See also

20.06.2025 11:30 AM

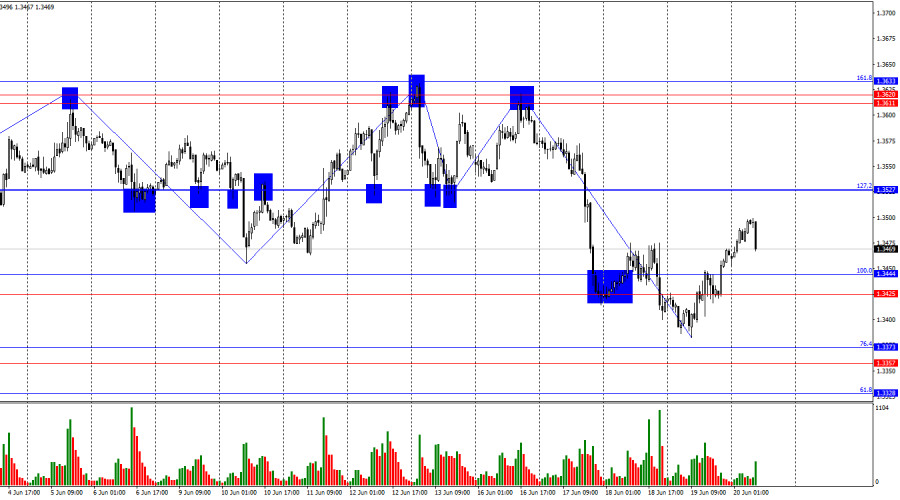

20.06.2025 11:30 AMOn the hourly chart, the GBP/USD pair consolidated below the support zone of 1.3425–1.3444, which suggested the potential for further decline in the British pound. However, following the Bank of England's meeting, the bulls stepped in and managed to close above the 1.3425–1.3444 zone. As a result, the upward movement may continue towards the next Fibonacci level of 127.2% at 1.3527. A rebound today from the 1.3425–1.3444 zone would also support expectations for further growth.

The latest upward wave failed to break the peak of the previous wave, while the most recent downward wave broke the previous low. Bulls still face difficulty expecting continued growth without new negative news from President Trump, and have temporarily retreated. However, I assume this retreat may not last long.

Thursday's most significant and only major event was the Bank of England's meeting. Traders correctly anticipated the rate decision but misjudged the MPC vote outcome. Three, not two, MPC members voted in favor of easing monetary policy, though this difference is minor. The Bank of England announced its intention to continue easing, but gradually, responding to changes in inflation. In the past two months, the Consumer Price Index has risen, but the regulator attributes this to higher oil and gas prices and does not believe the elevated inflation will be persistent.

This morning, the UK released its retail sales report, which showed a 2.7% month-on-month decline in May—much worse than traders expected. As a result, the bulls predictably retreated, though the pound's position did not significantly improve. I believe this report will not be the key driver of the pound's movement today. A further rise in quotes remains possible.

