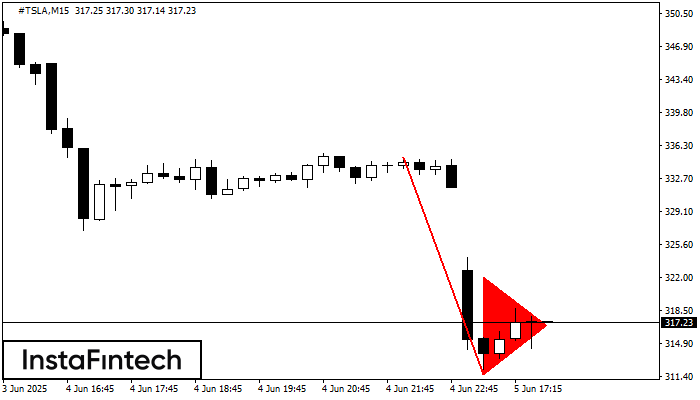

Bearish pennant

was formed on 05.06 at 16:45:10 (UTC+0)

signal strength 2 of 5

The Bearish pennant pattern has formed on the #TSLA M15 chart. It signals potential continuation of the existing trend. Specifications: the pattern’s bottom has the coordinate of 311.59; the projection of the flagpole height is equal to 2342 pips. In case the price breaks out the pattern’s bottom of 311.59, the downtrend is expected to continue for further level 311.36.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength