See also

26.05.2025 11:50 AM

26.05.2025 11:50 AMThis unexpected turn of events triggered a wave of optimism across global markets. Investors interpreted the move as a sign of potential de-escalation in trade tensions between the U.S. and Europe, which was immediately reflected in rising asset prices. The delay provides both parties with additional time for negotiations and the search for compromise solutions.

However, despite the positive market response, concerns remain about the long-term outlook for the global economy. Ongoing trade disputes between major economic powers continue to pressure supply chains and hinder investment.

Still, some argue that Trump's actions have increased market uncertainty. Despite the postponed deadline, the trade war narrative is back in focus, especially after Trump's proposed tax breaks and their implications for the U.S. budget deficit rattled markets throughout the previous week.

When it comes to Trump's tariff strategy, a pattern has emerged: severe tariff threats are often followed by pauses, during which negotiations take place. Notably, Trump's decision to extend the deadline came after a phone call with European Commission President Ursula von der Leyen.

Von der Leyen, head of the EU's executive branch, said earlier on Sunday that Europe is ready to proceed quickly and decisively with negotiations, but emphasized that a good deal will take time.

Following Trump's latest remarks, enthusiasm for the U.S. dollar diminished. Speculative traders maintained a bearish bias toward the dollar, but reduced their positions to $12.4 billion in the week ending May 20, down from $16.5 billion the week prior. This reflects a deepening shift away from the dollar as traders react to President Trump's erratic policies.

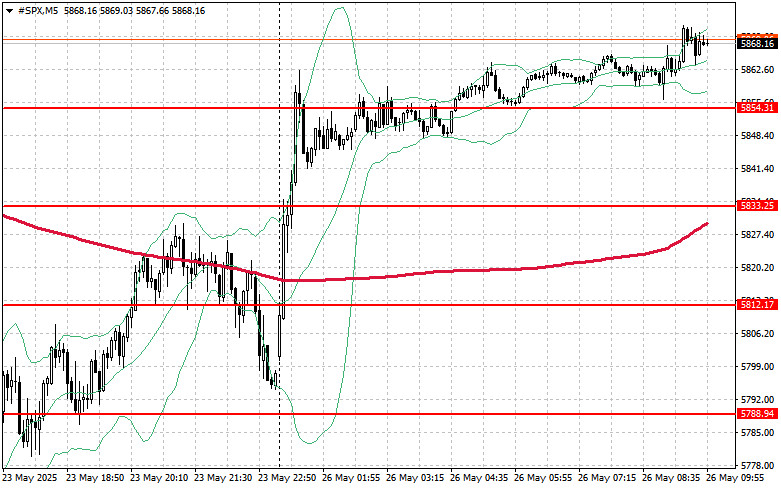

S&P 500 Technical Outlook:

The main task for buyers today is to break through the nearest resistance at $5,877. A breakout here would signal further growth and pave the way for a push toward the next level at $5,897.

Another key priority for the bulls is to gain control over $5,915, which would reinforce buyer momentum.

If the market moves lower amid declining risk appetite, buyers must assert themselves near $5,854. A break below this level would quickly drag the index back toward $5,833, and could open the door to a drop to $5,812.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.