Lihat juga

29.05.2025 12:30 AM

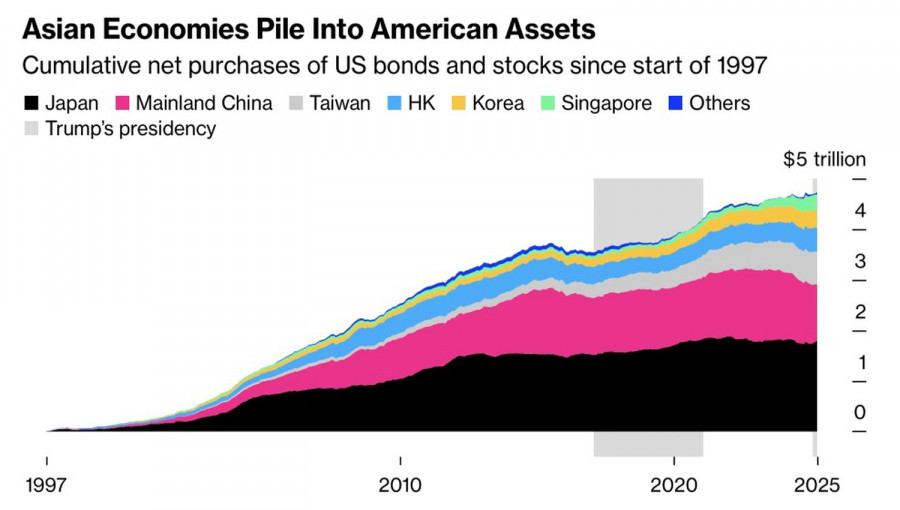

29.05.2025 12:30 AMWhen you begin dismantling a system, you risk cutting off the branch you are sitting on. For decades, the United States' main trading partners earned money by exporting goods to the U.S. and reinvested it into American assets. Japan's current account surplus transformed the country into the world's largest creditor and the biggest holder of U.S. Treasuries. By eliminating trade imbalances with the Land of the Rising Sun, Donald Trump is effectively stripping America of one of its key buyers of assets. Is it any wonder that USD/JPY is falling?

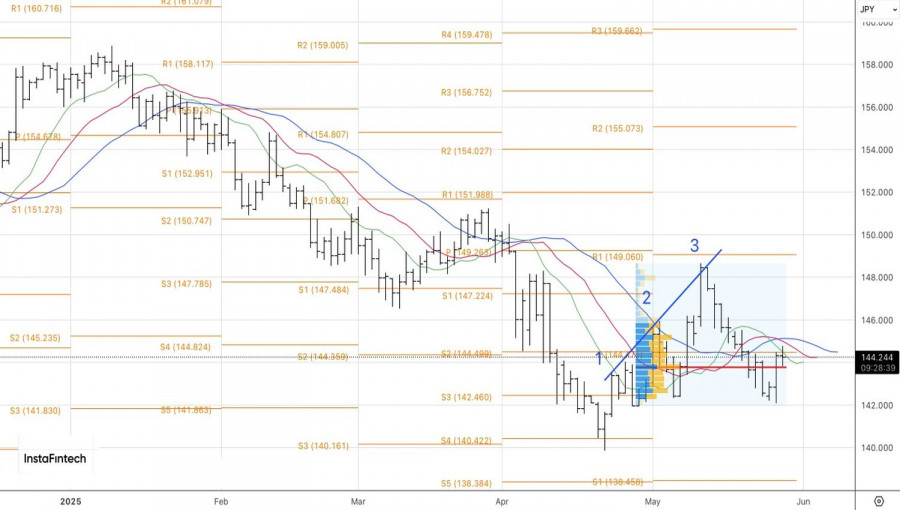

The 9% strengthening of the yen against the U.S. dollar in 2025 is rooted in capital repatriation by Japanese residents. This trend is amplified by the normalization of monetary policy, the Bank of Japan's reduced bond purchases, and a shortage of domestic investment options. As a result, yields on Japanese debt have surged. Long-term bonds, such as 30- and 40-year issues, have hit record highs, and the narrowing yield spread with U.S. equivalents provides a solid foundation for the downtrend in USD/JPY.

However, the rally in Japanese bond yields is causing serious concern in Tokyo. The cost of servicing the country's massive public debt—more than twice its GDP—is ballooning. A budget gap is opening that must be filled. In response, the government hinted at adjusting future bond issuance in favor of short-term securities. This move pulled back the yields on 30- and 40-year bonds and allowed USD/JPY bulls to mount a counterattack.

I don't believe the bulls will be celebrating for long. The systemic overhaul of international trade initiated by Donald Trump will come at a steep cost for the U.S. Deprived of its largest buyers, America will struggle to stimulate its economy at its usual pace. The economy cannot handle another massive fiscal stimulus package under the 47th president. It's no surprise that Moody's stripped the U.S. of its top-tier credit rating.

The correction in USD/JPY within the broader downtrend is not only due to stabilization in Japan's bond market. The White House's decision to delay the introduction of 50% tariffs on European imports has boosted global risk appetite. As a result, the yen has come under pressure as a safe-haven currency. However, these developments are temporary. As long as Donald Trump's policies create uncertainty, the demand for safe havens will remain high.

Technically, on the daily chart of USD/JPY, a doji bar is formed. Its lower boundary is located near the fair value of 143.75. A break of this support will be the basis for forming or building up shorts.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.