See also

26.05.2025 11:41 AM

26.05.2025 11:41 AMFalse hope. Some people experience it just before death. The trade truce between the U.S. and China offered such a false hope. Investors briefly believed that everything would be fine. However, another outburst from Donald Trump proved that a recession is possible, and the slogan "Sell America" is more relevant than ever. The threat of 50% tariffs against the European Union became another blow to the S&P 500.

Over time, markets concluded that the imposition of large-scale tariffs and subsequent delays are merely part of the White House's negotiation tactics. But let's face it: tariffs have been imposed, the clock is ticking, and there are only two trade agreements—in place with the UK and China. And no matter how much the American administration promises more deals "tomorrow," nothing has changed. And now we have Trump's threats again.

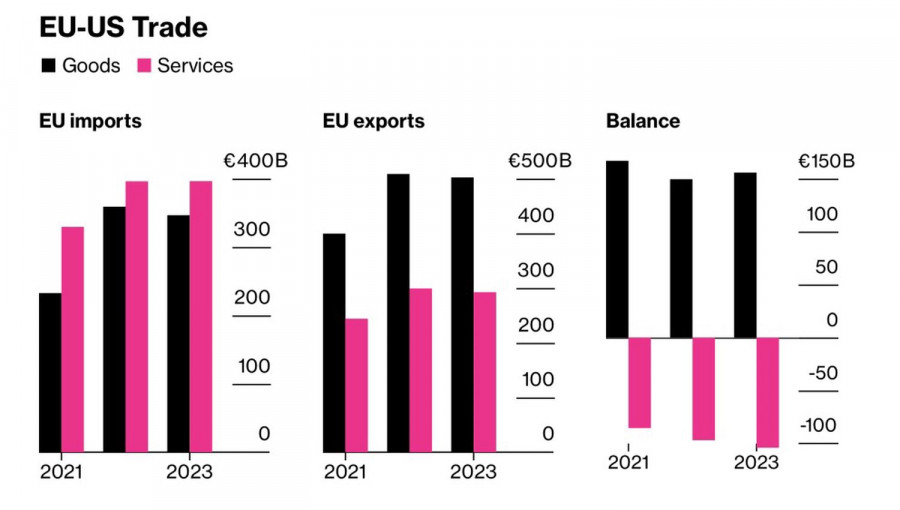

U.S. Foreign Trade with the European Union

There will be no winners in a trade war with the EU. Export-reliant Germany and the eurozone will find themselves in a dire position. However, the threat of runaway inflation will force the Fed to keep rates elevated, which will eventually lead to a recession.

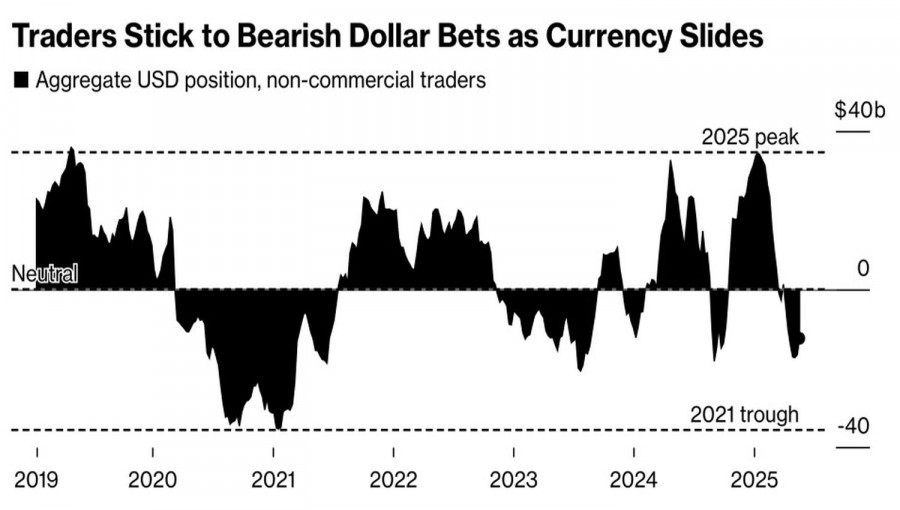

In such an environment, the overconcentration of assets in the U.S. works against them. If you believe the U.S. economy is heading for trouble, now is the time to diversify into European and Asian securities. Even if you're convinced the U.S. stock market will remain the best in the world, it still makes sense to hedge your risks—including those tied to a weakening dollar. Speculators are relentlessly selling it, citing White House policy uncertainty and growing fears of an economic downturn.

Dynamics of Speculative Positions on the U.S. Dollar

According to Allianz Global Investors, which manages $650 billion in assets, the U.S. can no longer offer the reliable "runway" it did just a few months ago.

The situation is worsened by fiscal policy issues, increasingly linked to the current administration's lack of competence. Bond yields are rising sharply, and the Treasury is powerless to stop it—even though Scott Bessent previously listed lower yields on U.S. debt as one of the top priorities of the White House's economic policy.

Tariff chaos and fiscal incompetence are a poor recipe for economic health. Recession risks haven't gone away, and once investors smell trouble, the broad-based equity sell-off will be unstoppable.

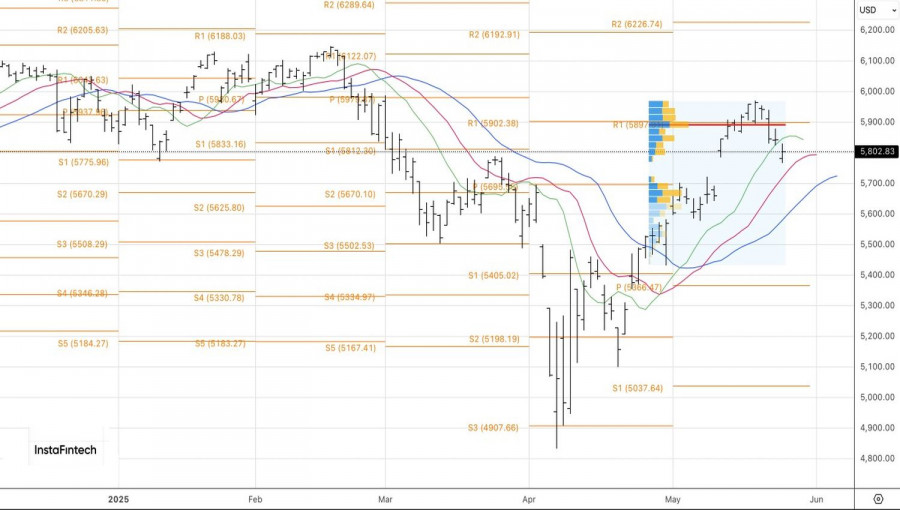

Technically, on the daily S&P 500 chart, the index continues to decline, testing dynamic support zones represented by combinations of moving averages. As long as prices stay below the fair value of 5895, short positions opened from 5910 should be maintained—and selectively increased.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.