See also

28.05.2025 06:43 PM

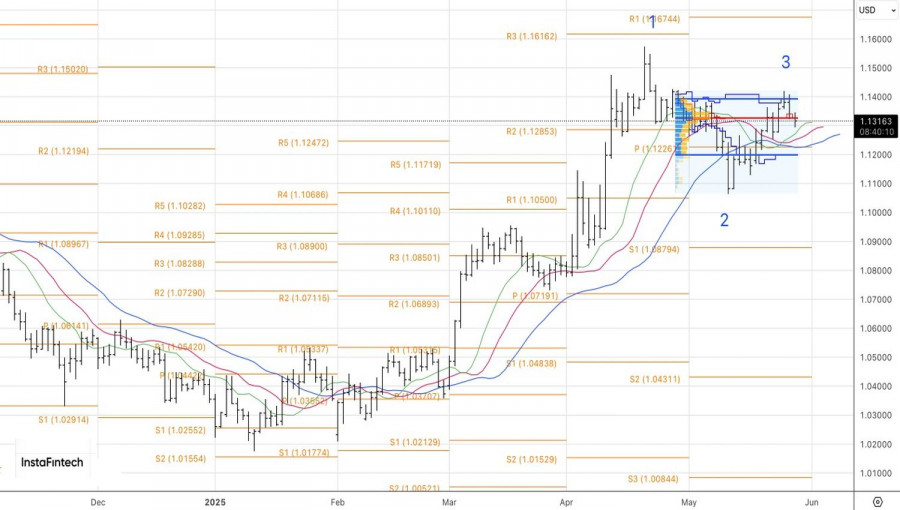

28.05.2025 06:43 PMAfter a rapid rally from February through April, EUR/USD entered a prolonged consolidation phase. For several weeks now, the major currency pair has remained locked within the 1.1100–1.1400 trading range. However, sooner or later, this will change. Consolidation will give way to a trend. To understand where the euro might move next, we must look into the underlying causes.

BNP Paribas unexpectedly downgraded its year-end 2025 forecast for EUR/USD from 1.20 to 1.18, citing a faster de-escalation of trade conflicts than initially anticipated. Donald Trump swiftly shifts from threats to delays, which boosts global risk appetite and halts the "sell America" strategy. Nonetheless, the bank maintains a "bullish" outlook for the euro, driven by capital outflows from the U.S. into Europe and active hedging of U.S. dollar investments by European pension funds.

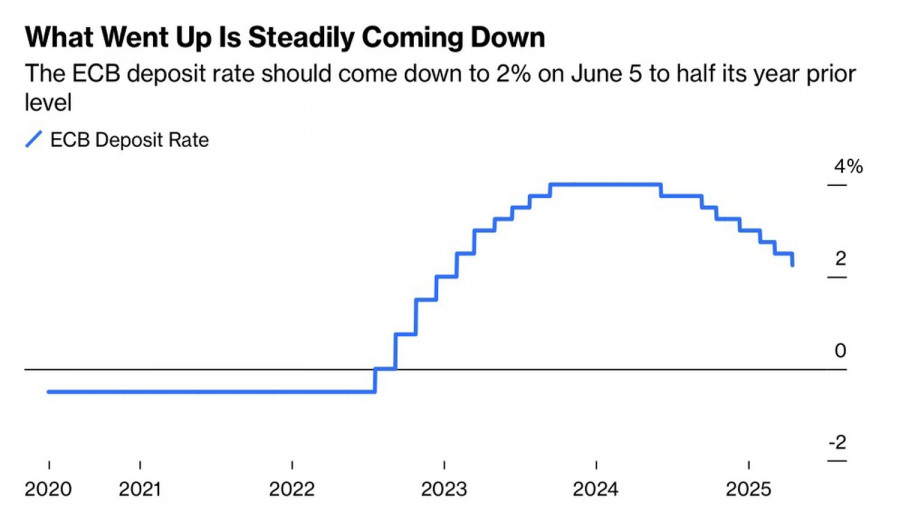

Capital flows are becoming a more significant driver of exchange rate dynamics on Forex than monetary policy. Otherwise, EUR/USD would be declining steadily amid expectations that the ECB will resume monetary easing as early as June. Meanwhile, the Fed isn't even considering rate cuts until at least September. Moreover, if the impact of the White House's trade policy on the U.S. economy remains unclear until fall, the pause in the Fed's rate cycle could be extended.

ECB Deposit Rate Dynamics

In the current environment, monetary policy easing is seen more as a lifeline for the economy during trade wars. The European Central Bank is ready to throw it; the Fed is not. So who will sink first— the eurozone or the U.S.?

Some pressure on the euro came from comments by Joachim Nagel. The Bundesbank president highlighted Germany's unexpectedly strong 0.4% GDP growth in Q1, attributing it to a spike in U.S. import demand. The situation could deteriorate in Q2, which would be a problem for EUR/USD bulls.

Following a mix of consumer confidence and durable goods data from the U.S., investors are now looking to the FOMC meeting minutes for clues. It's unlikely the Fed will hint at a restart of monetary easing. Any hawkish rhetoric could pressure U.S. stock indices. A decline in the S&P 500 would be a compelling argument in favor of buying EUR/USD. The dollar has lost its status as the primary safe-haven asset, and a deterioration in global risk appetite now acts as a headwind for it.

Technically, on the daily chart of EUR/USD, there are signs of a potential 1-2-3 reversal pattern forming. For this to activate, bears need to break through dynamic support near the 1.1225 level, and then push the pair beyond the fair value range of 1.1200–1.1400. Until that happens, it makes sense to maintain a buying bias.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.