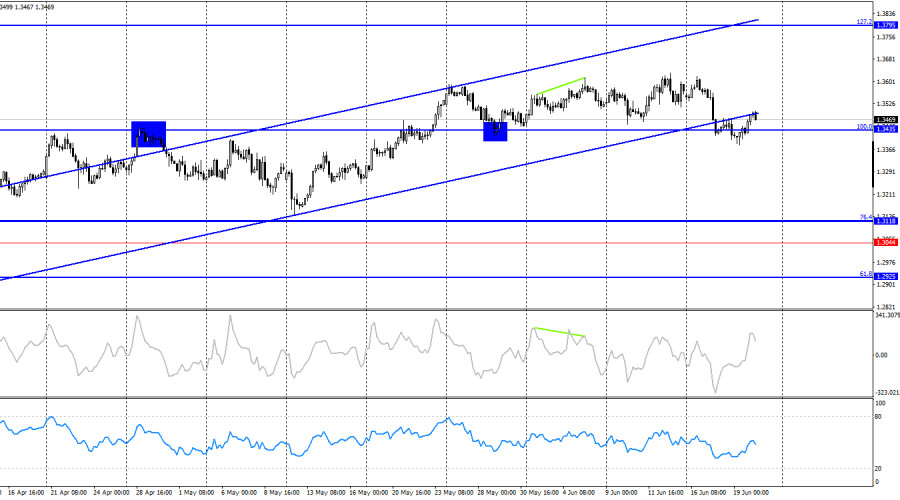

On the 4-hour chart, the pair returned to the 100.0% Fibonacci level at 1.3435. The downward movement may continue toward the next retracement level at 76.4% — 1.3118. Bears also managed to break below the ascending trend channel. The trend may now shift to bearish, but I currently see little reason to expect a strong decline in the pound. No indicators are signaling any impending divergences.

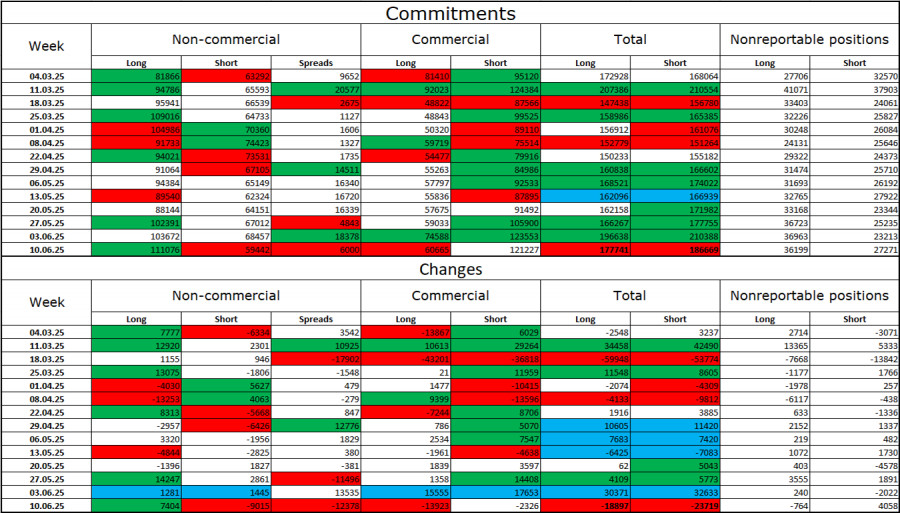

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" trader category became significantly more bullish over the last reporting week. The number of long positions held by speculators increased by 7,404, while short positions fell by 9,015. Bears have long lost their market advantage and have no realistic chance of success. The gap between long and short positions now stands at 51,000 in favor of the bulls: 111,000 versus 59,000.

In my view, the pound still has room to fall, but recent developments have shifted the market outlook in the long term. Over the past three months, the number of long positions has grown from 65,000 to 111,000, while short positions dropped from 76,000 to 59,000. Under Donald Trump, confidence in the dollar has eroded, and the COT reports show traders are reluctant to buy the dollar. Therefore, regardless of the broader news background, the dollar continues to fall amid the developments surrounding Trump.

News Calendar for the U.S. and UK:

Friday's economic calendar includes only one entry, which is already available to traders. There will be no further significant news impact on market sentiment for the rest of the day.

GBP/USD Forecast and Trading Tips:

Selling the pair was possible on a rebound from the resistance zone of 1.3611–1.3620, targeting 1.3527 and 1.3444. These targets have been reached. I previously recommended considering buying opportunities upon a close above the 1.3425–1.3444 zone, aiming for 1.3527. These trades can remain open today.

Fibonacci grids are constructed from 1.3446–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

[Nasdaq 100 Index] – [Thursday, August 28, 2025] The Nasdaq 100 Index is in bullish condition today, as confirmed by the RSI at the Neutral Bullish level, and 50(EMA)

[Gold] – [Thursday, August 28, 2025] The Golden Cross of the EMA(50) above the EMA(200) and the RSI indicator in the Neutral-Bullish zone indicate that gold has the potential

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.