See also

19.06.2025 07:58 PM

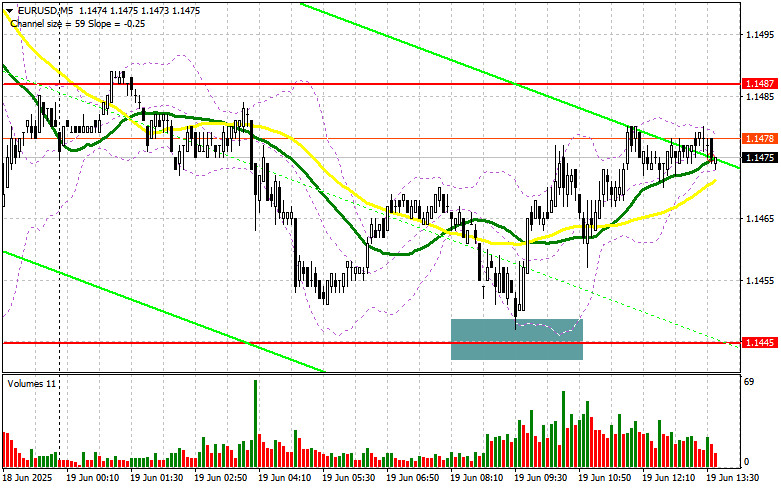

19.06.2025 07:58 PMIn my morning forecast, I focused on the 1.1445 level and planned to make trading decisions based on it. Let's look at the 5-minute chart to understand what happened. The price declined, but it fell short of forming a false breakout near 1.1445 by just a few points, so I remained without trades in the first half of the day. The technical outlook for the second half of the day remained unchanged.

To open long positions on EUR/USD:

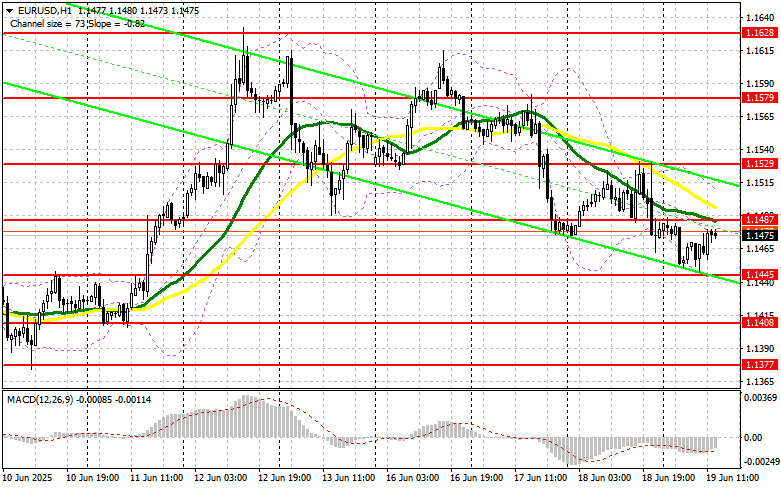

The absence of fundamental statistics from the eurozone helped reduce pressure on the euro, allowing the EUR/USD pair to hold near the weekly low and rebound from it. Unfortunately, there are no fundamental U.S. statistics expected in the second half of the day either, so high volatility is unlikely due to the holiday. If the euro declines, I will act near the 1.1445 support level, which we failed to reach earlier. A false breakout there will be a reason to buy EUR/USD in anticipation of a recovery and a retest of the 1.1487 resistance. A breakout and retest of this range will confirm the correct entry point, targeting the 1.1529 area. The furthest target will be the 1.1579 level, where I will take profit. If EUR/USD declines and there is no activity near 1.1445, pressure on the pair will increase, leading to a deeper drop. In that case, bears may reach 1.1408. Only after a false breakout form will I consider buying the euro. I also plan to open long positions immediately on a rebound from 1.1377, aiming for an intraday upward correction of 30–35 points.

To open short positions on EUR/USD:

Sellers showed up but lacked support from large players, which led to a correction in the pair. In case of another upward attempt, a false breakout around 1.1487 will be a signal to open short positions, targeting the 1.1445 support. A breakout and consolidation below this level will be a good selling signal, with a move toward 1.1408. The furthest target will be the 1.1377 area, where I plan to take profit. If EUR/USD continues to rise in the second half of the day and bears remain inactive around 1.1487 (where moving averages are acting in sellers' favor), buyers may push the pair toward 1.1529. I will sell there only after an unsuccessful consolidation. I also plan to open short positions immediately on a rebound from 1.1579, aiming for a downward correction of 30–35 points.

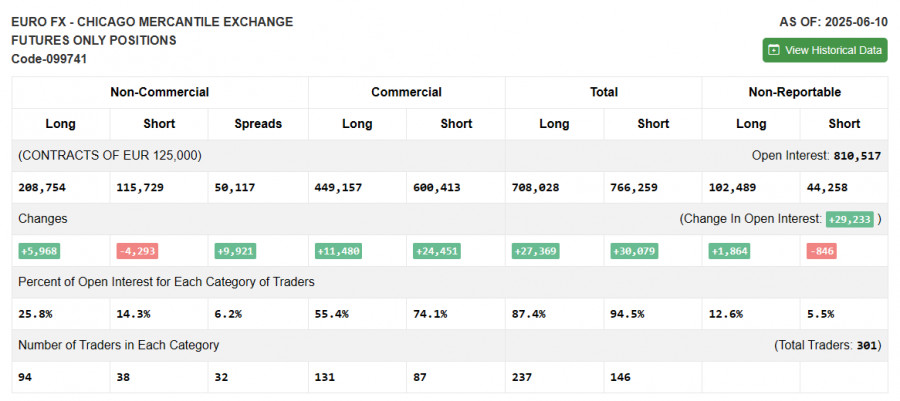

COT Report (Commitment of Traders) – June 10

The COT report for June 10 showed a reduction in short positions and a rise in long positions. The data showing a sharp drop in U.S. inflation did not provide sufficient support for the dollar, despite the clear expectation that the Federal Reserve will keep rates unchanged in the near future. More important will be how Powell comments on the inflation situation and what forecasts he gives for potential rate cuts in the fall. This will determine the future direction of the EUR/USD pair, which currently shows no signs of struggling to rise—something the report confirms. The COT report indicated that non-commercial long positions increased by 5,968 to 208,754, while non-commercial short positions declined by 4,293 to 115,729. As a result, the gap between long and short positions increased by 9,921.

Indicator Signals:

Moving AveragesTrading is conducted below the 30- and 50-day moving averages, which indicates continued downward pressure on the pair.

Note: The periods and prices of the moving averages are considered by the author on the H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands In case of a decline, the lower boundary of the indicator around 1.1445 will act as support.

Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Monday's Trades 1H Chart of EUR/USD The EUR/USD currency pair plunged on Monday for quite understandable, logical, and consistent reasons. Essentially, the only event

The GBP/USD currency pair traded more calmly on Monday. The European trading session passed entirely in a flat range, but during the U.S. session, the euro pulled the pound downward

On Friday, the GBP/USD currency pair was trading in a downtrend. The price easily broke through the Senkou Span B and Kijun-sen lines, as well as worked through the 1.3420

On Friday, the EUR/USD currency pair once again traded with low volatility but demonstrated nearly perfect technical behavior. There was little news during the day, with the only noteworthy report

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair exhibited a relatively strong decline, triggered by weak business activity indices in the UK. However, this explanation

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no significant movements on Thursday and remained in low volatility, despite it being the most eventful

InstaTrade video

analytics

Daily analytical reviews

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.