See also

13.06.2025 02:14 PM

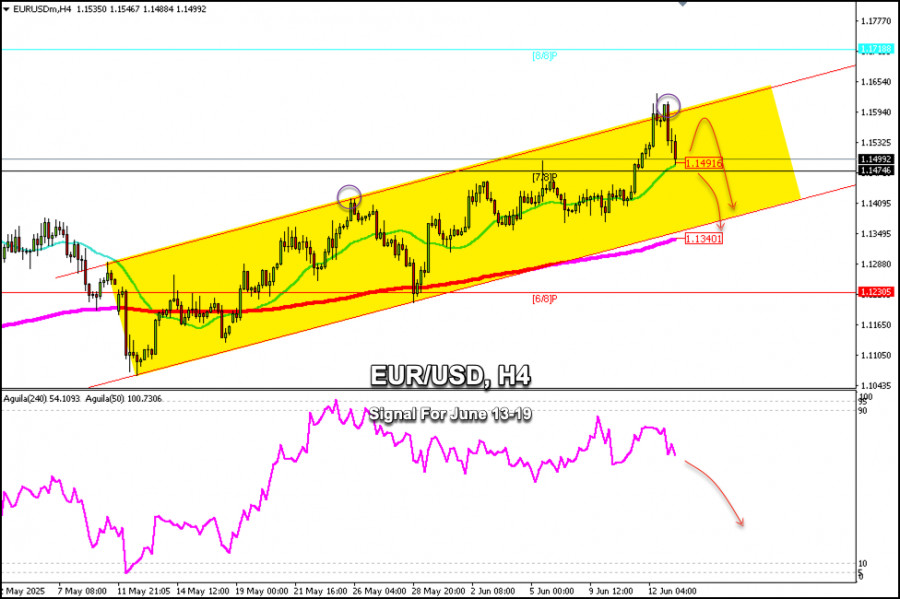

13.06.2025 02:14 PMEarly in the American session, the euro is trading around 1.1499, retreating after reaching its highest level last seen in 2021 around 1.1630.

It would be prudent to buy the EUR/USD pair around 1.1491, as this level coincides with the 7/8 Murray and 21 SMA, which could offer a technical rebound in the coming hours.

Consequently, if the euro price consolidates above 1.1500, it could be seen as a bullish signal and could re-reach the top of the uptrend channel around 1.1590.

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.

The eagle indicator is showing a negative signal. Thus, we believe that if the euro falls below the psychological level of 1.15, it will be seen as a bearish signal, and we could sell with short-term targets around the 6/8 Murray level at 1.1230.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.