See also

24.06.2025 08:44 AM

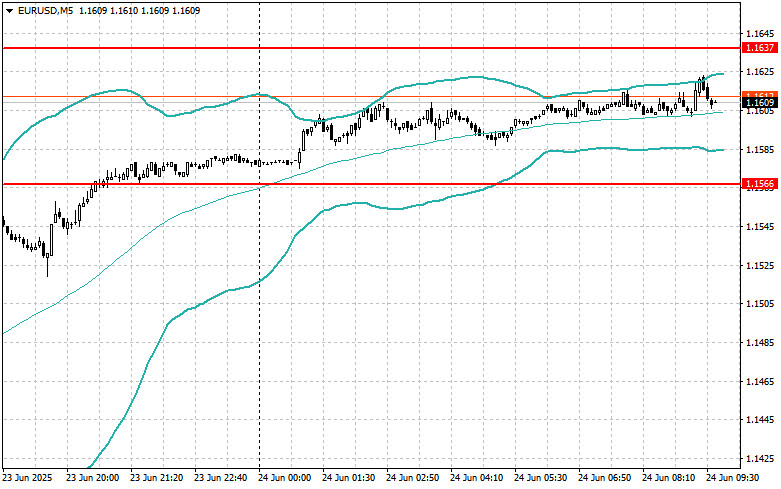

24.06.2025 08:44 AMThis morning, the euro may continue its upward movement, but solid data must be released for that to happen. Expected releases include the German IFO Business Climate Index, the Current Assessment Indicator, and the Expectations Indicator. Also of importance is the speech by European Central Bank President Christine Lagarde. Positive IFO data — especially improvements in business sentiment — could act as a catalyst for euro strengthening. Investors would interpret this as confirmation of the German economy's resilience, which would boost confidence in the ECB's ability to balance inflation control with economic growth support.

Conversely, Lagarde's weak IFO readings or cautious rhetoric emphasizing economic risks could pressure the euro. Concerns over slowing economic growth or a more dovish monetary stance could prompt capital outflows from the European currency.

Therefore, today's macroeconomic reports and the ECB President's remarks will shape the euro's short-term dynamics.

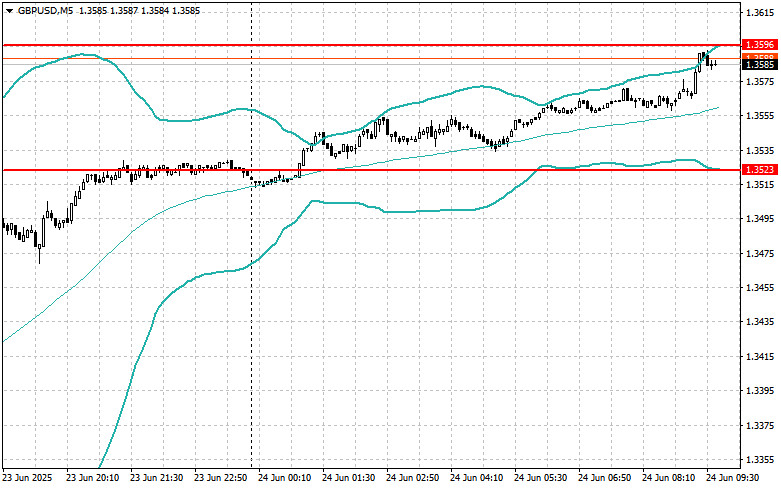

Today's UK releases include data on the CBI Industrial Order Balance, as well as a speech by Bank of England Governor Andrew Bailey. However, the primary growth driver for the British pound will likely remain developments in the Middle East and the de-escalation of the military conflict between Iran and Israel.

If the data aligns with economists' expectations, the best approach is to use a Mean Reversion strategy. If the data significantly exceeds or falls short of expectations, then the Momentum strategy is more appropriate.

