See also

31.01.2025 05:44 PM

31.01.2025 05:44 PMToday, investor attention will be focused on the Personal Consumption Expenditures (PCE) Price Index, scheduled for 13:30 GMT. If the data exceeds expectations, the Federal Reserve may maintain its hawkish stance, potentially leading to a decline in both stock and crypto markets. However, if the figures remain stable or decline, the US dollar may come under pressure, increasing the likelihood of further crypto market growth.

Market outlook

In general, Bitcoin and other cryptocurrencies remain in an uptrend. If there are no negative macroeconomic surprises, the crypto market may continue to strengthen.

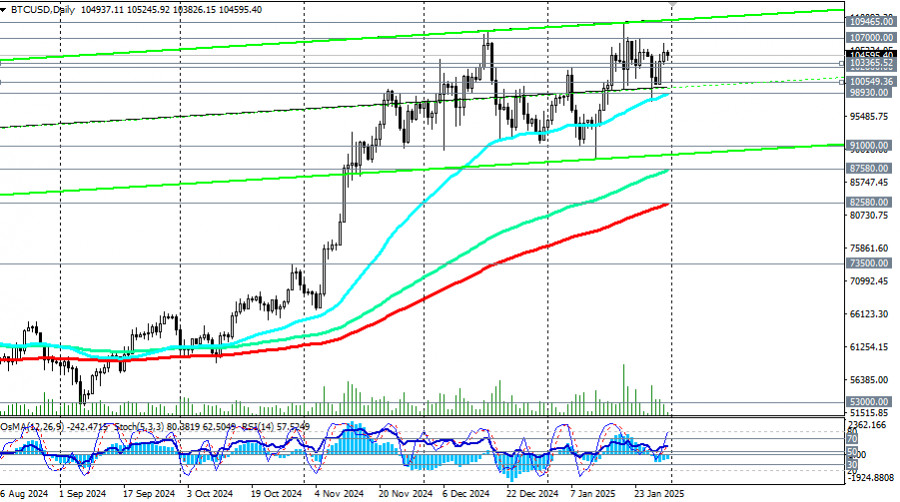

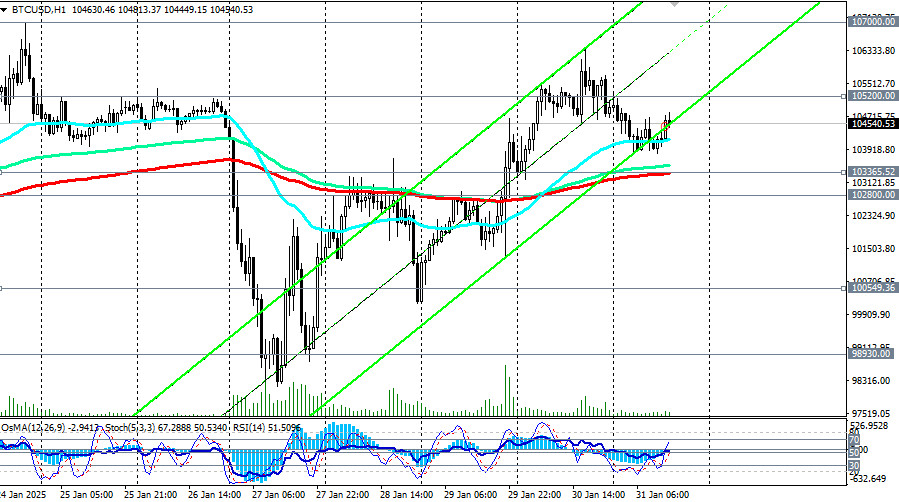

Long positions are preferred for BTC/USD. A break above the local resistance of 107,000.00 could serve as a signal for new buying opportunities, with an earlier signal triggered by a breakout above 105,200.00.

The alternative bearish scenario would be confirmed by a break below today's low of 103,826.00, leading to further declines toward key support levels at 103,365.00 (200 EMA on the 1-hour chart), 102,800.00, 100,550.00 (200 EMA on the 4-hour chart), and 98,930.00 (50 EMA on the daily chart).

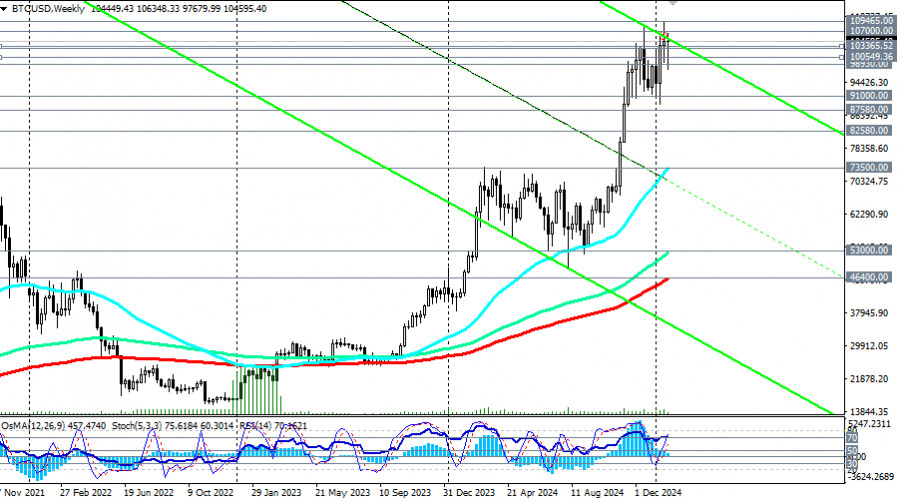

A deeper correction could bring BTC down to the local support level of 91,000.00. A break below this level might trigger a larger sell-off toward 75,000.00, as suggested by some economists.

From both a technical and fundamental perspective, considering Trump's statements about making the US a "crypto haven," the outlook for digital assets—especially Bitcoin—remains positive. As a result, long positions remain preferable for BTC/USD.

Key support and resistance levels

Support levels: 103,820.00, 103,365.00, 103,000.00, 102,800.00, 102,000.00, 100,500.00, 100,000.00, 99,000.00, 98,930.00, 91,000.00, 87,500.00, 82,580.00, 81,100.00, 80,000.00

Resistance levels: 105,000.00, 105,200.00, 106,000.00, 107,000.00, 108,000.00, 109,000.00, 109,500.00, 110,000.00

Trading scenarios

Main scenario (bullish):

Buy stop at 105,210.00, 106,000.00, 107,100.00

Stop-loss: 103,300.00

Targets: 108,000.00, 109,000.00, 109,500.00, 110,000.00

Alternative scenario (bearish):

Sell stop at 103,300.00

Stop-loss: 104,700.00

Targets: 103,000.00, 102,800.00, 102,000.00, 100,500.00, 100,000.00, 99,000.00, 98,930.00, 91,000.00, 87,500.00, 82,580.00, 81,100.00, 80,000.00

Note: The target levels correspond to support and resistance levels. This does not guarantee that they will be reached, but they serve as reference points for trade planning and position placement.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.