Vea también

27.05.2024 08:34 AM

27.05.2024 08:34 AMGOLD

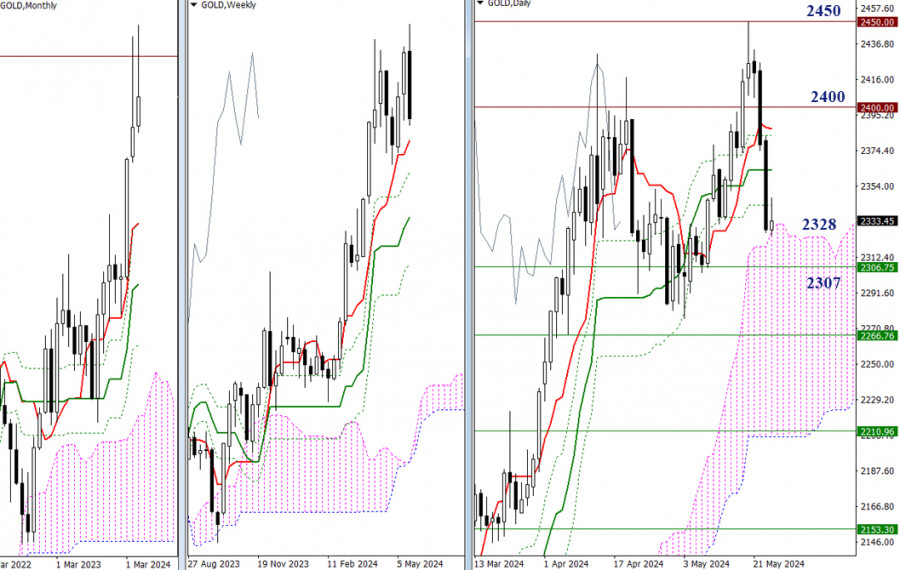

Gold slowed down, encountering support from the daily Ichimoku cloud (2328). All the levels of the daily Ichimoku cross have been breached, so eliminating it and forming a dead cross will be the primary objectives. The bears have formed a distinctly bearish candlestick pattern on the weekly timeframe. Ahead are the support levels of the weekly Ichimoku golden cross (2307 – 2267 – 2211). The bears will focus on these levels in the near future. This will be the final week of May, and it resembles April. If the trend continues, the bears are in an advantageous place to strengthen their positions further. However, if the bulls decide to regain lost ground, they will need to recover by returning to the psychological resistances at 2400 and 2450.

H4 – H1

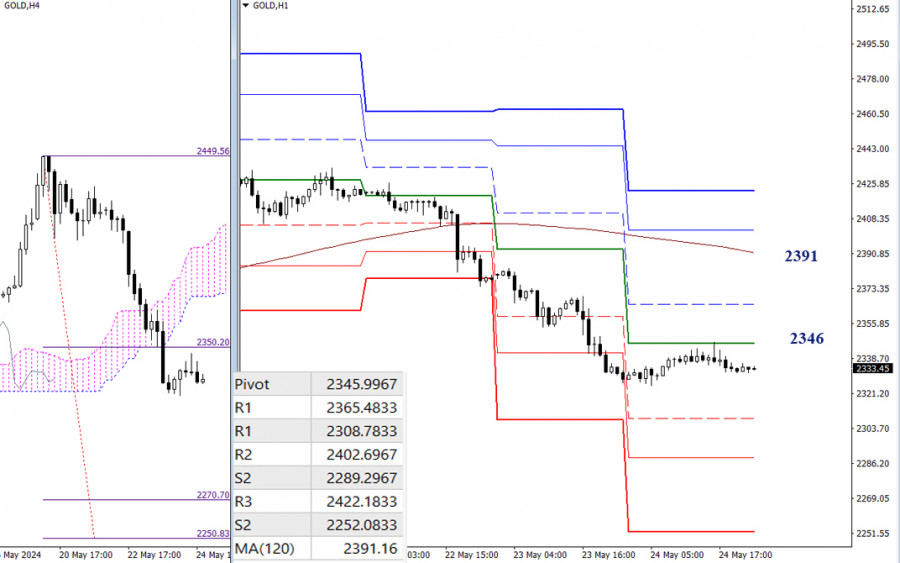

The bears currently have the main advantage on the lower timeframes. In order to continue the decline, the bears should aim for the supports of the classic Pivot levels, and you can check the updated locations since the market has opened, as well as the bearish target for breaking the H4 cloud (2271 – 2251). For the bulls to change their priorities and gain the upper hand, they need to work on their advantage, enabling the market to consolidate above key levels. After breaking and reversing the long-term weekly trend (2391), the bulls will shift the current balance of power in their favor. In this case, the classic Pivot levels will serve as reference points for the upward movement, and traders will then turn to resistance levels on the higher time intervals.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.