hawkish shift from the Federal Reserve.

Indeed, Iran remains one of the world's largest oil producers. Bombings targeting oil infrastructure push Brent and WTI prices higher. Moreover, Tehran has the capability to block the Strait of Hormuz — a vital artery for Middle East oil exports to Europe. This could drive gasoline prices sharply higher in the US, making it difficult for the Fed to resume its easing cycle before year-end. Higher interest rates would clearly weigh on US equities.

Risks are also building on the trade front. The US has failed to nail down trade deals with Canada, Japan, and several other nations. As the 90-day grace period expires in early July, the likelihood of renewed trade wars grows.

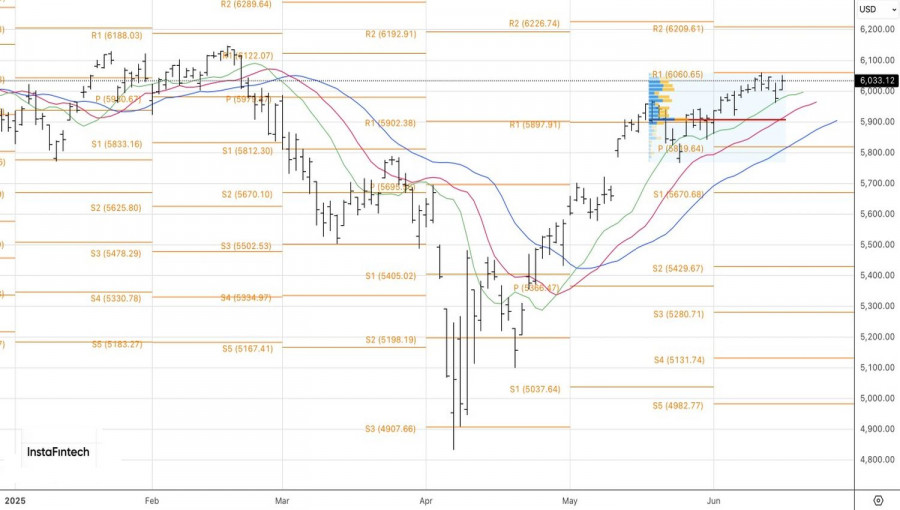

Technical outlook for S&P 500

Technically, bulls on the S&P 500 are attempting to reclaim the key pivot level at 6,060 on the daily chart. As long as the broad index remains below this level — or if bullish attempts to break through it fail again — selling on rallies remains a valid strategy.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.