Buying on a breakout above 1.1620 may lead to euro growth toward 1.1660 and 1.1699

Selling on a breakout below 1.1600 may lead to a euro decline toward 1.1570 and 1.1540

Buying on a breakout above 1.3595 may lead to pound growth toward 1.3630 and 1.3670

Selling on a breakout below 1.3565 may lead to a pound decline toward 1.3530 and 1.3490

Buying on a breakout above 145.30 may lead to dollar growth toward 145.60 and 145.90

Selling on a breakout below 144.90 may trigger dollar sell-offs toward 144.65 and 144.30

I will look for sell opportunities after a failed breakout above 1.1637 and a return below this level

I will look for buy opportunities after a failed breakout below 1.1566 and a return above this level

I will look for sell opportunities after a failed breakout above 1.3596 and a return below this level

I will look for buy opportunities after a failed breakout below 1.3523 and a return above this level

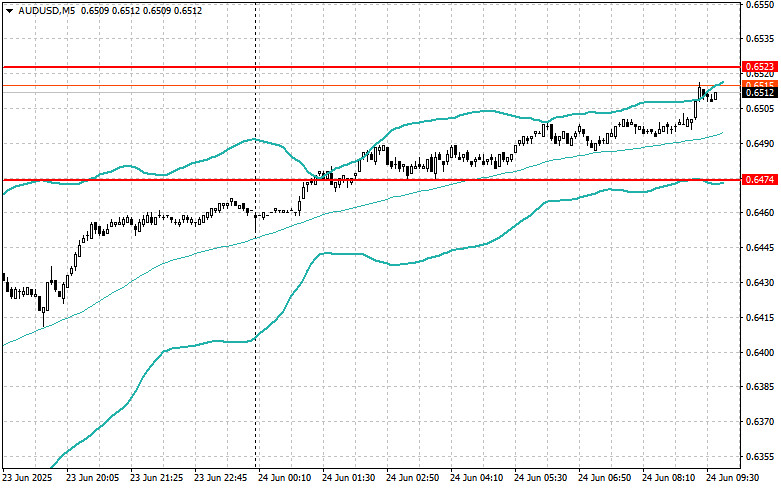

I will look for sell opportunities after a failed breakout above 0.6523 and a return below this level

I will look for buy opportunities after a failed breakout below 0.6474 and a return above this level

;

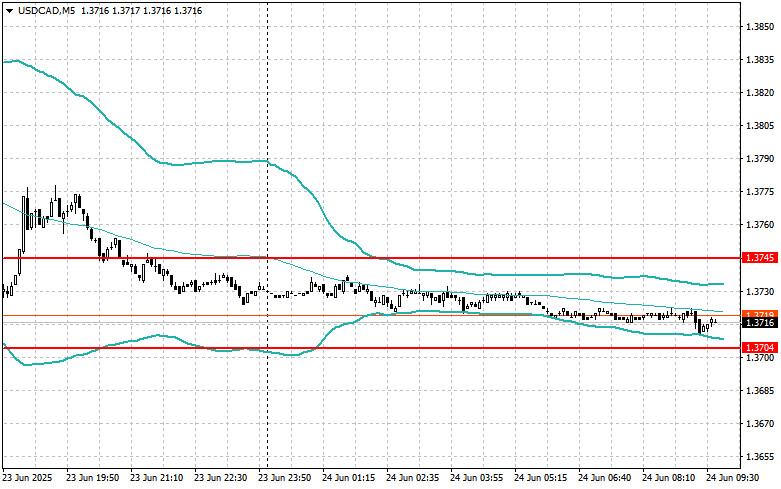

I will look for sell opportunities after a failed breakout above 1.3745 and a return below this level

I will look for buy opportunities after a failed breakout below 1.3704 and a return above this level

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 147.62 price level occurred when the MACD indicator had already moved far below the zero mark, which, in my view, limited the pair's downside potential

The test of the 1.3512 price level occurred when the MACD indicator had just started moving down from the zero mark, confirming the correct entry point for selling the pound

The first test of the 1.1674 price level occurred when the MACD indicator had already moved well below the zero mark, which limited the pair's downside potential. For this reason

The price test of 147.54 occurred at a moment when the MACD indicator had already moved significantly upward from the zero mark, which, in my view, limited the pair's bullish

The price test of 1.3533 coincided with the moment when the MACD indicator had just begun moving downward from the zero mark, confirming the correct entry point for selling

The price test of 1.1674 coincided with the moment when the MACD indicator had just begun moving downward from the zero mark, confirming the correct entry point for selling

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.