See also

06.05.2025 12:50 AM

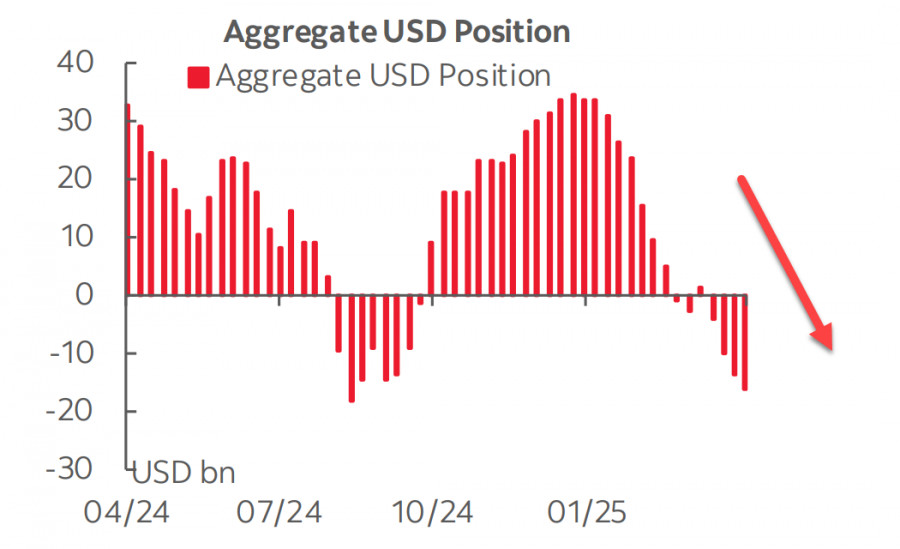

06.05.2025 12:50 AMThe latest CFTC report reveals that the dollar sell-off continues unabated. Weekly changes against major currencies amounted to -$3.1 billion, bringing the total accumulated short position to -$17.1 billion.

One of the reasons the dollar has struggled to regain momentum is China's refusal to yield to pressure from Donald Trump. The U.S. and China remain at odds over whether trade negotiations have begun. Trump claimed several times last week that discussions with China had taken place, which Beijing denied. Meanwhile, U.S. Treasury Secretary Scott Bessent — who appears to be leading the trade talks — stated that he was unaware of any conversation between Trump and Xi. Meanwhile, shelves in major U.S. retail chains are being emptied, and price increases are looming unless tariffs are reduced soon. Container shipping data shows that trade between the two countries has nearly stopped, as importers have stopped placing orders. American farmers also see a significant decline in exports to their largest foreign market.

China's defiance appears to have placed it in a stronger position than Trump had anticipated. Negotiations may be underway behind the scenes, but they are kept quiet until a tangible — even if temporary — result is achieved to ease tensions. With no visible progress, the dollar remains under mounting pressure as time works against the U.S. On Monday, the dollar weakened again as speculation grew that several Asian countries may consider revaluing their currencies to pressure the U.S. into making concessions.

The swap market has not revised its outlook for the Federal Reserve's rate trajectory, and it is still pricing in three cuts this year. Nothing in the recent data has been enough to shift that view, as the latest GDP and labor market reports painted a blurred and contradictory picture. First-quarter GDP showed an annualized decline of -0.3%, mainly due to a surge in imports in anticipation of new tariffs. Domestic demand remains stable and is not yet a cause for concern. Preliminary labor data indicated declines (ADP, job vacancies, and job indices) and weaker consumer activity. However, Friday's official report surprised with stronger-than-expected job growth.

The upcoming FOMC meeting on Wednesday carries a low probability of a rate cut. All attention will be on Jerome Powell's press conference, where he will face intense pressure. Trump has repeatedly said he expects a rate cut from the Fed and has hinted at the possible dismissal of Powell — though he recently walked that back to reassure markets. The mere threat of pressure on the Fed has pushed bond yields lower. As a result, Powell may issue a direct signal that a rate cut is possible in June. If markets pick up on such a hint, it could trigger a renewed wave of dollar sell-offs.

The S&P 500 stock index rose last week, but the rally was largely psychological — driven by expectations that Trump's tariff policy might eventually pay off. Additionally, the earlier drop starting in February was so sharp that a correction was inevitable. The index had lost 50% of its gains over the prior 28 months.

Still, in the long term, we expect that once the current correction ends, the index will resume its decline. A U.S. recession now appears almost inevitable. Our long-term target is 5130. A move to this level could unfold quickly or gradually, depending on the political landscape and how soon the U.S. economy's weakening fundamentals become undeniable. Global trade is now a black box—anything could come from it.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The challenging month of May was experienced differently across global markets, but the main beneficiaries were stocks, which gained momentum from late April and extended their rally into May—something that

Quite a few macroeconomic reports are scheduled for Monday, but only one truly important one. This concerns the U.S. ISM Manufacturing PMI. It's worth recalling that two business activity indices

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.