See also

22.05.2025 04:02 PM

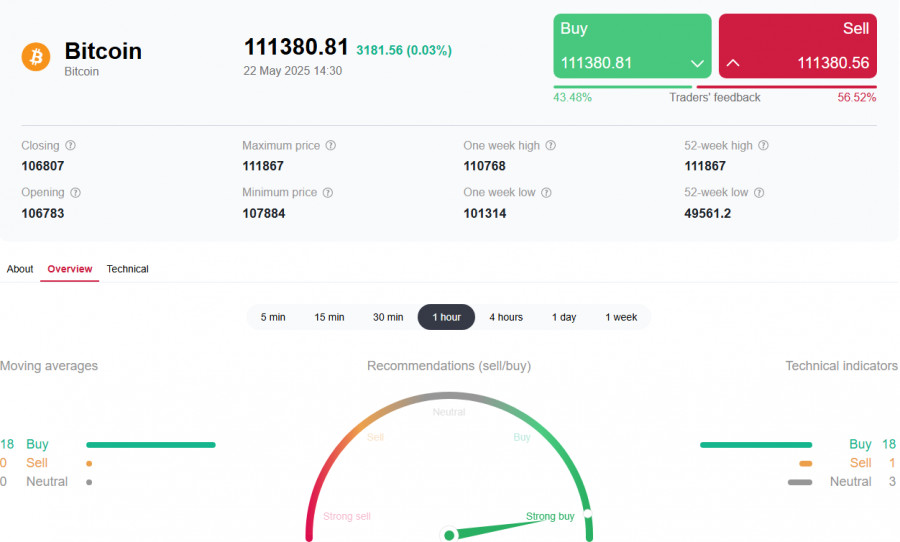

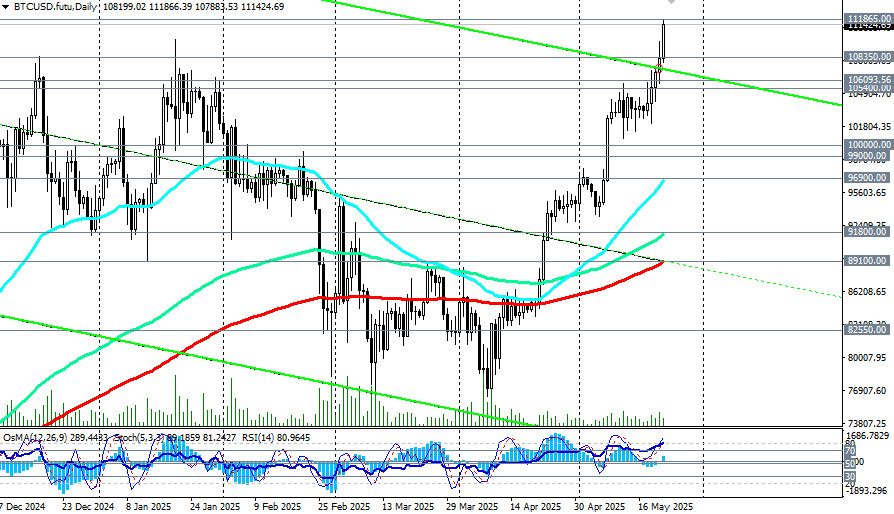

22.05.2025 04:02 PMBitcoin demand appears to be surging, judging by its recent performance. At the time of publication, the BTC/USD pair was trading near 111,200.00, slightly down from today's and the all-time high of 111,865.00. Overall, in the still-ongoing month, the price has climbed 18%, breaking the previous record of 109,985.00 set in January. This marks the 7th consecutive week of growth, signaling a strong bullish momentum.

As noted in our review yesterday, some economists are forecasting a price target of $500,000 per bitcoin by 2029 and $140,000 by the end of 2025. These ambitious projections are based on growing interest from institutional and government investors, including investments in companies holding Bitcoin on their balance sheets. An additional driver is declining confidence in government bonds amid deteriorating macroeconomic stability.

Even though the summer season, typically a time of cooling and corrections for the crypto market, lies ahead, long-term trends remain positive.

Economists also highlight supporting factors such as the decline in the US dollar index (USDX) and significant capital inflows into spot Bitcoin ETFs.

When the USDX drops and the dollar weakens, Bitcoin's price in USD tends to rise, even if its value in other currencies stays the same.

It's also worth noting that US Bitcoin ETFs saw inflows of over $1.6 billion between May 19 and 21, one of the strongest weekly surges since their inception. This underscores the avid interest in Bitcoin of institutional investors as a finite-supply asset.

Only 21 million Bitcoins will ever be mined, and as of today, 19.8 million have already been produced. This strict supply cap enhances Bitcoin's appeal as a long-term investment.

Another new growth catalyst for BTC has been recent remarks by White House advisor David Sacks regarding a stablecoin bill that could generate multibillion-dollar demand for US Treasury bonds. According to economists, this could greatly impact the crypto market.

Sacks emphasized that demand for dollar-backed stablecoins, collateralized by US Treasuries, will become central to the government's financial strategy. This opens new opportunities for crypto market capitalization growth, benefiting the state and positively influencing Bitcoin.

Fundamentally, this means Bitcoin buyers (with sound trading strategies and disciplined money management) have a considerably lower chance of failure than sellers.

Technically, BTC/USD maintains bullish momentum within a medium- and long-term bullish trend, fueled by strong bullish sentiment and underlying fundamentals. While a correction remains possible, it would likely offer new, more favorable buying opportunities.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.