See also

01.03.2024 10:36 AM

01.03.2024 10:36 AMOn Thursday, the US Labor Department published a weekly update on unemployment benefits. The data turned out to be worse than analysts' expectations. The number of continued unemployment claims increased from 1,860 million to 1,905 million. Besides, the number of initial applications for benefits rose from 202K to 215K. Despite the signs of weakness in the labor market, the US dollar asserted its strength across the board. Perhaps the reason for the greenback's growth was expectations of a decline in inflation in the Eurozone. The inflation report will be available on Friday.

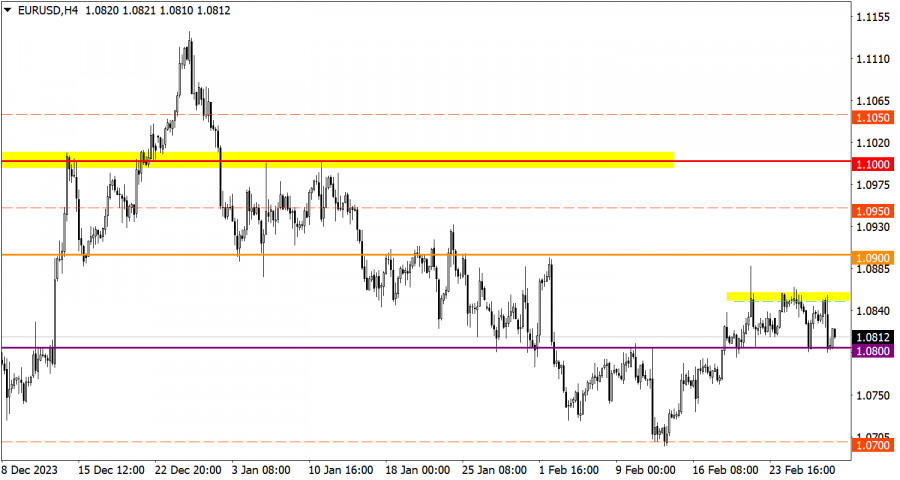

The EUR/USD pair again reached the level of 1.0800, where traders cut on short positions was observed. Judging by the speculative price swings, the instrument will soon quit the range between 1.0800 and 1.0850.

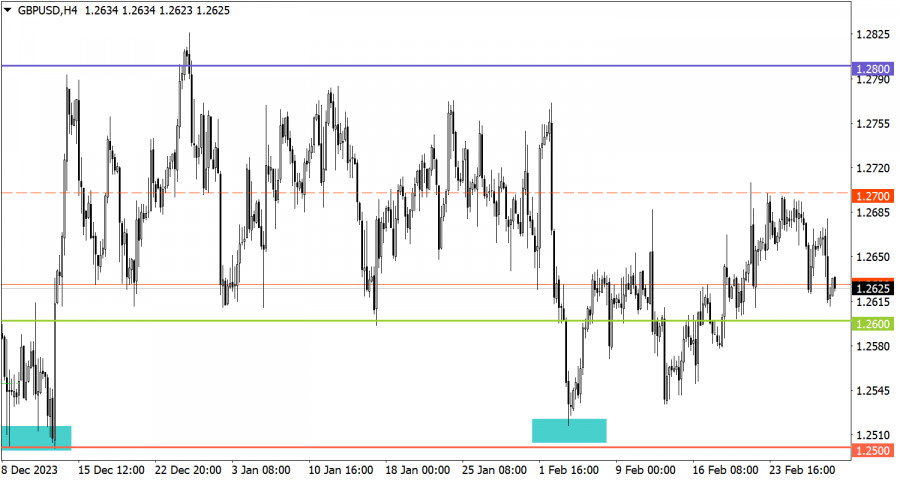

The GBP/USD pair has been following a downtrend from the resistance level of 1.2700. As a result, the instrument is approaching the support level of 1.2600.

Today, the preliminary inflation data for the EU will be released. The annual CPI is expected to slip to 2.5% in February from 2.8% in January. This may contribute to the US dollar's advance.

If EUR/USD settles below 1.0800, traders will add more short positions. Consequently, the instrument will trade lower. Until then, the realistic scenario is a climb to 1.0850.

To enable a further increase in short positions, GBP/USD needs to settle below 1.2600. Otherwise, this level will be viewed by traders as support. In turn, this will encourage a gradual recovery in the pound sterling.

The candlestick chart type consists of graphic rectangles in white and black with lines at the top and bottom. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time period: opening price, closing price, maximum and minimum price.

Horizontal levels are price coordinates relative to which a price may stop or revered its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price developed. This color highlighting indicates horizontal lines that may put pressure on the price in the future.

Up/down arrows are guidelines for a possible direction in the future.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.