See also

30.05.2025 09:29 AM

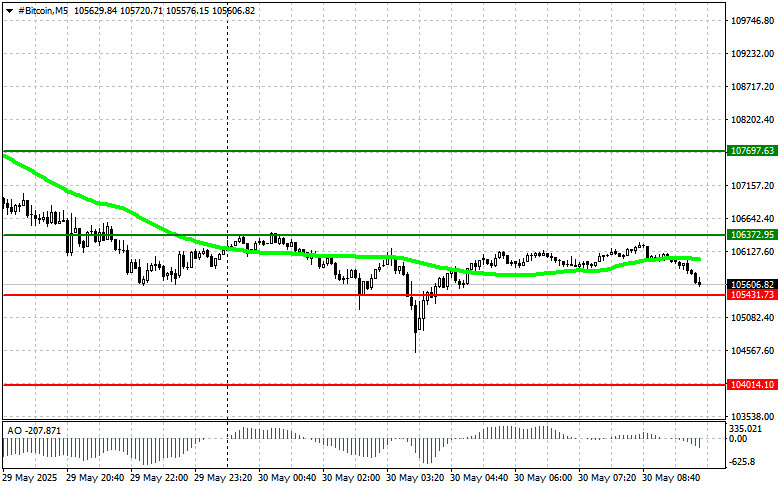

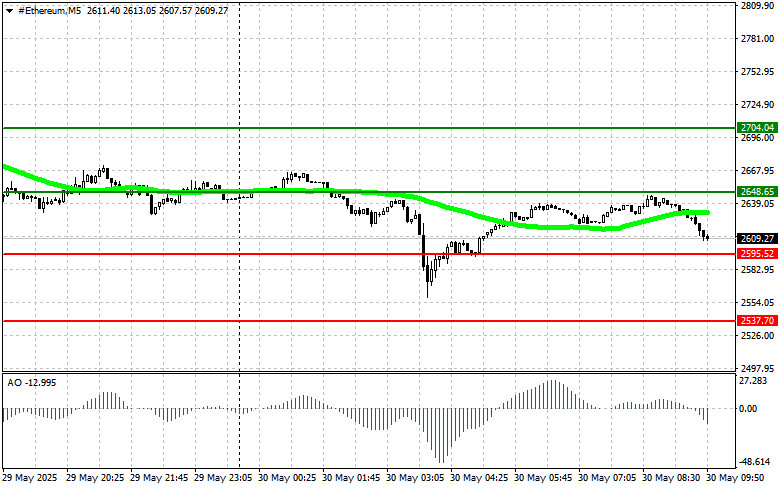

30.05.2025 09:29 AMBitcoin and Ethereum continued their corrections, falling significantly throughout yesterday. The decline extended into today's Asian session, with Bitcoin updating its price to $104,500 and Ethereum testing $2,560.

Thus, it is no surprise that on Thursday, there was a net outflow of $358.6 million from exchange-traded funds (ETFs), ending a 10-day streak of positive flows that had brought in a total of $4.26 billion. This reversal underscores how fragile market optimism can be, highlighting investors' heightened sensitivity to even minor changes in economic indicators and geopolitical events. However, it's important to note that a single day of outflows is not a cause for panic. The ETF market constantly experiences inflows and outflows, and short-term outflows are perfectly normal. Monitoring long-term trends and analyzing the underlying causes of capital movements is much more important.

Possible reasons for the outflow include profit-taking by investors who benefited from the recent market rally and reallocating assets to other classes or sectors that seem more promising under current conditions. Additionally, concerns about upcoming Federal Reserve decisions on interest rates and their potential impact on economic growth could also be a factor.

According to SoSoValue, BlackRock's IBIT was the only spot Bitcoin ETF to report a net inflow of funds, bringing in $125 million. Fidelity's FBTC led the outflows with $166.32 million, followed by Grayscale's GBTC, which saw $107.53 million withdrawn. Net outflows from Ark and 21Shares' ARKB totaled $89.22 million, while Bitwise's BITB saw $70.85 million leave. ETFs from VanEck, Valkyrie, Invesco, and Franklin Templeton also experienced outflows.

Meanwhile, on Thursday, spot Ethereum ETFs listed on U.S. exchanges recorded a net inflow of $91.93 million, marking nine consecutive days of positive flows.

For the intraday strategy, I will continue to focus on large pullbacks in Bitcoin and Ethereum, expecting the ongoing bull market to continue in the medium term.

As for short-term trading, the strategy and conditions are described below.

Scenario #1: I plan to buy Bitcoin today at the entry point around $106,300, aiming for a rise to $107,600. Around $107,600, I plan to exit the buys and immediately sell on a pullback. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower boundary at $105,300 if there is no market reaction to its breakout, aiming for $106,300 and $107,600.

Scenario #1: I plan to sell Bitcoin today at the entry point around $105,400, aiming for a drop to $104,000. Around $104,000, I plan to exit the sales and immediately buy on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper boundary at $106,300 if there is no market reaction to its breakout, aiming for $105,400 and $104,000.

Scenario #1: I plan to buy Ethereum today at the entry point around $2,648, targeting a rise to $2,704. Around $2,704, I plan to exit the buys and immediately sell on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: If the market does not react to Ethereum's breakout, it can also be bought from the lower boundary at $2,595, aiming for $2,648 and $2,704.

Scenario #1: I plan to sell Ethereum today at the entry point around $2,595, targeting a drop to $2,537. Around $2,537, I plan to exit the sales and immediately buy on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary at $2,648 if there is no market reaction to its breakout, aiming for $2,595 and $2,537.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has once again failed in its attempt to test and consolidate above the $120,000 mark, currently dipping back below $119,000. Ethereum has also slightly retreated after attempting to break

Solana – Friday, July 25, 2025 With the EMA in a Death Cross condition and the RSI (14) in a Neutral Bearish condition, Solana cryptocurrency indicates that sellers are still

Litecoin – Friday, July 25, 2025 The appearance of divergence between the RSI(14) indicator and Litecoin's price movement indicates the potential for limited upside. The RSI(14) remains in a neutral

Bitcoin continues to trade within the 116,500–120,000 channel, showing solid volatility. Ethereum, however, is performing significantly worse following a recent decline in spot ETF inflows. Meanwhile, yesterday Tether CEO Paolo

Bitcoin once again attempted to break above $119,000 but failed, retreating today toward the $117,000 level. Ethereum has dropped back below $3,600 and is currently heading toward the $3,500 area

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.