See also

27.12.2024 12:33 AM

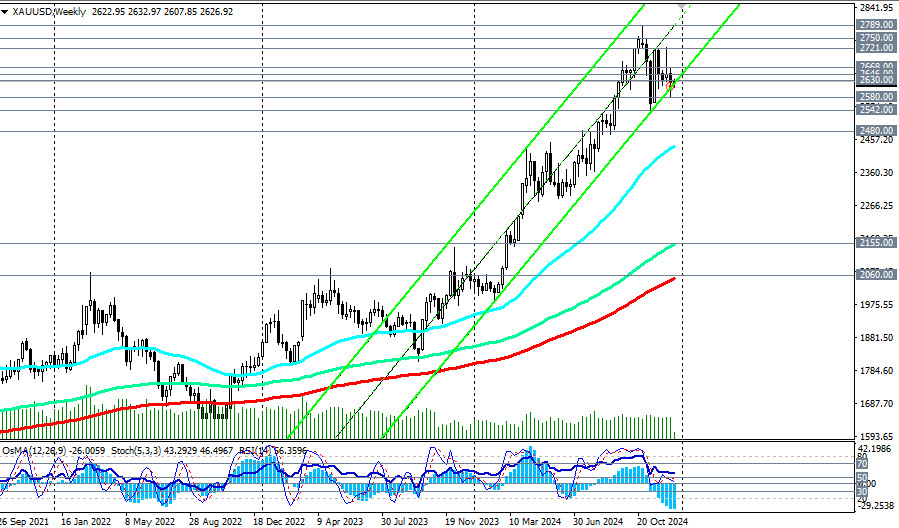

27.12.2024 12:33 AMThe outcomes of the December Federal Reserve meeting resulted in a significant strengthening of the dollar, leading to a decrease in demand for gold and silver. Precious metals are considered safe-haven assets, but they do not generate investment income. When global central banks, especially the Federal Reserve, maintain a tight monetary policy or signal expectations of further tightening, the demand for these assets tends to decline.

Despite this, the upward trend in gold prices remains intact. It is likely that the multi-year bullish trend will continue, although it may not be as pronounced as in previous months.

Performance Review

Over the past month, XAU/USD has lost approximately 3.5%, briefly dropping to mid-September lows around 2537.00. However, it has maintained its long-term bullish momentum and rebounded, although it has not yet surpassed the record high of 2790.00 reached at the end of October.

Since then, the price has settled into a range mostly confined between 2721.00 and 2580.00.

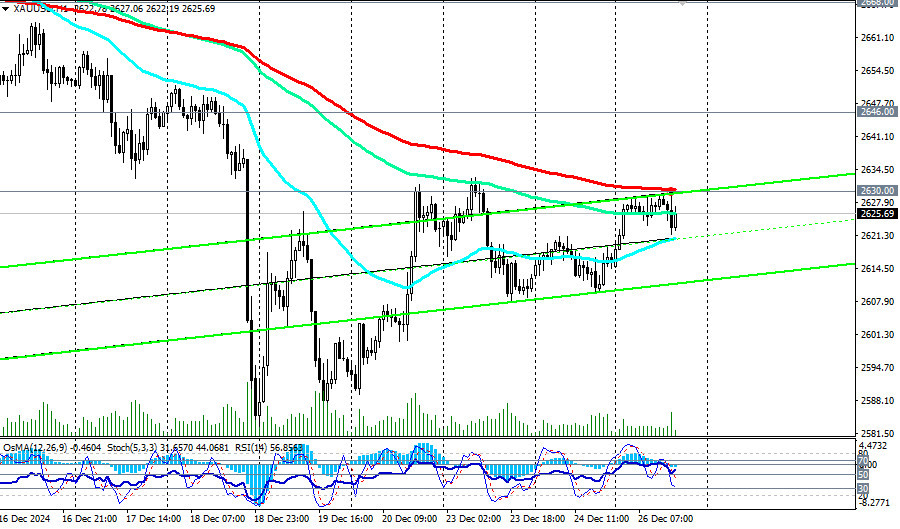

As of this writing, the XAU/USD pair is trading near 2630.00 and is testing a key short-term resistance level indicated by the 200-period moving average on the hourly chart.

A breakout above this level, along with the resistance at 2646.00 (the 200-period EMA on the 4-hour chart), would indicate a full return of the price to the medium-term bullish zone and within the ascending channel on the daily chart. This movement could drive the price toward the upper boundary of the channel, which lies between 2750.00 and 2790.00.

This area is likely to become a target in the coming weeks or even months.

Alternative Scenario

In an alternative scenario, a decline signal may occur if the support at 2620.00 is broken, followed by a breach of local support at 2608.00. The nearest targets are the support zones at 2580.00 and 2542.00 (the 144-period EMA on the daily chart).

It is unlikely that we will see a deeper decline into the zone below the key medium-term support level at 2480.00 (the 200-period EMA on the daily chart). Overall, XAU/USD remains in the bullish zone.

The advantage remains with long-term buy positions.

Support Levels: 2620.00, 2608.00, 2600.00, 2580.00, 2542.00, 2500.00, 2480.00Resistance Levels: 2630.00, 2646.00, 2668.00, 2700.00, 2721.00, 2750.00, 2790.00, 2800.00, 2900.00, 3000.00

Primary Scenario:

Alternative Scenario:

*) Targets correspond to support/resistance levels. While these levels may not always be reached, they can serve as useful benchmarks for planning and executing trading strategies.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.