See also

09.06.2025 03:23 PM

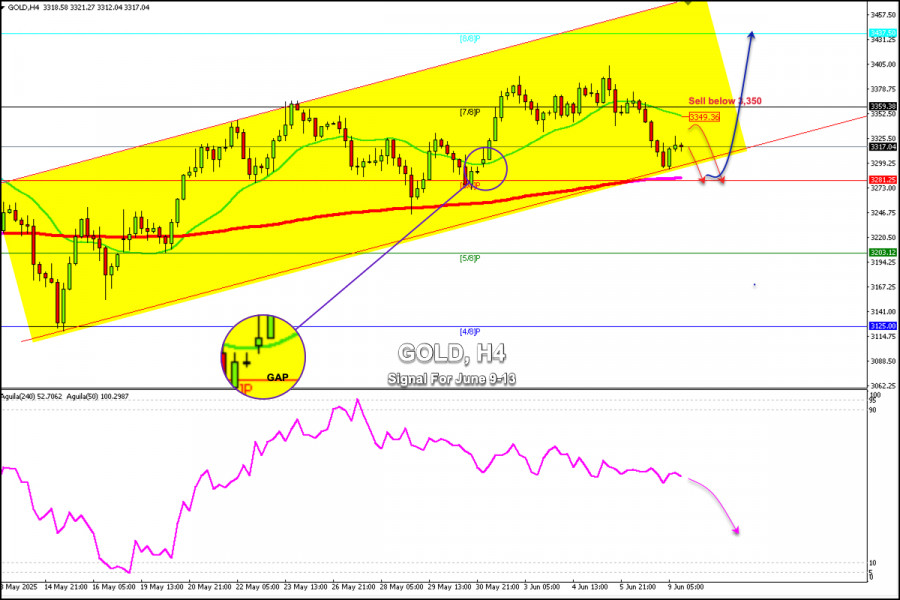

09.06.2025 03:23 PMEarly in the American session, gold is trading around 3,317, rebounding after reaching a low of 3,294 during the European session.

On the H4 chart, gold could continue to rise and could reach the 21SMA located around 3,449. However, there is strong bearish pressure, and we believe it could reach the 6/8 Murray level located at 3,281. Gold could break above this level and reach the gap created on May 14 around 3,197.

The area where the 21SMA and 7/8 Murray are located is expected to act as strong resistance. Sellers have been well-received in this area, and it will be seen as an opportunity to sell.

On the other hand, if gold rebounds around the 200 EMA and consolidates above 3,281, the outlook could be bullish, and we could expect it to reach the 8/8 Murray at 3.437.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.