See also

12.06.2025 06:05 AM

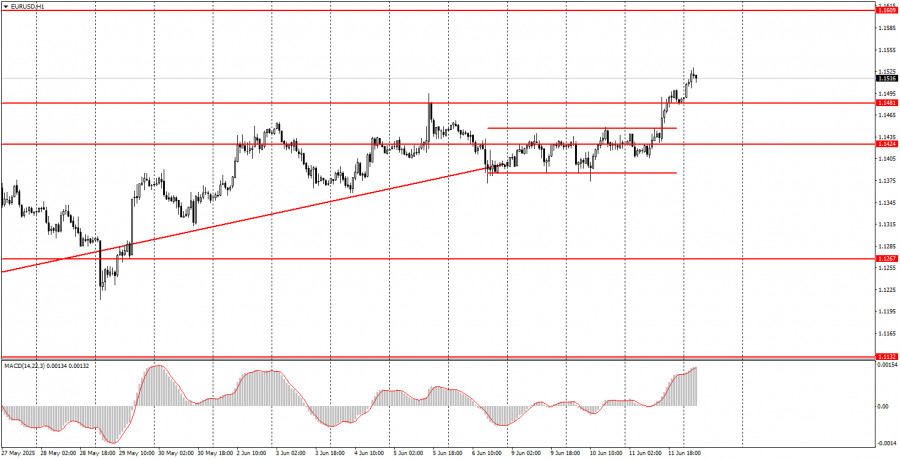

12.06.2025 06:05 AMOn Wednesday, the EUR/USD currency pair resumed its upward trend, lasting more than four months. More precisely, it has continued since Donald Trump became president. As we can see, the pair rises sharply, corrects weakly, or consolidates within a range. This week, for example, the pair moved sideways in a narrow price range for 2.5 days before resuming its climb. Notably, the trigger for the dollar's new decline was relatively minor: a U.S. inflation report published yesterday came in 0.1% below expectations. Such a deviation is not enough to justify an 80-pip drop in the dollar. However, the issue isn't inflation, which currently has little influence on a Federal Reserve in pause mode. The real issue lies in the U.S., where mass protests against Trump continue, no trade deals have been signed, and relations with China and the EU remain tense. These broader fundamental factors continue to push the U.S. dollar deeper into decline.

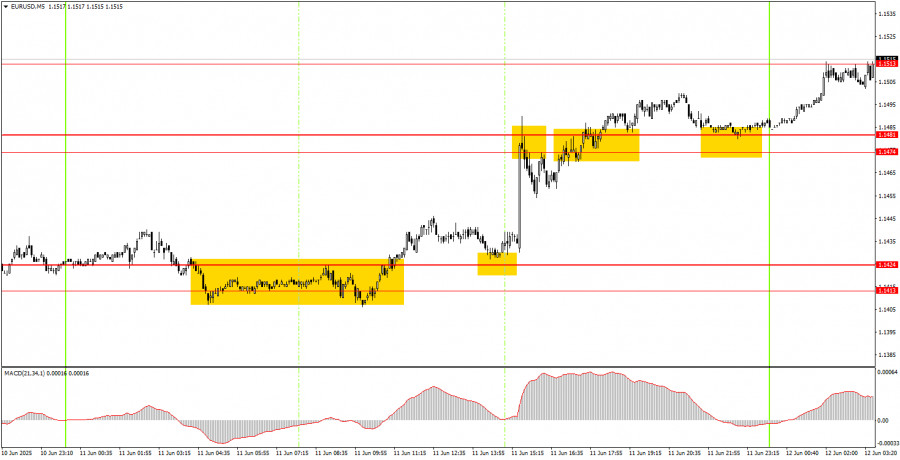

On the 5-minute timeframe, several signals were generated on Wednesday, but the movements were choppy. Before the inflation report was released, the pair traded very calmly, then sharply jumped, followed by more stable price action. Two buy signals were generated during the European session and mirrored each other. This allowed novice traders to enter long positions before the rally. The price then quickly tested the 1.1474–1.1481 area but failed to break through, so long positions could have been closed in solid profit. A break above this zone would have allowed for new longs, and the euro continued to rise.

In the hourly timeframe, the EUR/USD pair has broken the ascending trendline, but the uptrend that began under Donald Trump remains intact. In principle, the fact that Trump is president is still enough for the market to continue selling the dollar. That alone is a strong reason for traders to flee the dollar without hesitation. Trump continues to issue threats, set ultimatums, impose or raise tariffs, and make other disruptive decisions. As a result, even if the market isn't selling the dollar daily, it certainly has no appetite to buy it either.

On Thursday, the EUR/USD pair will likely continue its upward movement, as no positive news is coming from the U.S. The market continues to look for any excuse to sell the dollar, only occasionally pausing briefly.

On the 5-minute timeframe, watch these key levels: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. No significant events are scheduled for either the EU or the U.S. on Thursday, but remember that mass protests and unrest continue in America.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the 1.3475 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and examine what happened. A decline

In my morning forecast, I highlighted the 1.1537 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair traded with an upward bias. However, there were no clear or solid reasons for this movement. Recall

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair attempted to extend its decline within the new downward trend, but the dollar's rally ended

The GBP/USD currency pair continued its downward movement on Thursday, but only briefly. In the second half of the day, when the results of the Bank of England meeting were

On Thursday, the EUR/USD currency pair displayed a complete lack of activity, showing no inclination to trade or move. Despite the Federal Reserve meeting held the previous day, the market's

Analysis of Wednesday's Trades 1H Chart of GBP/USD On Wednesday, the GBP/USD pair spent most of the day in a minimal upward movement, clearly awaiting the outcome of the Federal

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair generally continued trading downward. However, the U.S. dollar only resumed its rise after the results

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.