See also

20.05.2025 05:40 AM

20.05.2025 05:40 AMThe EUR/USD currency pair surged upward on Monday with renewed strength. But what justified this move, given that Monday's macroeconomic and fundamental backdrop was practically nonexistent? Yes, the second estimate of inflation in the Eurozone was published... but did not differ from the first one. It no longer affects the European Central Bank's monetary policy since the ECB has cut rates seven times and is preparing for an eighth. In any case, monetary easing, which could lead to a decline in inflation, is a bearish factor for the euro, yet the euro rose throughout Monday.

We therefore believe that only the news of the U.S. credit rating downgrade by Moody's could have triggered the renewed dollar sell-off. To be honest, this is a relatively minor headline—other major agencies have previously downgraded the U.S. rating as well. And the U.S. still holds one of the highest credit ratings in the world, so this is merely a formal excuse to sell the dollar that the market eagerly seized upon.

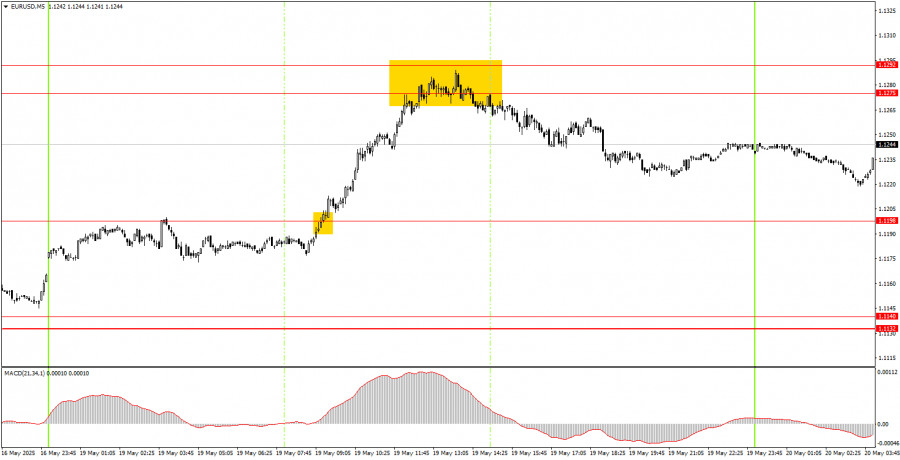

In the 5-minute time frame, Monday generated two nearly perfect trading signals. At the beginning of the upward movement, the price broke through the 1.1198 level, where novice traders could open long positions. The rally ended in the 1.1275–1.1292 zone, from which a clear bounce followed. At this point, longs could be closed and shorts opened. Traders could have earned 60–70 pips from both trades on Monday.

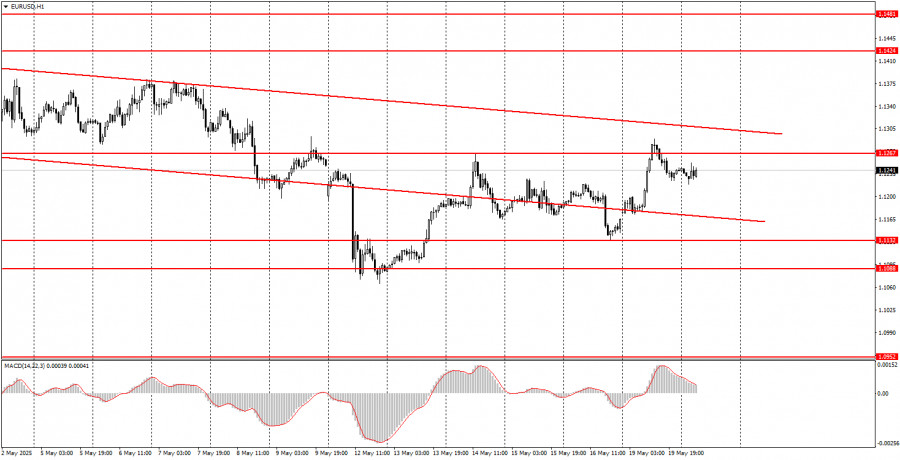

In the 1-hour time frame, the EUR/USD pair has finally begun something resembling a downward trend. Overall, the market remains highly negative toward the U.S. dollar. However, Trump has stepped onto the path of de-escalating the trade conflict, the very one he initiated, which means the dollar could recover in the near term. The strength of the dollar's rise will depend on how many trade deals are signed and how quickly. Also important are Trump's high-impact headlines, such as the firing of Powell or new tariff threats.

On Tuesday, the EUR/USD pair will trade based on technical factors. The macroeconomic background still does not influence price action, so traders should closely monitor the price behavior around 1.1198 and the 1.1275–1.1292 zone.

On the 5-minute TF we should consider the levels of 1,0940-1,0952, 1,1011, 1,1088, 1,1132-1,1140, 1,1198, 1,1275-1,1292, 1,1413-1,1424, 1,1474-1,1481, 1,1513, 1,1548, 1,1571, 1,1607-1,1622. There are no important scheduled events in the Eurozone or the U.S. for Tuesday, so a flat market and low volatility are likely again.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair continued its upward movement on Wednesday, following the new trend. Recall that the price had settled below the previous

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair traded with low volatility and an upward bias. We anticipated that the macroeconomic background would

On Wednesday, the GBP/USD currency pair also traded higher, although volatility remained low. Nevertheless, the British pound rose throughout the day. While there were no strong reasons for this during

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair experienced only a slight decline, likely due to technical factors. Even on the hourly timeframe, it's clear

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.