See also

03.06.2025 12:38 AM

03.06.2025 12:38 AMEverything eventually comes to an end—both good and bad. One can debate endlessly whether the European Central Bank's deposit rate cut is positive or negative for the euro. However, the nearing end of the monetary expansion cycle is excellent news for EUR/USD. Combined with new threats from Donald Trump and fears that the White House's tariff policy will finally begin to impact the labor market, this factor contributes to the euro's upward trend recovery.

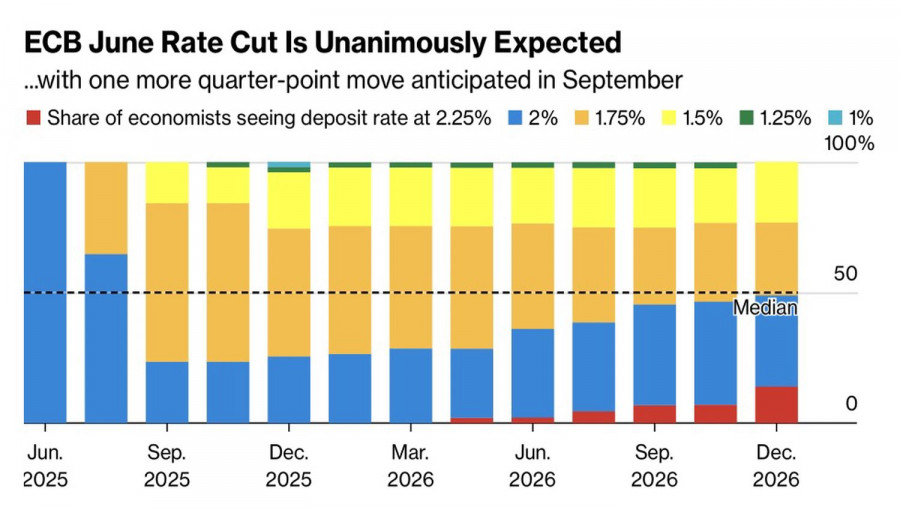

Following the Governing Council's meeting on June 5, investors expect the deposit rate to be cut to 2%. This would mark the eighth act of monetary expansion in 2024–2025—and this step might be the last. The "doves" would prefer to continue, believing that the eurozone economy is unlikely to withstand the trade war without stimulus. The "hawks" are opposed; they argue that low borrowing costs would encourage governments to take on more debt, risking the transformation of the currency bloc from a miser into a spendthrift, thereby undermining its financial stability.

Add to that the uncertainty surrounding U.S.-EU trade negotiations, the annulment of universal tariffs by the International Trade Court, and Trump's renewed threats about doubling tariffs on steel and aluminum. It becomes clear that Christine Lagarde and her colleagues have no reason to rush. Logic dictates adopting a wait-and-see stance. Moreover, signals from Lagarde about ending the monetary policy easing cycle could flash a green light for EUR/USD bulls.

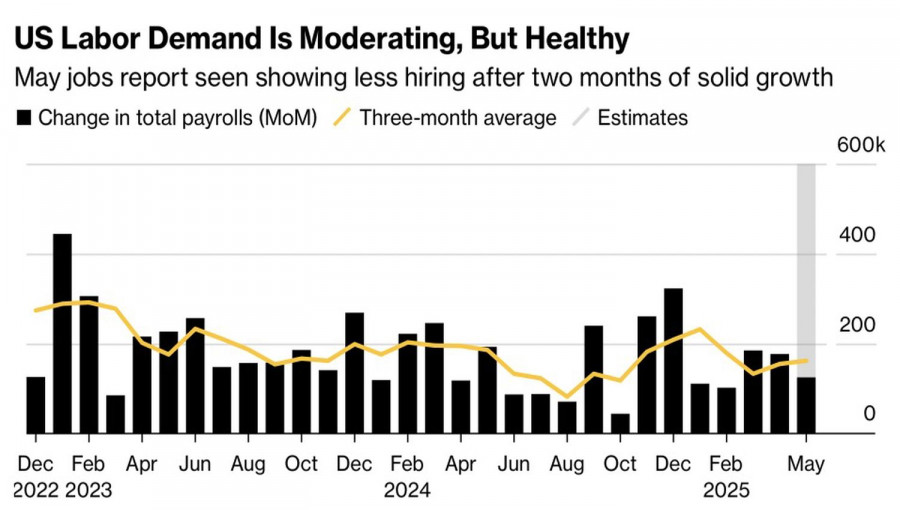

While the ECB is wrapping up, the Federal Reserve is just beginning. FOMC member Christopher Waller believes that the Fed will resume its rate-cutting cycle in the year's second half. He argues that high inflation due to tariffs will be transitory—prices won't stay elevated as they did in 2022. Fiscal stimulus is weaker now, and the labor market is softer than before. If signs of labor market cooling emerge as early as May, EUR/USD bears might start drafting their farewell letter.

The base case scenario assumes that employment will only show signs of an impending economic downturn in the U.S. by autumn. For now, laid-off government employees, including those dismissed by Elon Musk, are still counted in the labor force. Should the downturn happen earlier, the American dollar will be in trouble.

Judging by the neutral market reaction to Trump's claim that China has violated the terms of the truce, markets are gradually moving away from trade war fears and returning to traditional fundamentals. As a result, the outcomes of the ECB's June meeting and the U.S. May employment report are drawing increased attention in Forex trading.

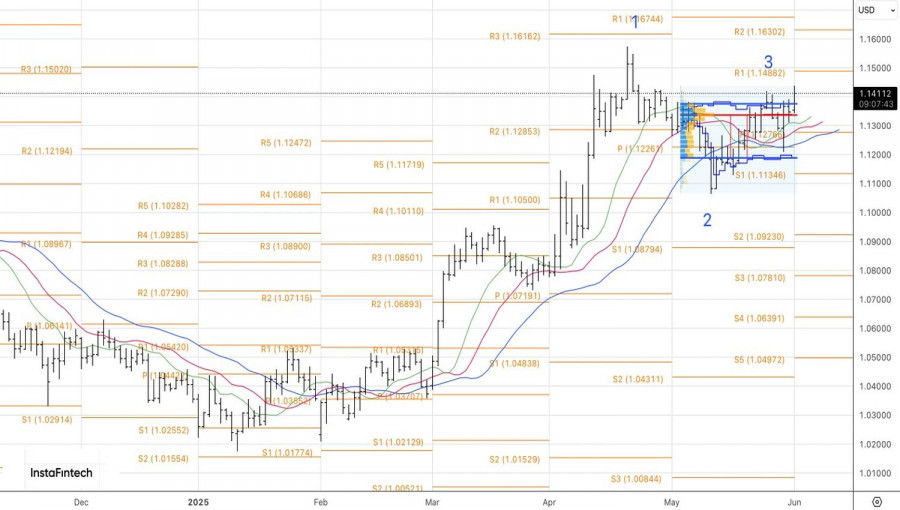

Technically, on the daily chart, EUR/USD forms a Spike and Ledge pattern. A breakout above the fair value range of 1.1190–1.1390 has allowed building long positions from the 1.1200–1.1225 area. These positions should be held.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.