See also

10.06.2025 09:30 AM

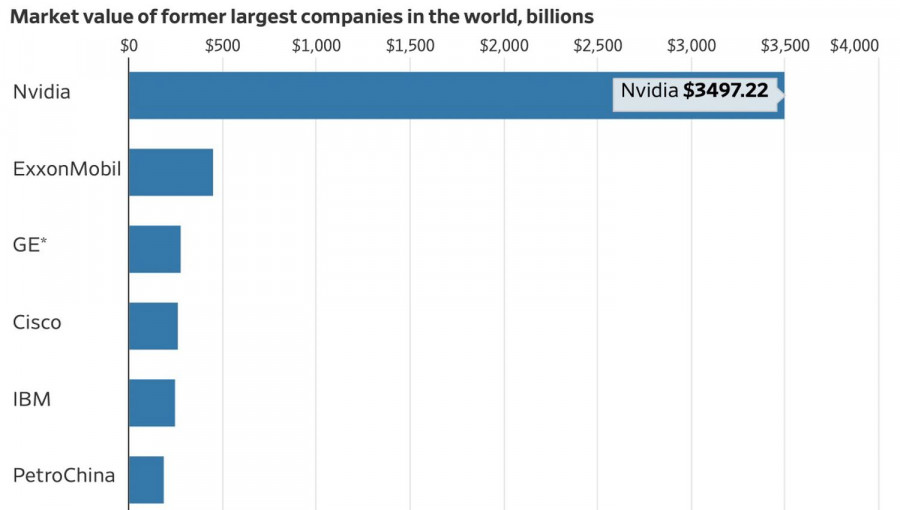

10.06.2025 09:30 AMNothing lasts forever under the moon. While markets advance gradually, investors closely monitor the competition among the world's most valuable companies. NVIDIA and Microsoft take turns leading, while Apple lingers hopelessly in third place. Tesla is performing the worst among the Magnificent Seven—which is hardly surprising given the recent clash between Donald Trump and Elon Musk. Yet history shows us that the stars of yesterday eventually fade away.

A quarter century ago, Cisco Systems shares were considered a must-have in any investment portfolio. However, since peaking in March 2000, simply putting money into a bank account would have delivered better results. The disheartening stories of General Electric and IBM, rulers of the 1990s and 1980s, respectively, suggest that NVIDIA's reign may also be short-lived—especially now that formidable Chinese competitors have emerged.

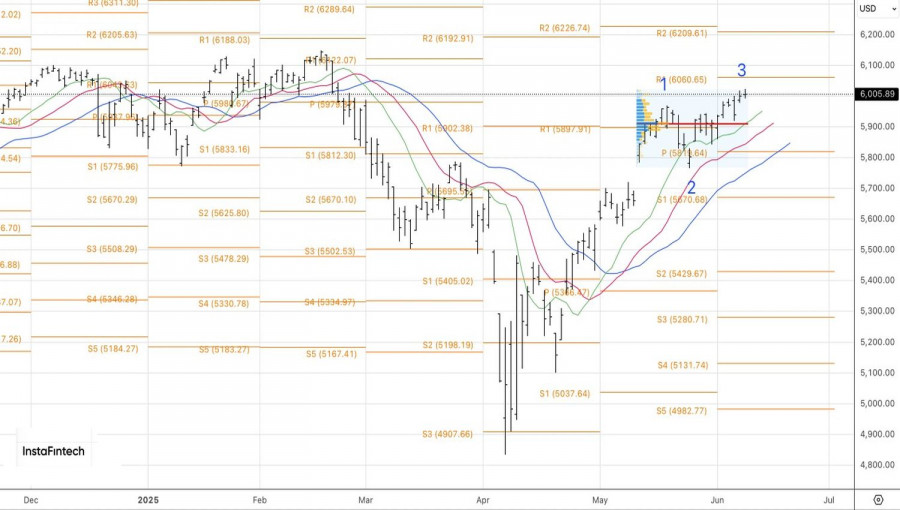

Trump imposed restrictions on software and chip exports to China to keep the tech giant on the throne. Lifting those restrictions in exchange for Beijing loosening export controls on rare earth miners is a key topic in the U.S.-China trade talks in London. The continuation of the dialogue, the White House's willingness to make concessions, and National Economic Council Director Kevin Hassett's remark that the meeting will be brief all fuel the S&P 500 rally.

The market is increasingly convinced that the tariff peak has passed and the worst is over. Combined with strong corporate earnings and the resilience of the U.S. economy, this supports the continued northbound trajectory of the broad stock index. Still, there is growing sentiment in the market that the uncertainty surrounding White House economic policy must diminish for the S&P 500 rally to extend and reach new record highs. But is that even possible with such an eccentric president?

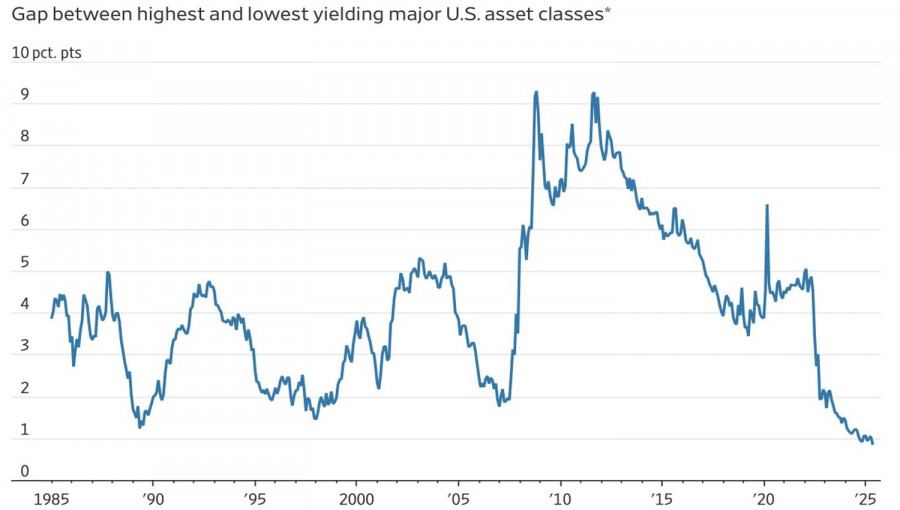

Meanwhile, investors are puzzled by another mystery. The returns on Treasury bonds, equities, cash, and corporate debt have converged. The difference between the highest- and lowest-yielding assets has reached its narrowest point in four decades. That implies either that risky assets are less useful than usual or that safe assets are not as safe—or possibly both.

Trump's policies are reshaping not just global trade but also financial markets.Technically, the S&P 500 continues its rally on the daily chart, heading toward the pivot level at 6060. Whether it breaks through will determine the fate of the broad stock index. A successful breakout of this key resistance will justify increasing long positions from the 5945 level. Conversely, a pullback would be a reason to lock in profits and consider selling.You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.