See also

19.06.2025 09:08 AM

19.06.2025 09:08 AMWhile the White House and the Federal Reserve are in wait-and-see mode, the market has also decided to hold steady. Donald Trump has yet to make a final decision on whether the U.S. should intervene in the Israel-Iran conflict. Meanwhile, the Fed wants more data on the economic impact of tariffs before making any definitive rate decisions. The stagflation scenario outlined by the central bank clearly unsettled the S&P 500. The broad stock index has retreated—but calling it a "sell-off" would be an overstatement.

The Fed lowered its 2025 GDP growth forecast from 1.7% (March) to 1.4%. In 2024, the economy expanded by 2.4%. At the same time, it raised its projections for inflation, from 2.7% to 3%, and for unemployment, from 4.4% to 4.5%. The central bank does not know how tariffs will ultimately impact the economy and prefers to leave its options open. It will act accordingly depending on which side of the Fed's dual mandate becomes more concerning—rising inflation or deteriorating labor conditions. If inflation surges, rates will remain unchanged; a new monetary easing cycle could begin if unemployment rises.

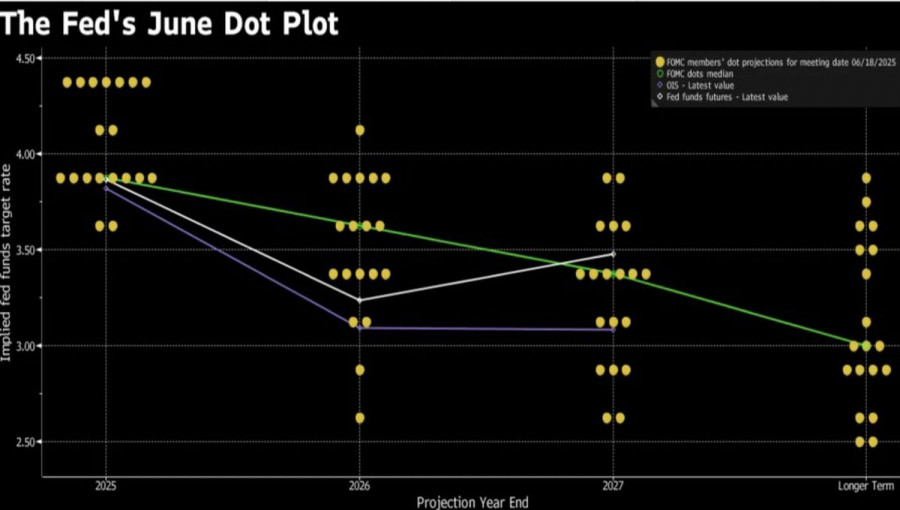

Although the median FOMC projection for the federal funds rate remained unchanged, seven committee members now see no rate cuts in 2025—up from four in March. Keeping borrowing costs high at 4.5% is negative for the economy and the stock market. Unsurprisingly, the U.S. President did not take the Fed's June verdict lightly.

Trump called for an immediate rate cut of 1 to 2.5 percentage points and labeled Jerome Powell a fool. He emphasized that he had already collected $88 billion in tariffs, with no rise in inflation. So why should the Fed maintain a pause? The Republican candidate is confident he could do a better job than the current Fed Chair. Sarcastically, he even asked whether he could appoint himself to the position.

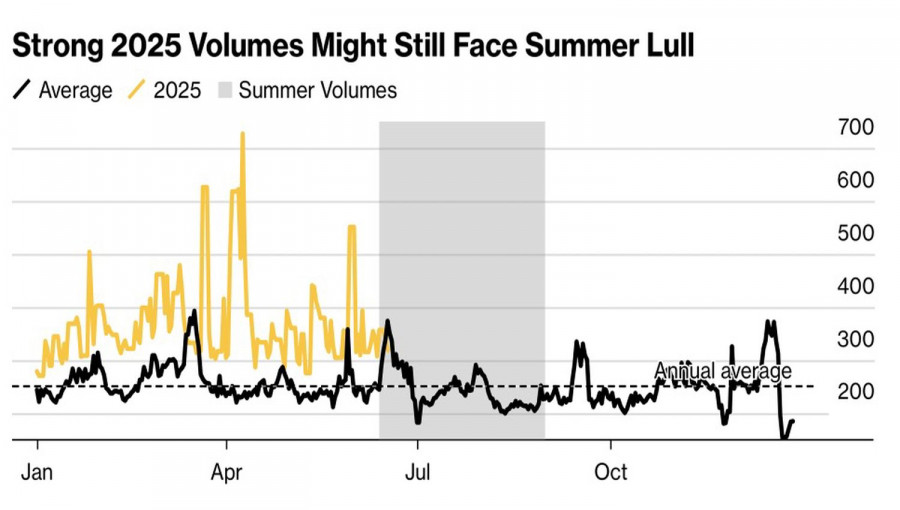

It's evident that Trump is unhappy with the decline of the S&P 500. During his first presidential term, the stock market was seen as a barometer of his administration's effectiveness. There's little reason to think this perspective has changed. The market continues to react sharply to Trump's comments, which can trigger significant volatility—especially during the typically quiet summer season.

Ironically, U.S. involvement in the Middle East conflict could support the S&P 500. In such a scenario, the likelihood of Iran capitulating would rise, reducing the chance of Tehran blocking the Strait of Hormuz. A drop in oil prices would lessen inflationary pressures in the U.S. and might push the Fed toward monetary easing—a positive development for equities.

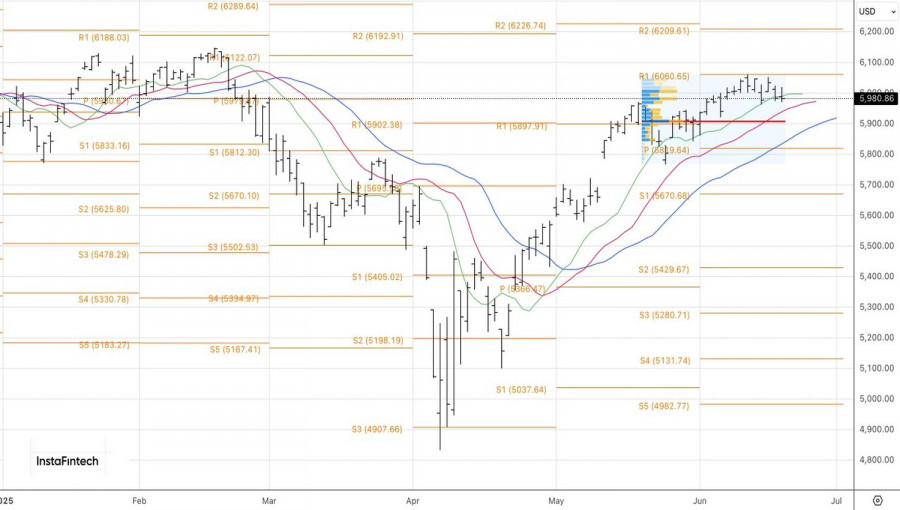

On the daily chart, recent attempts by the bulls to mount a counterattack have failed. This highlights weakness on the buy side and opens the door to short positions targeting the fair value around 5900 and the key pivot level at 5800.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The inflation report published on Tuesday reinforced market participants' expectations that the U.S. central bank will cut interest rates at the September meeting, opening the way for continued growth

Only one macroeconomic release is scheduled for Wednesday — the second estimate of Germany's July inflation. In the EU, second estimates generally do not differ from the first, German inflation

The EUR/USD currency pair once again traded rather calmly. While the pair is not exactly stuck in place, volatility remains low. There is no clear sideways range at the moment

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.