See also

28.05.2025 10:04 AM

28.05.2025 10:04 AMBitcoin failed to hold above the $110,000 level, while Ethereum again showed decent growth, fueled by news of a possible significant increase in the gas limit per block in the blockchain.

Yesterday, the topic of the U.S. Bitcoin reserve was once again discussed in the market. Bo Hines, President Trump's Executive Director for Digital Assets, stated that the United States plans to become a BTC superpower. This ambitious statement came amid growing interest in cryptocurrencies and blockchain technologies from private investors and public institutions. Hines emphasized that the Trump administration sees Bitcoin as a promising investment vehicle and a key element of a new economic paradigm.

Clearly, implementing this strategy will require a comprehensive approach, including the development of a favorable regulatory framework, investment in infrastructure, and support for innovative projects in the digital asset space—something Donald Trump is currently striving for. Special attention will also be given to ensuring transaction transparency and security and combating illegal activities associated with cryptocurrencies.

"Creating a 'BTC superpower' also involves active engagement with the international community to establish global standards for digital asset regulation," said the White House representative. "The U.S. aims to take the lead in this field by setting the rules of the game and attracting talented professionals from around the world." According to Hines, the U.S. intends to accumulate as large a BTC reserve as possible and will not sell a single coin.

As for the intraday strategy in the cryptocurrency market, I will continue to rely on any significant pullbacks in Bitcoin and Ethereum in anticipation of the continued development of a medium-term bull market that is still very much intact.

Below are the short-term trading strategies and conditions.

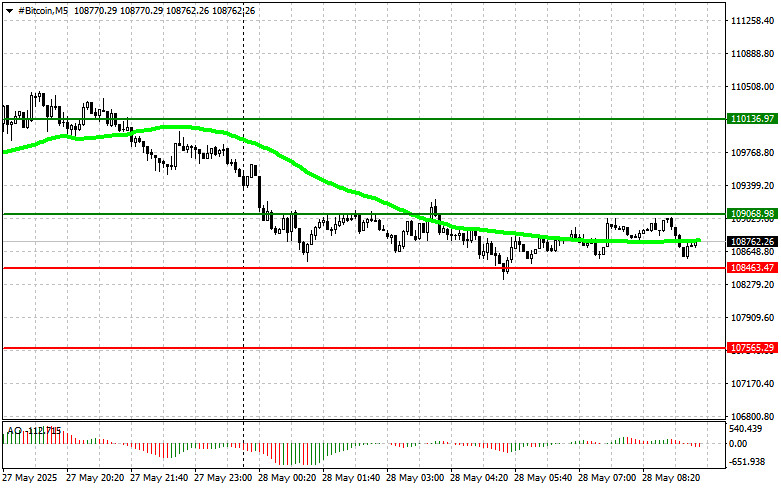

Scenario #1: I plan to buy Bitcoin today upon reaching the entry point near $109,000, with a target of rising to $110,000. Around the $110,000 mark, I will exit long positions and sell immediately on a rebound. Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above the zero line.

Scenario #2: Bitcoin can also be bought from the lower boundary at $108,500 if there is no market reaction to a breakout, aiming for a rebound back to $109,000 and $110,000.

Scenario #1: I plan to sell Bitcoin today at an entry point of around $108,400, with a target of falling to $107,500. Around $107,500, I will exit short positions and buy immediately on a rebound. Before selling a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Bitcoin can also be sold from the upper boundary of $109,000 if there is no reaction to a breakout, aiming for a return to $108,400 and $107,500.

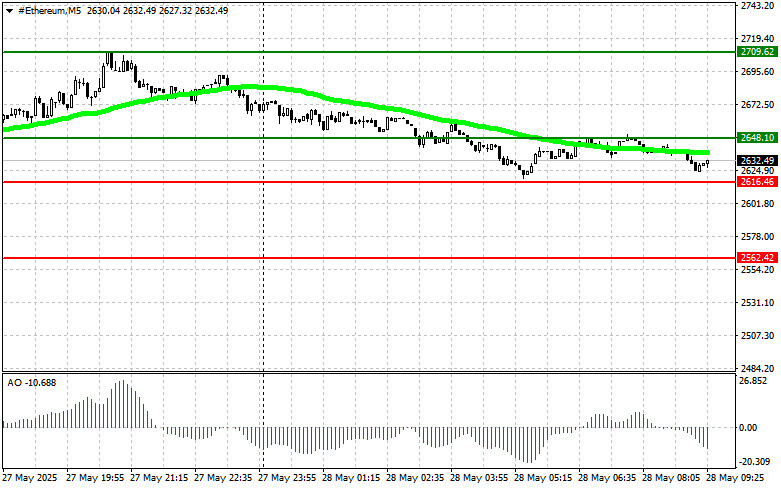

Scenario #1: I plan to buy Ethereum today upon reaching the entry point near $2648 with a target of rising to $2709. Around $2709, I will exit long positions and sell immediately on a rebound. Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: If the market does not react to a breakout, Ethereum can also be bought from the lower boundary at $2616, aiming for a return to $2648 and $2709.

Scenario #1: I plan to sell Ethereum today at an entry point of around $2616 with a target of falling to $2562. Around $2562, I will exit short positions and buy immediately on a rebound. Before selling a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Ethereum can also be sold from the upper boundary of $2648 if there is no reaction to a breakout, aiming for a return to $2616 and $2562.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin continues to trade within the 116,500–120,000 channel, showing solid volatility. Ethereum, however, is performing significantly worse following a recent decline in spot ETF inflows. Meanwhile, yesterday Tether CEO Paolo

Bitcoin once again attempted to break above $119,000 but failed, retreating today toward the $117,000 level. Ethereum has dropped back below $3,600 and is currently heading toward the $3,500 area

Bitcoin once again broke above $119,000, briefly surpassing the $120,000 mark, but then pulled back to around $118,500. This indicates considerable difficulty in returning to the all-time high near $123,000

Bitcoin once again failed to consolidate above the $119,000 level, falling back to the $116,000 area during the Asian session today. Ethereum also fell slightly after hitting $3850. Meanwhile, according

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.