See also

19.05.2025 09:18 AM

19.05.2025 09:18 AMNothing seems to matter. One would think that after the White House signed trade agreements with Britain and China, and following Donald Trump's visit to the Middle East, the S&P 500 would be losing momentum. Especially given the disappointing macroeconomic data out of the U.S., the unwillingness of the EU, Japan, and South Korea to make compromises, and the downgrade of the U.S. credit rating, all factors should have pushed the broad stock index lower. However, when a frenzied crowd takes charge, there is no guarantee the laws of economics will hold.

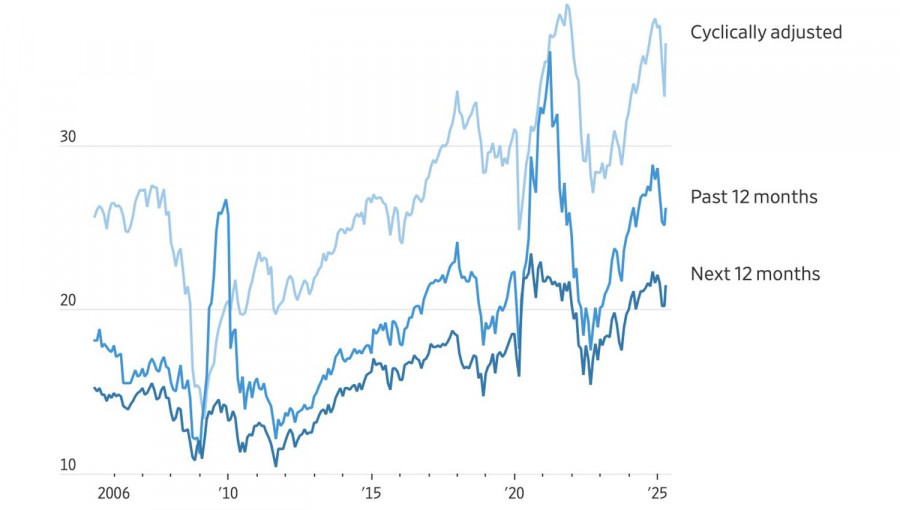

Moody's has become the last of the three major agencies to strip the U.S. of its highest rating. In theory, this should accelerate the sell-off of U.S. bonds, increase their yields, and push stock prices lower. By the way, stocks already look expensive by various price-to-earnings (P/E) metrics. Indeed, while the U.S. market trades at 23 times forward earnings, in the rest of the world it's just 14 times.

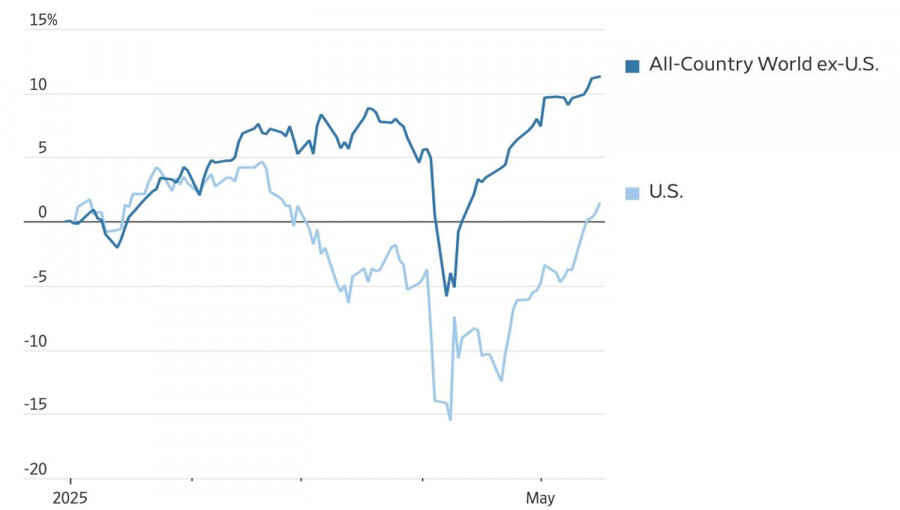

The more than 20% rally in the S&P 500, fueled by investor enthusiasm, is certainly noteworthy. However, since the start of the year, the broad stock index has only gained a meager 1.3%. For comparison, the EuroStoxx 600 is up 8%, and Germany's DAX 40 is up 19%. In U.S. dollar terms, the European indexes have gained 17% and 28% respectively. No wonder capital continues to flow from North America to Europe.

At the heart of this is the loss of American exceptionalism. The only question is whether this is a temporary retreat due to excessive bets on U.S. equities in past years or the beginning of America's long and painful decline relative to the rest of the world.

In 2024, U.S.-listed stocks accounted for two-thirds of the global MSCI equity index. The 10 most valuable companies in the world were all American. Over the past five years, the U.S. economy has vastly outperformed its rivals, and the USD index has reached heights not seen since the Plaza Accord of 1985. America held undisputed leadership in innovation, productivity, and finance. In other words, exceptionalism had gone too far.

Donald Trump's return to the White House jolted investors awake. The growing unpredictability of U.S. policy demands diversification in investment portfolios. The U.S. is no longer a safe haven for capital. Returns are lower than in Europe, and the risks are no less significant. This leads to the conclusion that the U.S. stock market may continue to underperform, no matter how much the crowd inflates the bubble. Isn't it time for it to burst?

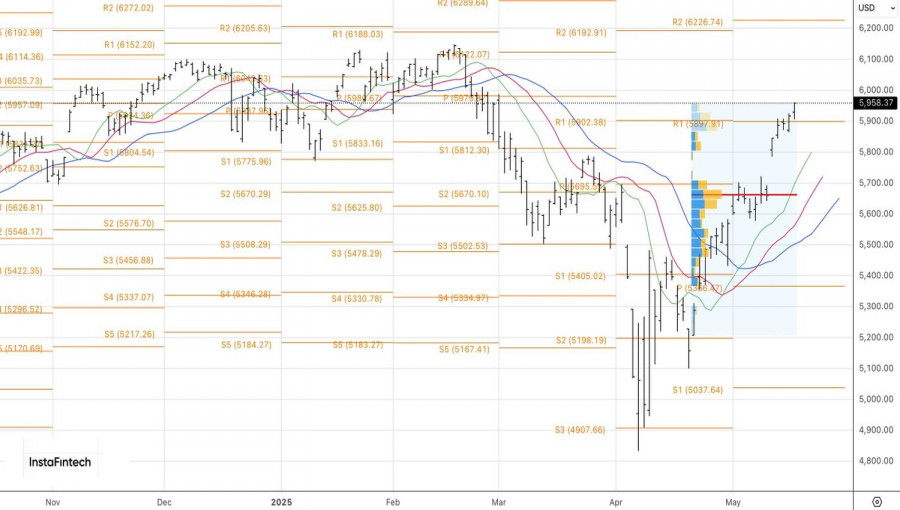

Technically, the daily chart of the S&P 500 shows the continuation of a rally. Long positions initiated from the 5900 level still make sense to hold. However, a drop below this level or a rebound from resistance zones at 5980 and 6040 would signal to start selling the broad stock index.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.