See also

13.05.2025 09:20 AM

13.05.2025 09:20 AMBingo! No one could have dreamed of such an outcome from the U.S.-China meeting—not even in their most optimistic fantasies. The reduction of U.S. import tariffs from 145% to 30%, and Chinese tariffs from 125% to 10%, sparked a full-on celebration among S&P 500 bulls. The broad equity index posted its best performance in a month, came within arm's reach of breaking into the green for 2025, and is now just 5.6% away from February's record close. Are new all-time highs just around the corner?

Goldman Sachs thinks so. The bank raised its 12-month forecast for the broad index from 6,200 to 6,500, claiming the worst is behind us. There will be no recession in the U.S., equities will climb, and the recent dark streak is becoming a distant memory. Indeed, the deal with China was the most crucial for America. As a result, the average U.S. import tariff has fallen to 12%, not high enough to push the economy off a cliff.

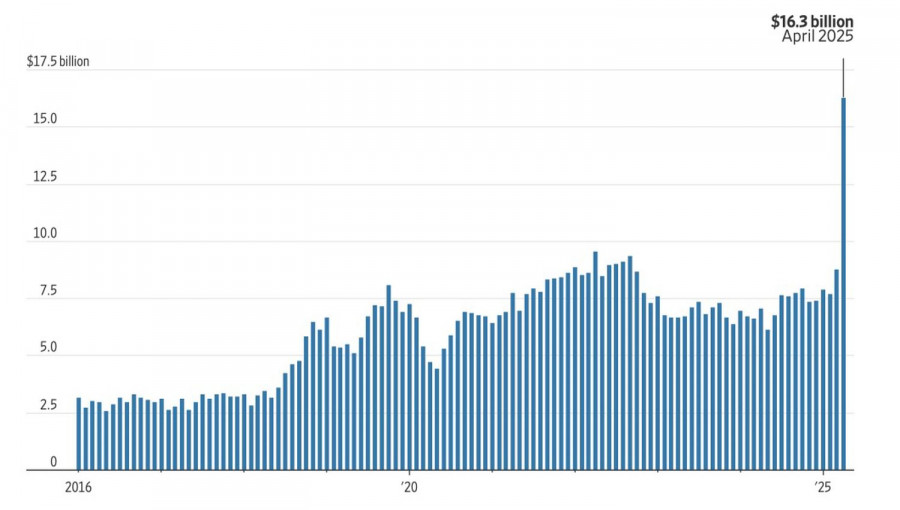

Everything is going according to Donald Trump's plan. Equity indices are rising, and in April alone, the U.S. collected a record $16.3 billion in tariff revenue. Since the start of the fiscal year in October, tariffs have added $63.3 billion to the federal budget—$15.4 billion more than during the same period in 2023/2024.

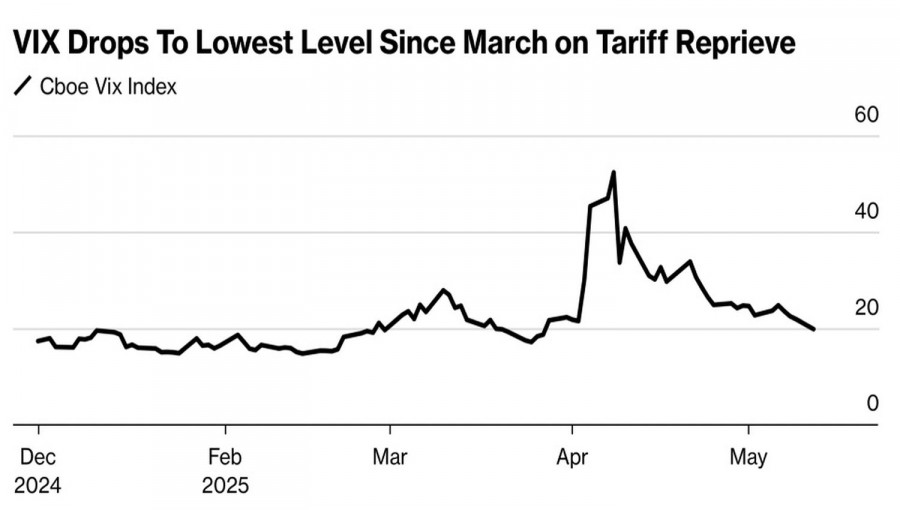

Fear has nearly disappeared from financial markets, as shown by the VIX volatility index falling to its lowest level since March and the put-call ratio for the S&P 500 dropping to its lowest since February.

Everything American is back in style: stocks, bonds, the dollar, and the assets of the Magnificent Seven are being purchased rapidly. Investors seemingly forget that tariffs have already taken a toll on the U.S. economy. Bloomberg analysts expect the labor market to cool by May and inflation to accelerate by June. The risk of stagflation still looms, making the key question: How much will the Fed cut rates?

Following the U.S.-China agreement, futures markets reduced their expectations for monetary easing from 75 basis points to 56 bps—now pricing in two rate cuts in 2025, down from four anticipated in late April. The timing of the policy easing cycle has also shifted from July to September.

My view: The boost from trade de-escalation has likely been priced in. The S&P 500 needs new drivers to continue its rally and reach fresh record highs. One potential catalyst? A renewed round of fiscal stimulus, such as tax cuts. Until then, the index may be headed for a consolidation phase.

On the daily chart, the index remains in an uptrend, continuing the recovery of its long-term bullish trajectory. Long positions initiated at 5655 and 5695 were timely and profitable—their future hinges on a test of resistance at 5900. A breakout would justify adding to longs, while a rejection could signal a reversal and open the door for short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.