See also

04.06.2025 09:27 AM

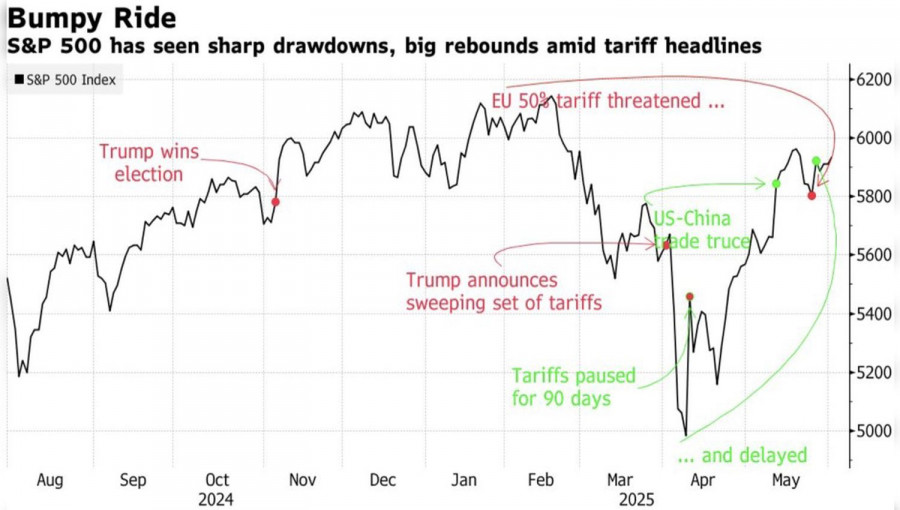

04.06.2025 09:27 AMIs the market only hearing what it wants to hear? Or is it simply playing the "buy the dip" game? According to Nomura, buying the S&P 500 five days after Donald Trump escalates trade conflicts would have yielded a 12% return since early February. Over the same period, simply holding the broad stock index would not have made investors richer. Did they decide to test this pattern by buying stocks after the White House announced an increase in tariffs on steel and aluminum from 25% to 50%? Or was the rally fueled by strong labor market data?

S&P 500's Reaction to Trade Conflict Escalation

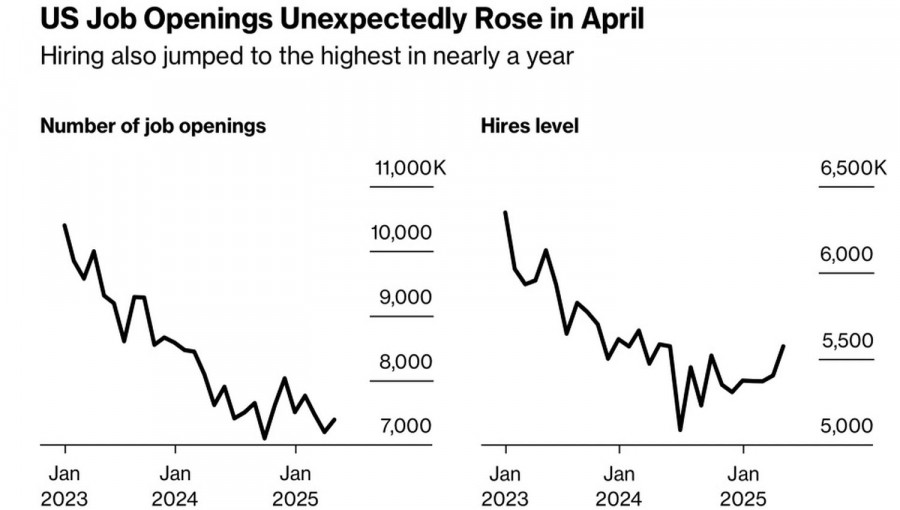

The unexpected increase in job openings and hiring in April signaled the continued strength of the U.S. economy — good news for the S&P 500. Also positive was Commerce Secretary Howard Lutnick's statement expressing optimism about the imminent conclusion of a trade deal between the U.S. and India. Meanwhile, Washington sent reminders to dozens of other countries about the upcoming hike of universal tariffs from 10% to much higher levels. The U.S. is demanding the best offers from its trade partners, but such letters cause concern.

Following the International Trade Court's ruling that the White House's tariffs were illegal, many countries have adopted a wait-and-see approach. Donald Trump's patience may run out, and an escalation of trade conflicts could drag down the S&P 500.

U.S. Job Openings and Hiring Trends

At the same time, markets are ignoring the progress of a major new tax cut bill moving from the House of Representatives to the Senate. This bill could increase the U.S. budget deficit from the current $5 trillion to $8 trillion over the next decade. Already, the Treasury is paying $1 trillion in interest on debt. This figure could rise by another $1.8 trillion if bond yields remain at their current levels.

Allianz warns that introducing a tax on foreign investment in U.S. securities could push Treasury yields up by 1.5 percentage points and trigger a 10% drop in U.S. stock indices. This part of Donald Trump's "big and beautiful" bill could become a significant and alarming event for financial markets.

The "buy the dip" game is fun, but the market's greed and complacency are cause for concern. Trade wars are ready to erupt anew, and the U.S. fiscal problems are worsening by the day. Even though Treasury Secretary Scott Bessent insists there will never be a default, talk is cheap — no one knows what the future holds.

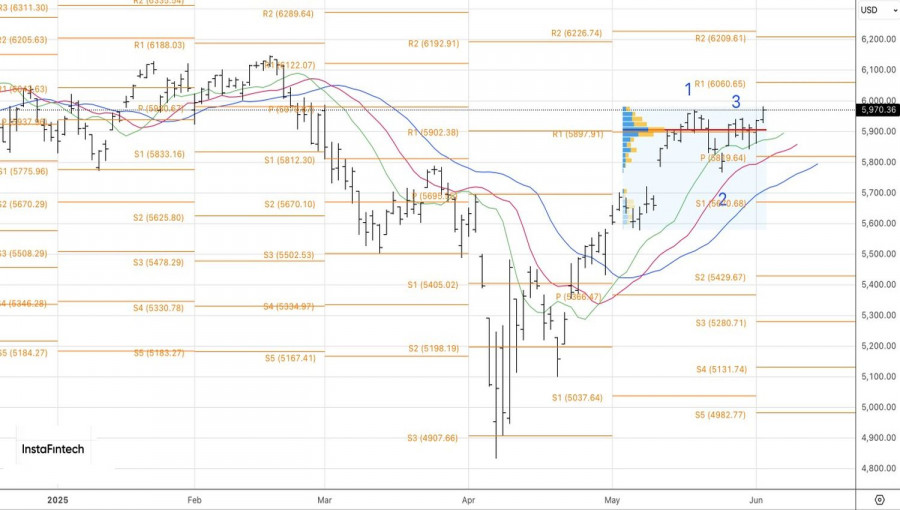

Technically, on the daily S&P 500 chart, a successful breakout of the resistance near point 3 of the 1-2-3 pattern has occurred. As a result, long positions were opened from the 5945 level. These positions look shaky, so caution is essential. A rejection at 6060 or a fall below 5900 in the broad index would be grounds to reverse and switch to short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.