See also

15.05.2025 03:41 AM

15.05.2025 03:41 AMThe EUR/USD currency pair continued its recovery on Wednesday despite an empty macroeconomic calendar. We are not counting the sole inflation report from Germany, as it initially had no potential to influence the pair's movement, and it didn't need to. This week, traders haven't lacked news or reasons to open positions. As early as Monday, news emerged that China and the U.S. had reached an agreement in their first meeting, with import tariffs to be reduced to 30% and 10%, respectively. Both parties removed most of their trade barriers, reopening trade between the world's two largest economies. However, this factor provided only brief support for the U.S. dollar.

By Tuesday, a sharp dollar sell-off began, initially triggered by technical correction needs, then reinforced by a weaker-than-expected inflation report. Once again, we must highlight the market's one-sided reaction to macroeconomic data. At the beginning of the month, the unemployment rate remained steady, and NonFarm Payrolls surpassed expectations. However, the market's reaction was muted. The dollar rose—but only slightly. When the Federal Reserve opted not to cut interest rates or announce any easing of policy in upcoming meetings, the dollar experienced only a modest rise again. Yet, the dollar collapsed when inflation came in just 0.1% below forecasts.

Everyone in the market understands that April's CPI result was an anomaly. Some experts pointed out that retailers likely didn't have time to raise prices, possibly in anticipation of tariff relief. Prices didn't rise simply because businesses delayed passing on costs. But in reality, costs did go up, and no business will sell goods or services at a loss. So, even with Trump's current "preferential" tariffs, inflation will rise—it's just a question of by how much.

Nevertheless, the market ignored this, along with the Fed's ongoing hawkish stance, and eagerly seized every opportunity to sell the dollar. This behavior is understandable—trusting Trump can be costly. One day, he wakes up in a good mood and praises a great trade deal with China; the next, it rains in Washington, and he lashes out at the EU with threats and criticism. So, there is no confidence that the trade war has truly de-escalated. Nor is there any certainty that the economy will respond positively to the 74 remaining trade deals yet to be signed. So far, Trump has signed just one.

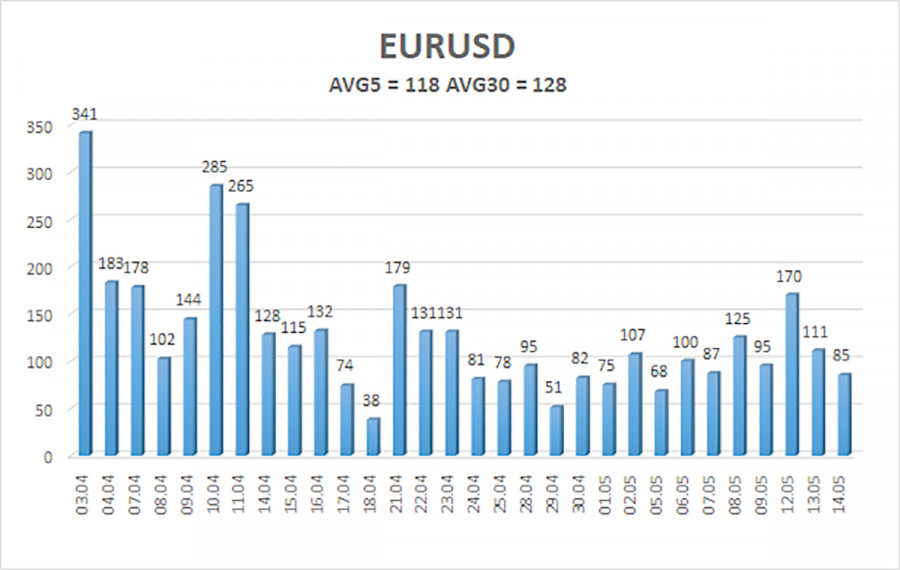

As of May 15, the pair's average volatility over the past five trading days is 118 pips, which is considered "high." On Thursday, we expect the pair to move between 1.1092 and 1.1328. The long-term regression channel still points upward, signaling a short-term bullish trend. The CCI indicator entered the oversold zone last week, which, on a bullish trend, suggests a continuation. Later, a bullish divergence formed, triggering another upward wave.

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

The EUR/USD pair continues a downward correction within a bullish trend. For months, we have stated that we expect the euro to fall in the medium term, and that view hasn't changed. Aside from Donald Trump, the dollar still has no real reason to fall. Lately, however, Trump has leaned toward a trade truce. Thus, the trade war factor now lends some support to the dollar, which could return to its prior position around 1.03. Under the current circumstances, long positions are not considered relevant. Short positions with targets at 1.1108 and 1.1092 remain appropriate if the price remains below the moving average.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Although the market has largely stopped reacting to incoming economic data—especially from the U.S.—and is more focused on the geopolitical and economic moves of Donald Trump, who is steering

There are only two macroeconomic reports scheduled for Tuesday. Although the first report looks significant on its own and the second one is directly related to the U.S. labor market

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.