See also

11.04.2024 09:41 AM

11.04.2024 09:41 AMConsumer price growth accelerated from 3.2% to 3.5%, slightly higher than the expected 3.4%. This resulted in dollar rising sharply, as the Fed may raise the refinancing rate in the summer, since inflation continues to increase, and at a faster pace than forecasted. However, most market players lean towards the idea that interest rates will start to decrease in the autumn, although this may soon be revised.

For now, a slight retreat could be seen in the market, while dollar will likely continue to rise actively. The results of the upcoming ECB meeting may be the cause of dollar's further appreciation, as the committee may specify the timing of its policy easing. After all, inflation in Europe slowed down, approaching the target level of 2.0%.

EUR/USD hit the weekly low last week during the downward movement driven by the US inflation data. However, such an intensive price change indicates a possible overheating of short positions, which could lead to a retracement or stagnation. The possibility of such a development, however, appears to be small, as today's ECB meeting may provoke speculative price jumps.

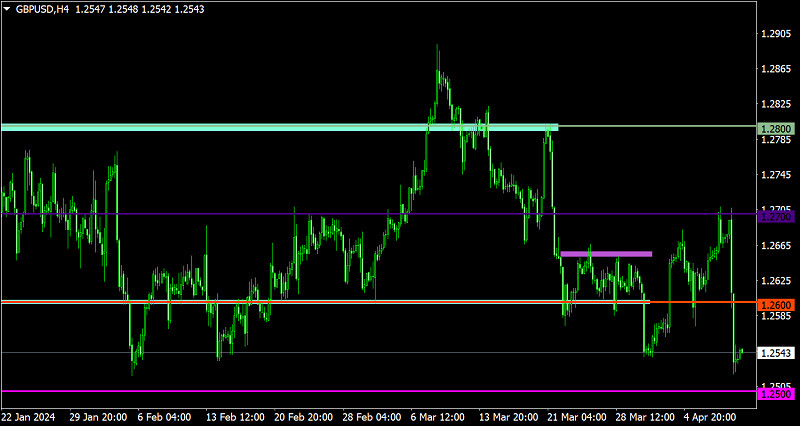

In GBP/USD, the intensive decline in quotes brought the price closer to the support level of 1.2500. Although the movement slowed down, the speculative sentiment remains. Dropping below the level will likely increase the volume of short positions. Otherwise, the level of 1.2500 may act as support.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.