See also

20.02.2024 12:08 PM

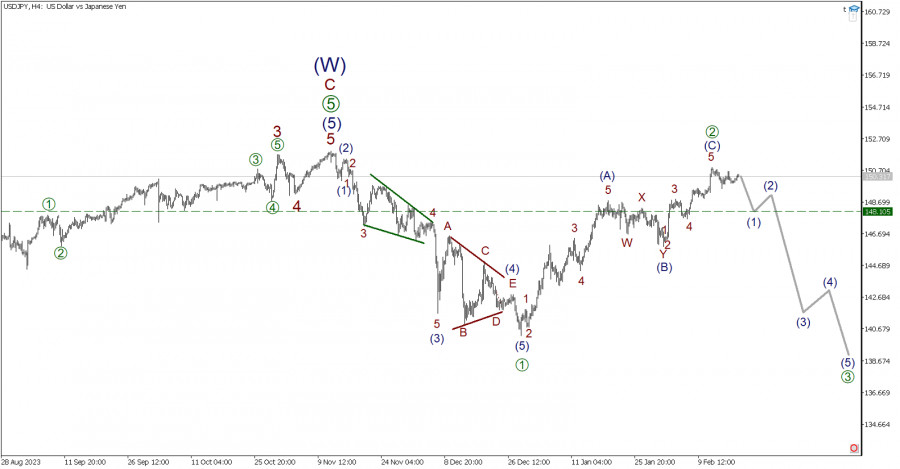

20.02.2024 12:08 PMLet's consider the situation with the USD/JPY currency pair on a four-hour timeframe. From the perspective of wave theory, after completing the global wave (W), the market began to build a new bearish trend. Most likely, the initial part of the impulse [1]-[2]-[3]-[4]-[5] is in the early stages of development.

The first part, impulse [1], appears completed, and the upward correction [2] also looks finished. Correction [2] consists of three main parts—sub-waves (A)-(B)-(C).

On the last segment of the chart, we can observe the development of the initial part of a new impulse wave [3]. Its potential internal structure is depicted on the chart.

In the upcoming trading days, the development of the first sub-wave (1) towards the price level of 148.10 is expected. Then, a minor rise in correction (2) is anticipated. In the current situation, it is recommended to consider opening short positions.

As of today, there are no planned events that would impact the market. Thus, the market will continue its movement within the current scenario.

Trading recommendations: sell at 150.31, take profit at 148.10.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.