See also

23.05.2025 10:19 AM

23.05.2025 10:19 AMMarkets continue to act blindly amid the chaotic actions of Donald Trump, who is trying to pull the U.S. out of a deep, all-encompassing crisis like Baron Munchausen pulling himself out of a swamp by his own hair.

Investors appear to have accepted that the chaotic period initiated by the U.S. president, both geopolitically and economically, will continue indefinitely. There is no longer any doubt among rational observers that America and the broader Western world have entered a phase of declining geopolitical and economic influence. Trump's constant maneuvering, transparent attacks on trade partners for economic leverage, and tax policy changes that defy common sense are the primary drivers of heightened market volatility.

In such an environment, market participants cannot rely on the development of sustainable trends. Traders interpret the landscape as short-term and local — buy today, sell tomorrow. Rumors, headlines, and statements from the 47th President are treated as triggers for short-term speculative trades. Traders have significantly stopped responding to macroeconomic data, which I have not witnessed in my 26 years in the profession.

Gold, the classic barometer of geopolitical and economic fear, clearly reflects this reality. On the weekly chart, gold has entered a chaotic sideways range following a sustained uptrend that began in autumn 2023. The daily chart shows a short-term downtrend forming, with a strong resistance level around 3358.50. The market's failure to breach this level shapes a "descending flag" — typically a continuation pattern within an uptrend. However, whether the uptrend in gold will continue remains unclear due to the overarching uncertainty over markets. That same uncertainty could drive the price down to the lower boundary of the flag, around 3100.00.

Concerns over compliance with the 90-day tariff truce between China and the U.S., the growing budget deficit due to lower tax revenues, and persistent volatility are forcing investors to approach capital allocation cautiously.

Additional risks include the possibility of rising inflation in the U.S. amid tax cuts and the lingering threat of a recession.

Markets have been in chaos for several weeks, with no clear probabilities for how events may unfold. This instability continued yesterday amid an unexpected sell-off of government bonds across major markets, reinforcing the idea that the only viable trading tactic remains "grab and run."

The current situation will likely persist for a prolonged period. The primary market strategy will continue to prioritize short-term speculation instead of long-term positioning.

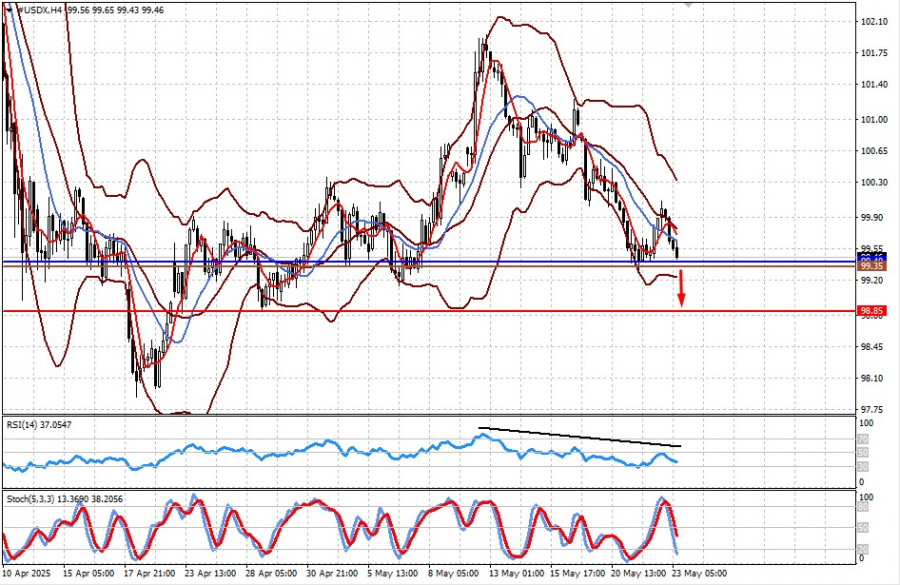

The dollar index is currently trading above 99.40. Continued pressure on the dollar may result in a decline toward 98.85, particularly after it breaks below that level. A possible entry point for short positions could be 99.35.

Gold is trading within a short-term downtrend and may resume its decline. Failure to break above 3358.50 could trigger a renewed drop toward 3263.75. A potential sell level is 3322.42.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Macroeconomic Reports: A fairly large number of macroeconomic publications are scheduled for Friday, but most of them will not interest traders. For example, the report on industrial production

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.