Vea también

05.05.2025 12:51 AM

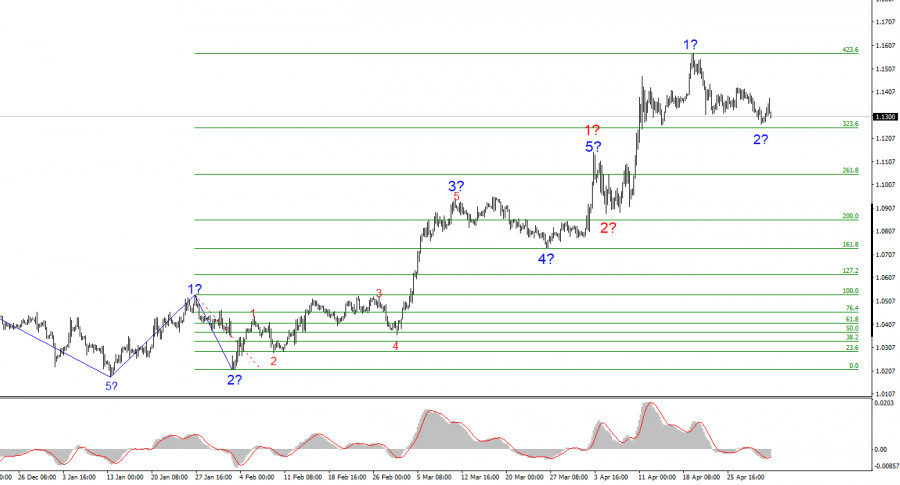

05.05.2025 12:51 AMFor several weeks, the euro has remained in a sideways range. It seems like every analyst has already pointed this out and noted that without news from Trump, there's no movement in the market—quite literally. Economic data (as always) has been abundant. Last week, the United States released a significant amount of important data. The U.S. dollar slightly appreciated by the week's end, but I expected a different market reaction. It's clear that the news background matters to the market only when it concerns the trade war or other major and unexpected decisions by Donald Trump. It is uncertain how much longer the market will continue to wait. The fact that demand for the U.S. dollar has increased slightly recently does not seem particularly important to me. The wave layout of the EUR/USD instrument still indicates an upward trend segment, but even that is not of primary importance—Trump can easily disrupt it.

In the Eurozone, we will see reports on services sector activity, retail sales, and Germany's industrial production—and that's it. Even setting aside the fact that the market is ignoring economic data, the most interesting developments will come from the UK and the U.S., where central bank meetings are scheduled. Let me remind you that at the last European Central Bank meeting, it was decided to cut interest rates. The deposit rate is now practically at a neutral level. The Federal Reserve, meanwhile, has remained silent and hasn't carried out a single round of easing in 2025. This fact, however, plays no role in the market right now—otherwise, demand for the U.S. dollar would be growing. I believe the upcoming economic data from the Eurozone will have no significant impact on the market.

Based on my analysis of EUR/USD, I conclude that the pair is continuing to build a new bullish wave segment. Soon, the wave count will depend entirely on the stance and actions of the U.S. President. This must always be kept in mind. From a purely wave-based perspective, I had expected a three-wave correction within wave 2. However, wave 2 has already ended in a single-wave form. Wave 3 of the upward trend has begun, and its targets could extend to the 1.25 area. Reaching these levels will depend entirely on Trump. A corrective wave may form at the moment, but growth is expected to resume once it is complete.

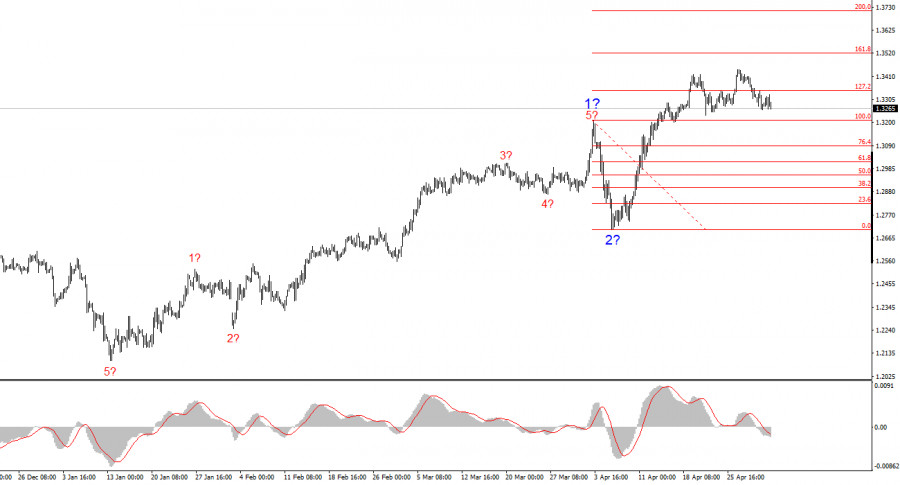

The wave structure of GBP/USD has shifted. We are now dealing with a bullish, impulsive trend segment. Unfortunately, under Donald Trump, markets may experience numerous shocks and reversals that defy wave theory and any other form of technical analysis. The presumed wave 2 has been completed, as the price has moved beyond the peak of wave 1. Therefore, we should expect the formation of bullish wave 3, with short-term targets at 1.3541 and 1.3714. It would be helpful to see a corrective wave 2 within wave 3, but the dollar would need to strengthen. And for that to happen, someone would have to start buying it.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados mundiales siguen bajo la fuerte influencia de los acontecimientos que ocurren en Estados Unidos, que tanto en el ámbito político como en el económico se comportan como

El par de divisas el par GBP/USD el jueves se consolidó por debajo de la línea media móvil, mientras que el dólar creció durante tres días consecutivos. Sin embargo, todo

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.