See also

03.02.2026 03:30 PM

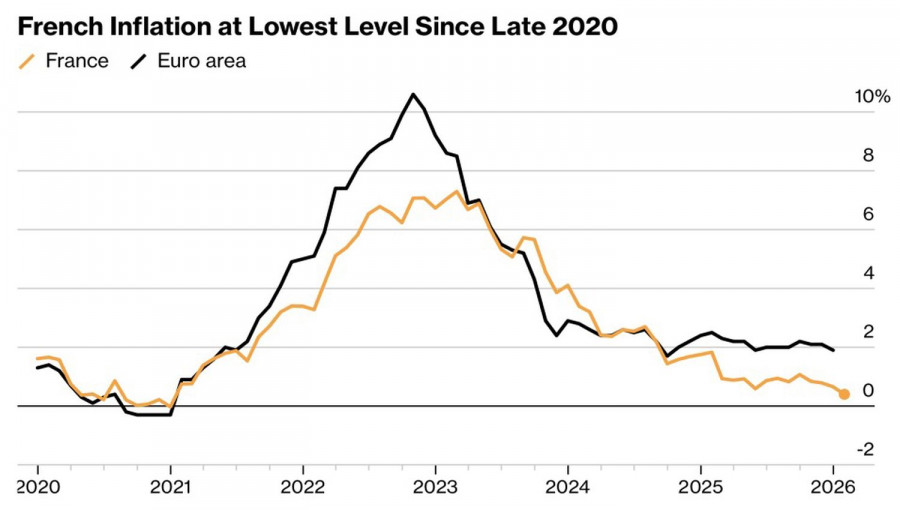

03.02.2026 03:30 PMThe White House and Fed chair nominee Kevin Warsh are convinced that even in a strong economy inflation can remain low. But is a slowdown in consumer inflation a sign of strong GDP? Investors aren't sure. That's why France's drop in inflation to a five?year low became a catalyst for selling EUR/USD.

Inflation dynamics in France

At the end of January, the market was wondering whether the ECB would "put the brakes" on euro bulls at the Governing Council meeting on February 5. The argument went that the higher the currency, the greater the chance of slowing inflation. That clearly wasn't in Christine Lagarde and her colleagues' plans. While a falling EUR/USD may have calmed them somewhat, the slowdown in French CPI growth only increased their headaches. Heaven forbid the ECB resume a cycle of monetary easing — that would be bad news for the single European currency.

It would be especially bad at a time when confidence is returning to the US dollar. Kevin Warsh's nomination as Fed chair shook financial markets. Precious metals suffered most, having drawn strength from fears that the Fed's independence would be compromised and from worries about a loss of confidence in the US currency.

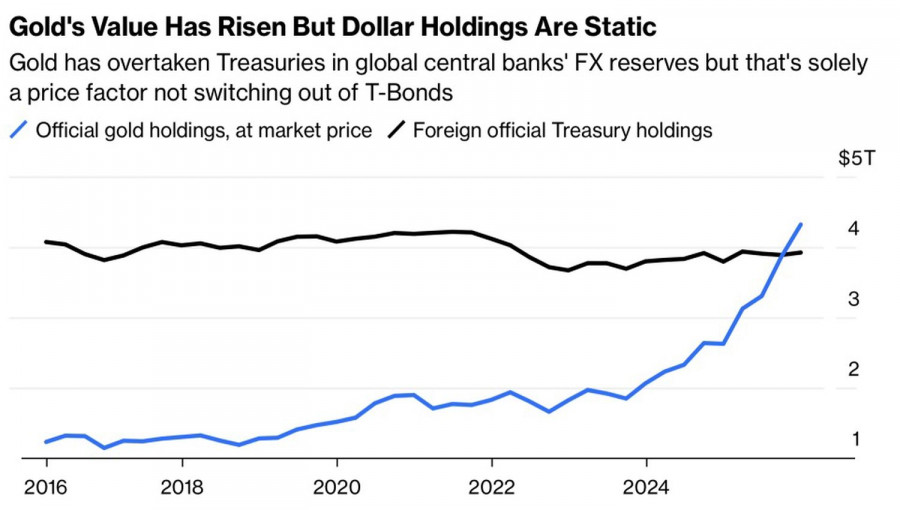

The diversification of official reserves was proceeding so quickly that the value share of gold exceeded the share of US Treasuries — and the liquidity of these instruments is not comparable.

Share of gold vs. US Treasuries in reserves of central banks

In Warsh's view, the root cause of inflation was the Fed's bloated balance sheet, which provided massive cheap liquidity for risk assets and eased financial conditions. Gold rally in January had a clearly speculative character — the price surged faster than ever — so balance?sheet reduction helped burst the precious?metals bubble.

The question is where that money will go. Bitcoin didn't benefit much from gold's rout. US stocks are near record highs and look overvalued on fundamentals. Bonds face a two?fold risk: balance?sheet reduction increases supply, lowers prices and raises yields, while a sharp cut in the federal?funds rate would have the opposite effect.

As a result, the primary beneficiary of Kevin Warsh as Fed chair is going to be the US dollar. What about Donald Trump's desire for a weaker dollar to boost corporate competitiveness? I believe closer coordination between the Federal Reserve and the Treasury will increase the risk of currency interventions. So, piling into the greenback is risky — everything should be done in moderation.

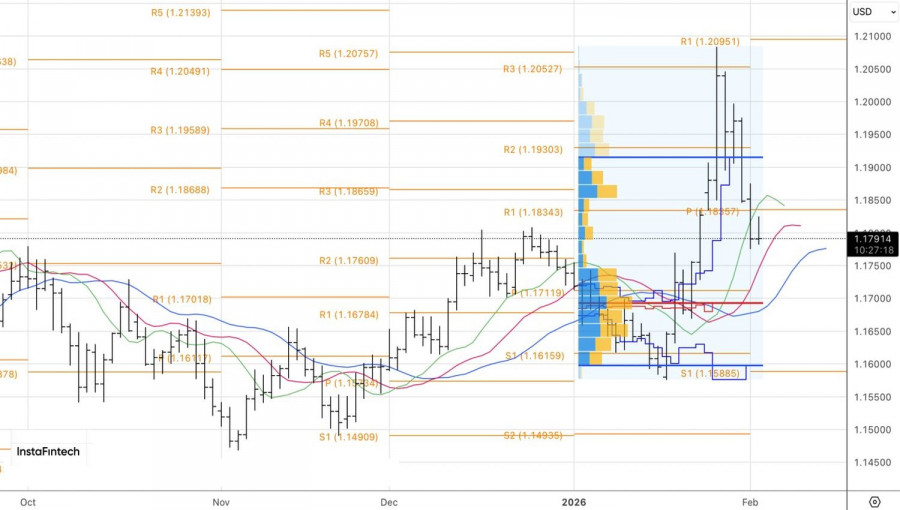

Technically, the daily EUR/USD chart shows a protracted decline. Short positions opened from 1.1905 were successfully added to on the break of 1.1835, which now stands as key resistance.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.