See also

15.05.2025 11:07 AM

15.05.2025 11:07 AMOn Thursday, a clear slowdown is observed in the stock market rally—one could even say it has stalled. This is due to the market having already priced in the 90-day truce between the U.S. and China, with investors now shifting their focus toward corporate quarterly earnings results.

A contributing factor to the earlier positive sentiment was the U.S. consumer inflation report, which showed a slowdown in monthly growth and even a decline on a year-over-year basis. However, this appears insufficient to sustain the demand for risk assets and to weaken the dollar. Even with the CPI falling year-over-year to 2.3% from 2.4%, the Federal Reserve currently has no plans to resume interest rate cuts.

Today, attention will undoubtedly be focused on the Istanbul negotiations between Russian and Ukrainian delegations regarding the potential for peace in the ongoing conflict. Although this issue may not be central to global markets, it does have an impact through the geopolitical lens. Therefore, any real agreements would strongly support not only the Russian financial market but also commodity markets, which are significantly influenced by Russia.

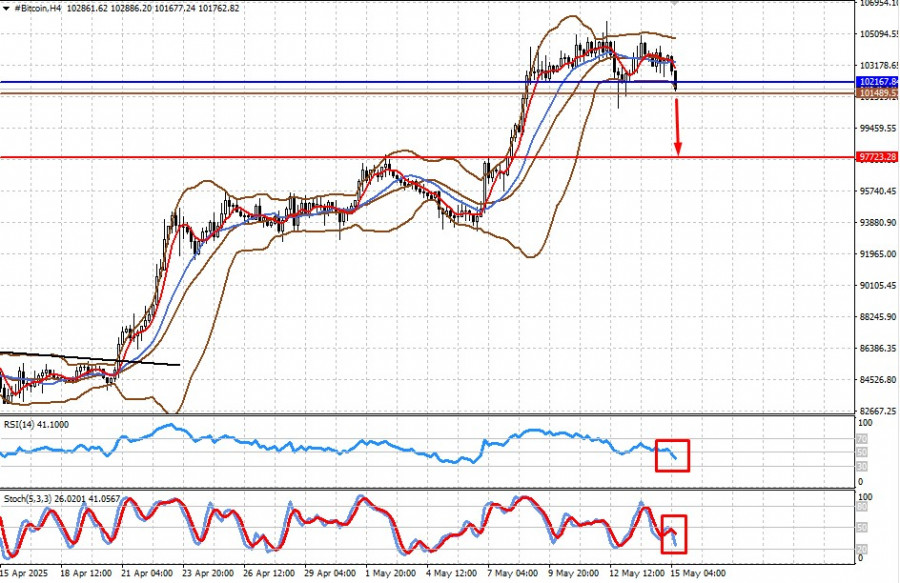

As for the cryptocurrency market, it is currently in sync with global market sentiment. The recent rally triggered by the U.S.–China truce briefly supported token demand, but only to a limited extent. A potential correction is now taking shape amid stabilized stock indices, reduced demand for commodities, and gold.

The U.S. dollar remains under pressure but is still managing to stay above the key 100-point level on the DXY index.

Aside from the Istanbul talks, today's market focus will also be on U.S. retail sales and producer price inflation (PPI) data. According to consensus forecasts, the core retail sales index is expected to have slowed to 0.3% in April from 0.5% in March. For producer inflation, a slowdown to 3.1% from 3.3% is forecasted year-over-year, but a 0.3% month-over-month increase is also expected, following a 0.1% decline in March.

As noted above, any positive development in the Russia–Ukraine negotiations would support the Russian stock market. On such momentum, the MOEX index could test the 3000.00-point mark. For other global markets, we may see decreased activity ahead of the U.S. data releases.

Forecast of the Day

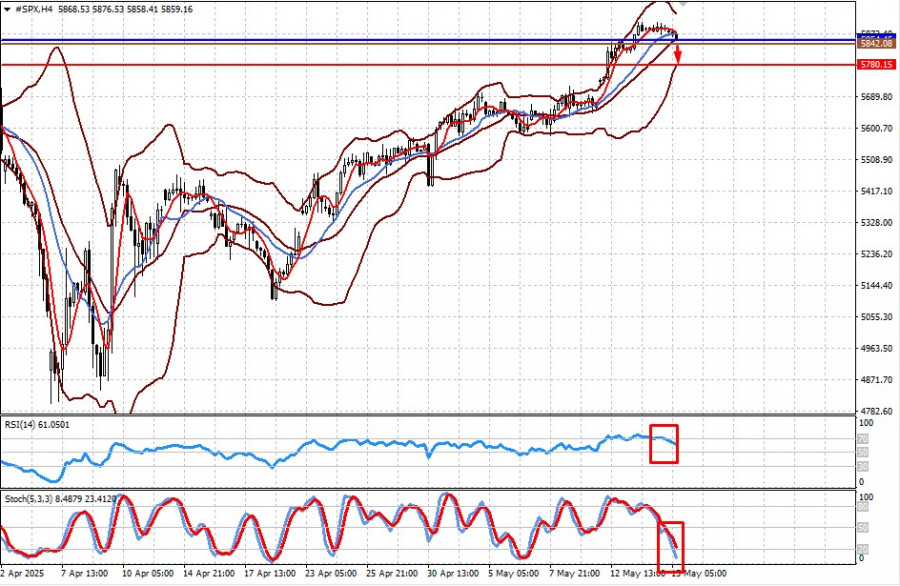

#SPX

The CFD on the S&P 500 futures may correct downward after reaching a local high, driven by anticipation of U.S. statistics or if the data comes in below expectations. In this case, a decline toward 5780.15 is likely if the price drops below 5854.45. The 5842.08 level may serve as an entry level for short positions.

Bitcoin

The token is correcting downward amid a broader market pullback. It has broken below the support line of 102,167.85, opening the door for further decline toward 97,723.28. The level of 101,489.57 may serve as a sell trigger.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.