See also

04.04.2024 08:57 AM

04.04.2024 08:57 AMPreliminary inflation estimates in the eurozone showed a slowdown in the pace of consumer price growth from 2.6% to 2.4%. Meanwhile, employment in the US grew by 184,000, surpassing the forecast of 125,000. Fed Chairman Jerome Powell also stated that the central bank will analyze the macroeconomic dynamics before deciding on interest rate cuts. Overall, this points toward an inevitable and substantial rise of dollar. However, contrary to expectations, euro continued to gain strength.

The market may return to its usual course today after the release of data on producer prices in the eurozone. The rate of decline may slow down from -8.6% to -8.3%, which may convince the market that the European Central Bank will be the first to cut interest rates. Therefore, the prospects for euro does not look as bright as they may seem.

EUR/USD surpassed the resistance level of 1.0800, resulting in the surge of long positions. This led to the further strengthening of the pair and its overbought condition, which may end with a slowdown and a correction. However, in the case of momentum, the overbought signal may be ignored, leading to further movement towards the level of 1.0900.

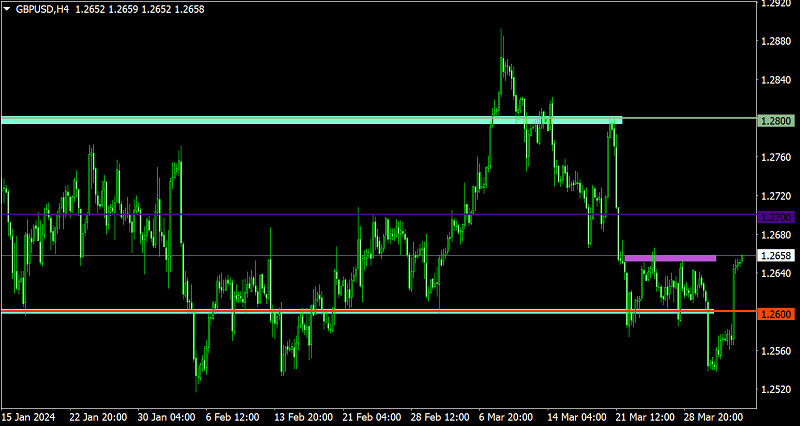

A similar picture could be seen in GBP/USD. It rose by 90 pips and shows signs of overbought conditions in the lower timeframes, which may lead to the decrease of long positions. However, in the case of momentum, market players may ignore this technical analysis.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.