See also

29.05.2025 11:15 AM

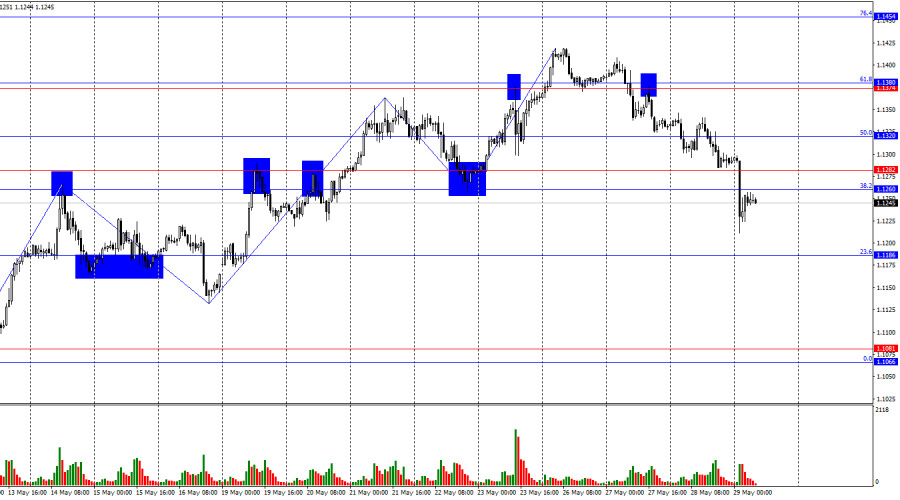

29.05.2025 11:15 AMThe wave structure on the hourly chart has changed. The last completed upward wave broke the previous peak, but the most recent downward wave broke the previous low. This suggests a potential trend reversal to bearish. Recent news regarding the cancellation of EU tariff hikes and the mutual reduction of tariffs between China and the U.S. supported the bears.

The news backdrop was virtually absent on Wednesday, with the only significant release coming late in the evening—the FOMC minutes. As a reminder, this is a report on the latest Federal Reserve meeting and typically does not reveal anything new to traders. Yesterday's report was no exception. The minutes indicated that most FOMC members favor maintaining a cautious approach to monetary policy amid rising economic uncertainty. Fed officials noted the inability to accurately assess the impact of the trade wars on the economy and thus prefer to wait for the full effects of tariffs to materialize. At present, it remains unclear which of Trump's tariffs will remain, which will be reduced or increased, and with which countries trade agreements will be signed. Consequently, the Fed expressed a desire to keep the interest rate in the 4.25–4.5% range until the situation becomes clearer. The report had little impact on the dollar.

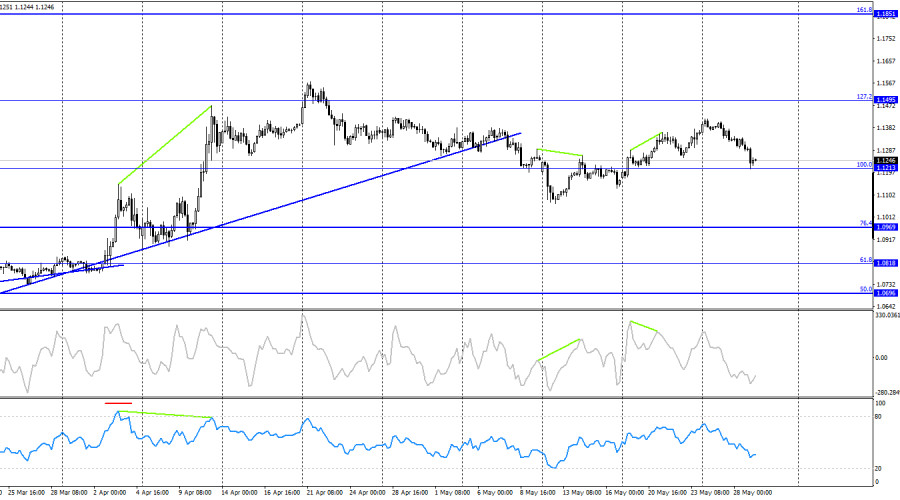

On the 4-hour chart, the pair returned to the 100.0% Fibonacci level at 1.1213. A rebound from this level would support the euro and resume growth toward the 127.2% retracement at 1.1495. A consolidation below 1.1213 increases the likelihood of a continued decline toward the 76.4% Fibonacci level at 1.0969. Currently, no emerging divergences are visible on any indicators.

