See also

08.05.2025 02:00 PM

08.05.2025 02:00 PMMajor US stock indices finished the session higher, spurred by Donald Trump's remarks about progress in trade deal talks. Markets took this as a constructive sign, leading to a rally in futures and improved investor confidence.

However, the lack of concrete details has prompted caution among analysts, who warn of potential volatility should negotiations falter. [Read more here.]

The Federal Reserve kept the official funds rate unchanged at 4.5% in line with market expectations. Meanwhile, the White House continued to send positive signals regarding foreign trade policy, particularly in the context of the agreement with China.

Experts note that the stock market's resilience going forward may depend on the substance of any trade concessions, which could ease global tensions. [Read more here.]

Following the Fed meeting, the US stock market maintained its optimistic trajectory, with gains seen in key sectors such as technology and consumer goods. Despite isolated pullbacks in some stocks, overall sentiment remains positive, driven by expectations of trade improvements and monetary policy stability.

An additional growth driver has been strong quarterly reports from major companies, reinforcing investor confidence. There's also increased interest in high-growth assets amid easing inflation concerns. [Read more here.]

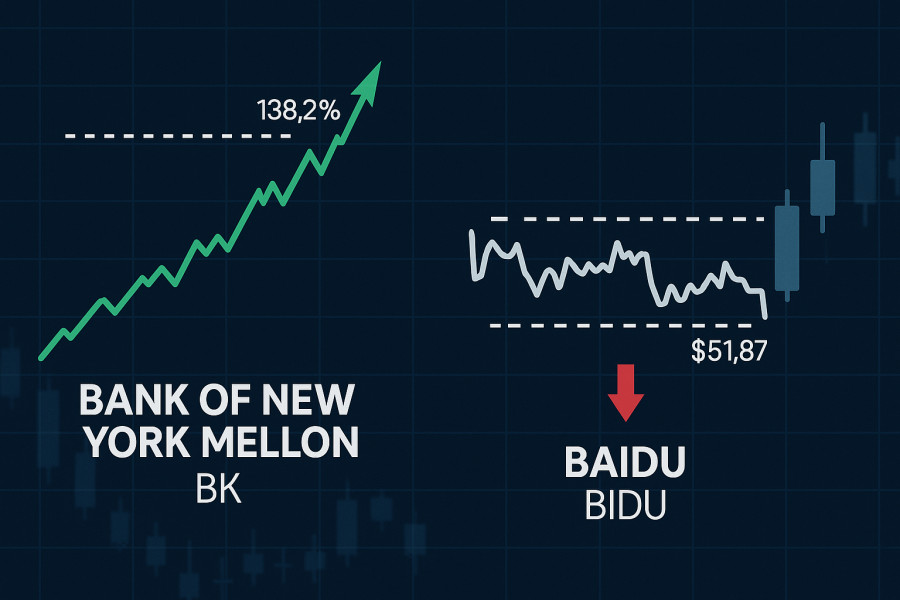

Shares of Bank of New York Mellon are on a steady bullish trajectory, breaking through key technical levels. The move may extend beyond the 138.2% Fibonacci retracement level.

At the same time, investors are cautious with Baidu stock, which remains range-bound and may fall to around $51.87, making it a potential sell candidate. [Read more here.]

InstaTrade offers the best conditions for trading stocks, indices, and derivatives—helping you capitalize effectively on market movements.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.