See also

16.05.2025 10:21 AM

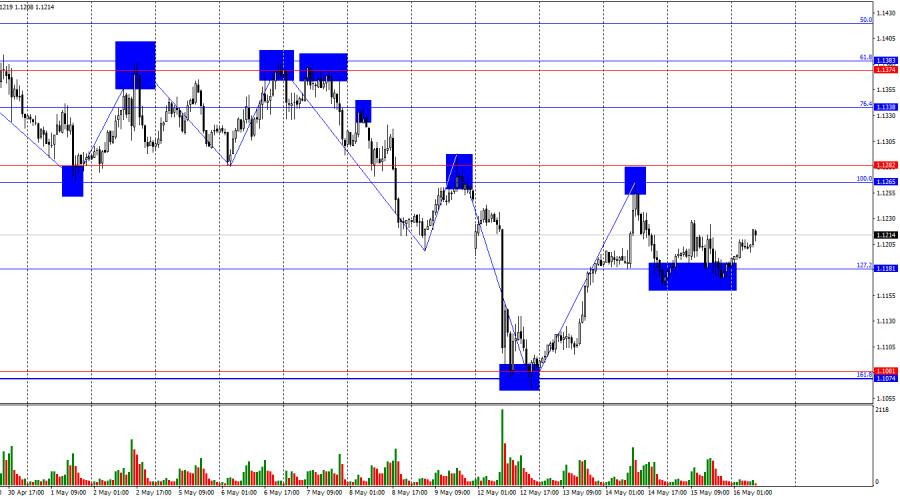

16.05.2025 10:21 AMOn the hourly chart, the wave structure remains straightforward. The last completed upward wave failed to break the previous high, while the most recent downward wave broke the previous low—thus maintaining the bearish trend. News of progress in U.S.-China trade talks supported the bears, but they still have many hurdles to overcome before claiming victory.

Thursday's fundamental backdrop offered little help to either bulls or bears. Reports from both the Eurozone and the U.S. were strikingly mixed. Eurozone industrial production jumped by a record 2.6% in March, but GDP growth slowed from 0.4% q/q to 0.3% in Q1. In the U.S., retail sales rose by 0.1% m/m in April—beating expectations—but the Producer Price Index unexpectedly declined by 0.5%. Rather than the inflation acceleration promised by Jerome Powell, the data suggest further disinflation may be ahead.

At some point, even Powell may be forced to concede, and the Fed might reduce rates—despite the FOMC president's firm stance last meeting that no such action was necessary. Throughout Thursday, the market moved sideways in response to the contradictory data, while traders continued waiting for new trade deals from the Trump administration. As of now, only one deal has been signed—with the UK—which is not enough to justify a confident or sustained bearish run.

