See also

23.06.2025 06:18 PM

23.06.2025 06:18 PMTrade Analysis and Tips for Trading the Japanese Yen

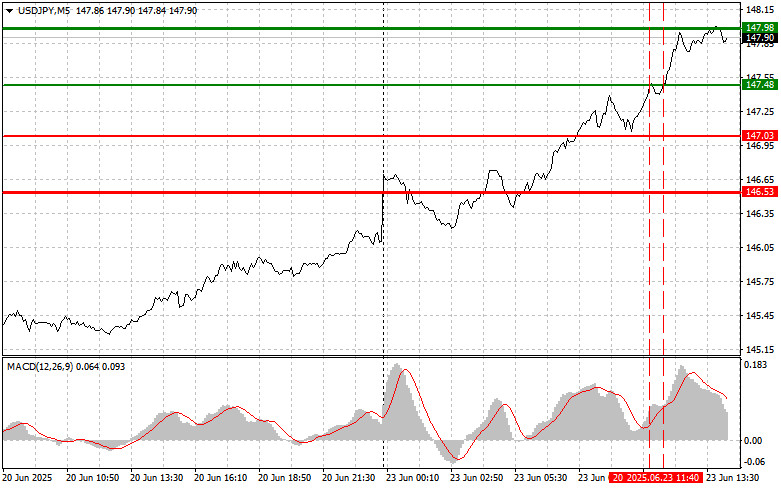

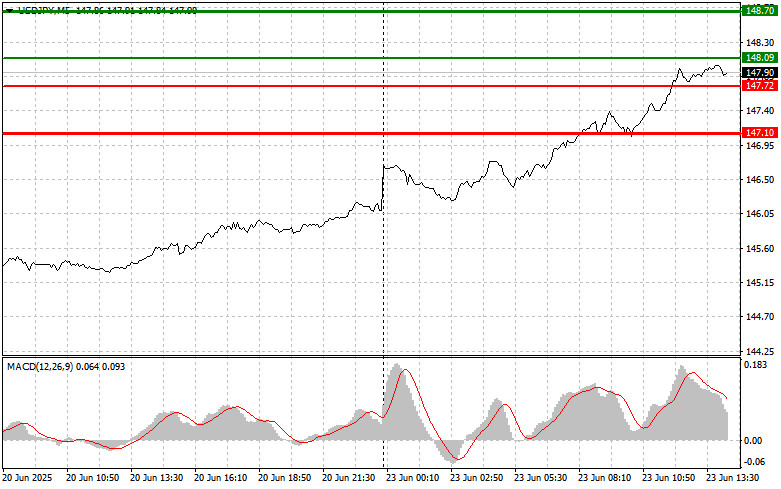

The test of the 147.48 level occurred when the MACD indicator was in the overbought zone, which prevented scenario #1 for buying the dollar from playing out during the ongoing bullish trend. I missed the entry point and ended up with no trades. Selling on the second test of 147.48 resulted in losses.

It has become known that Iran launched a mortar attack on a U.S. military base in Syria's northeastern Hasakah province, further escalating the situation in the Middle East and triggering new dollar buying. Geopolitical tensions in the region continue to rise, and this incident serves as yet another confirmation of instability. The impact of this event on financial markets could be significant, as investors, fearing further escalation, are moving away from riskier assets.

Today's speeches by FOMC members, such as Michelle Bowman and John Williams, will be closely watched. Investors will focus on their remarks, trying to spot any hints about the future path of interest rates. Michelle Bowman, known for her more hawkish stance, may express concern over persistent inflation and signal her willingness to support further monetary tightening. John Williams, on the other hand, usually takes a more balanced approach, and his comments may suggest the Fed favors a more data-dependent policy. It's important to note that FOMC members often hold different views, and their public speeches are a vital communication channel through which the Fed gradually prepares the market for potential policy changes.

As for the intraday strategy, I will primarily rely on scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY after reaching the entry point around 148.09 (green line on the chart) aiming for a rise to 148.70 (thicker green line on the chart). Around 148.70, I will exit long positions and open short trades in the opposite direction (expecting a 30–35 point pullback). A further rise in the pair is likely in continuation of the trend. Important! Before buying, ensure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 147.72 level while the MACD is in the oversold zone. This would limit the pair's downward potential and trigger a market reversal to the upside. A rise toward 148.09 and 148.70 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY after breaking through the 147.72 level (red line on the chart), which should result in a sharp decline in the pair. The key target for sellers will be 147.10, where I will exit short positions and open long positions in the opposite direction (expecting a 20–25 point rebound from the level). Downward pressure on the pair is unlikely to return today. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell USD/JPY in the event of two consecutive tests of the 148.09 level while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a market reversal to the downside. A decline toward 147.72 and 147.10 can be expected.

Chart Key:

Important Note for Beginner Traders:

Beginner traders on the Forex market must be very cautious when deciding to enter a trade. It is best to stay out of the market before the release of important fundamental data to avoid sharp price swings. If you choose to trade during news events, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember, successful trading requires a clear trading plan like the one outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 148.17 price level occurred when the MACD indicator had just started moving downward from the zero line, confirming the validity of the entry point for selling

The test of the 1.3405 price level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason

The test of the 1.1649 price level coincided with the MACD indicator just beginning to move down from the zero line, confirming a valid entry point for selling the euro

Trade Analysis and Tips for Trading the British Pound The test of the 1.3423 level occurred when the MACD indicator had already dropped significantly below the zero mark, which limited

The test of the 147.64 price level occurred when the MACD indicator had already declined significantly below the zero line, which limited the pair's downside potential. For this reason

The test of the 1.3436 price level occurred when the MACD indicator had already dropped significantly below the zero line, which limited the pair's downside potential. For this reason

The test of the 1.1710 price level occurred when the MACD indicator had been in the oversold area for a reasonably long time, which allowed Buy Scenario #2 to play

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.