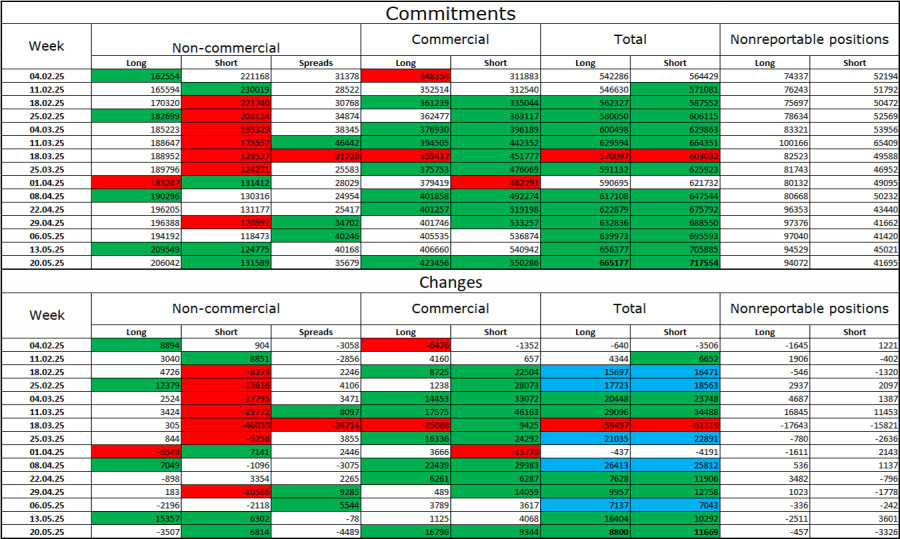

Commitments of Traders (COT) Report:

During the latest reporting week, professional traders closed 3,507 long positions and opened 6,814 short positions. The sentiment of the "non-commercial" group remains bullish—thanks to Donald Trump. The total number of long positions held by speculators is now 206,000, while short positions stand at 132,000. The gap continues to grow in favor of the bulls. Thus, the euro remains in demand, while the dollar does not. The trend is consistent.

For sixteen consecutive weeks, large market players have been reducing short positions and increasing longs. The divergence in monetary policy between the ECB and the Fed still favors the U.S. dollar, but Trump's policies remain a stronger influence on traders. These policies could lead to a U.S. recession and other long-term structural issues.

On May 29, the economic calendar includes two key U.S. events. However, the market's reaction may be muted, as traders are already familiar with Q1 GDP data. Bears now need stronger support from news and reports to maintain momentum.

Short positions were previously viable below the 1.1374–1.1380 zone with targets at 1.1320 and 1.1282—both of which were achieved. The consolidation below 1.1260–1.1282 allows traders to maintain shorts with a target at 1.1186. I recommend considering long positions on a rebound from 1.1186 on the hourly chart with a target of 1.1260–1.1282.

Fibonacci grids are constructed from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On the hourly chart, the GBP/USD pair on Wednesday consolidated above the weak 161.8% retracement level at 1.3520. This consolidation allows for expectations of continued growth toward the next retracement

With the condition of the Stochastic Oscillator indicator at the Overbought level and a Divergence appears between the indicator and the Nasdaq 100 index price movement, so that

The eagle indicator is showing a negative signal for the euro, suggesting a possible fall in the coming days. Therefore, our outlook remains bearish as long as the price consolidates

On the other hand, if bullish strength prevails, we could expect a technical rebound around 3,355. This area has provided gold with a good rebounding point in the past

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.