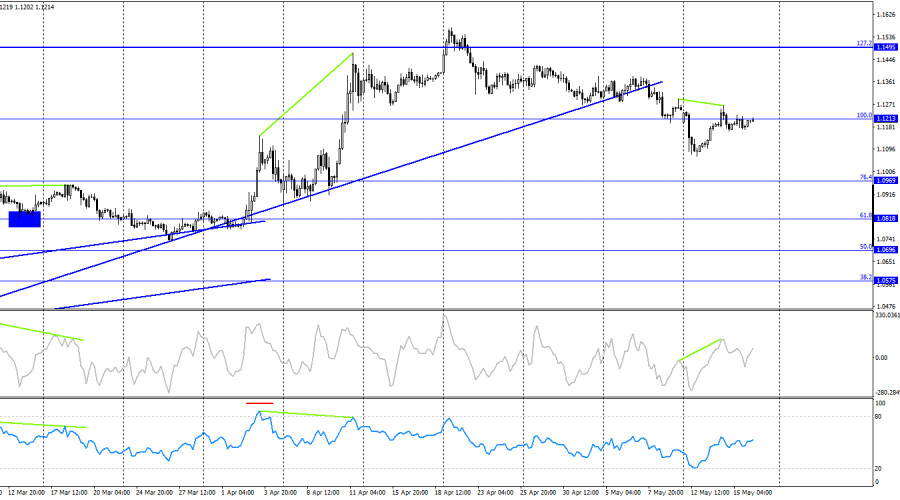

On the 4-hour chart, the pair remains below the 100.0% Fibonacci level at 1.1213, keeping the door open for a further decline toward the next retracement at 76.4% — 1.0969. A rebound from 1.1213 could revive support for the dollar, while a close above it would favor the euro and the return of a bullish trend toward the 127.2% Fibonacci level at 1.1495. A bearish divergence in the CCI indicator increases the likelihood of renewed price declines.

Commitments of Traders (COT) Report:

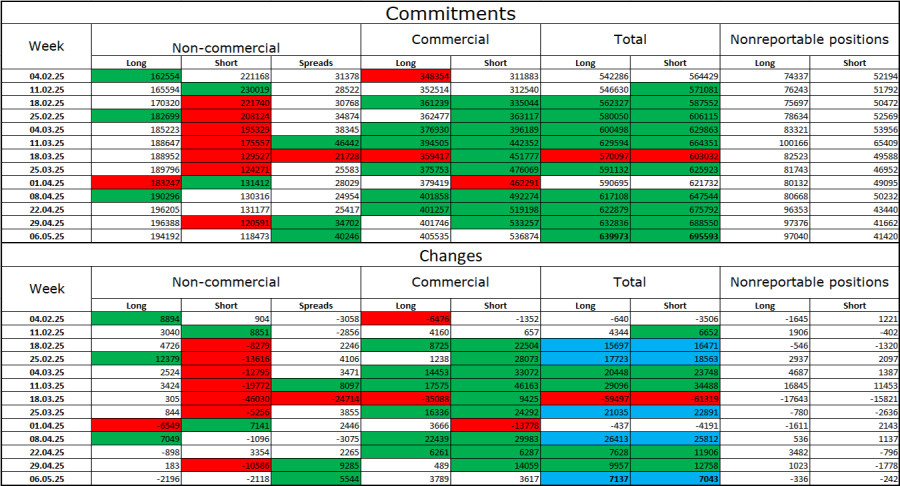

Over the latest reporting week, professional traders closed 2,196 long positions and 2,118 short positions. The sentiment among non-commercial traders remains bullish—thanks in part to Donald Trump. The total number of long positions held by speculators now stands at 194,000, compared to 118,000 short positions. Just a few months ago, the situation was reversed.

Large investors had been shedding euro positions for 20 weeks, but they've now been increasing long positions and reducing shorts for 13 consecutive weeks. While the policy divergence between the ECB and the Fed continues to favor the U.S. dollar, Trump's political influence remains a major wildcard, as his actions could trigger a recession in the U.S.

Economic Calendar – May 16:

U.S.:

Friday's economic calendar contains several entries, but none are considered major. Overall, the fundamental backdrop is expected to exert limited influence on market sentiment.

EUR/USD Forecast and Trading Advice:

Selling the pair is advisable today upon a close below 1.1181 on the hourly chart, with a target at the 1.1074–1.1081 zone. Alternatively, another rebound from the 1.1213 level on the H4 could also trigger a sell opportunity. As of now, I do not see any clear patterns that would support buying.

Fibonacci Grids:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what is seen on the 4-hour chart of the GBP/CAD cross currency pair, there appears to be a Divergence between the GBP/CAD price movement and the Stochastic Oscillator indicator

If we look at the 4-hour chart of the EUR/JPY cross currency pair which moving below the WMA (21), which also has a decreasing slope and the appearance of Convergence

EUR/USD is trading around 1.1437, below the Murray 6/8 level and within the uptrend channel formed on May 9. The instrument has an area where buyers have found it easier

Graphical patterns

indicator.

Notices things

you never will!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.