See also

31.10.2023 06:32 AM

31.10.2023 06:32 AMEUR/USD

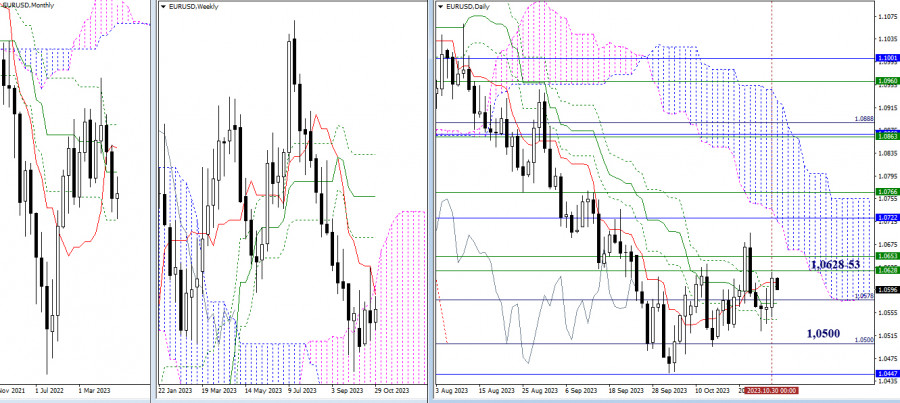

Higher Timeframes

At the end of yesterday, judging by the mood and the shape of the daily candle, it can be said that the advantage during the day belonged to the bullish players. However, one day did not fundamentally change the situation. The main conclusions and expectations remain the same. For the bulls, it is now important to overcome the weekly resistances at 1.0628 – 1.0653 (weekly short-term trend + upper boundary of the weekly cloud). Next, attention will be on updating the high (1.0695) and testing the area of 1.0716-22 (lower boundary of the daily cloud + monthly medium-term trend). The current support and influence on the situation at the moment are provided by the levels of the daily Ichimoku cross (1.0609 – 1.0601 – 1.0572 – 1.0543). The subsequent bearish targets today retain their significance and are located at 1.0500 (daily target level) and 1.0447 (final level of the monthly Ichimoku cross).

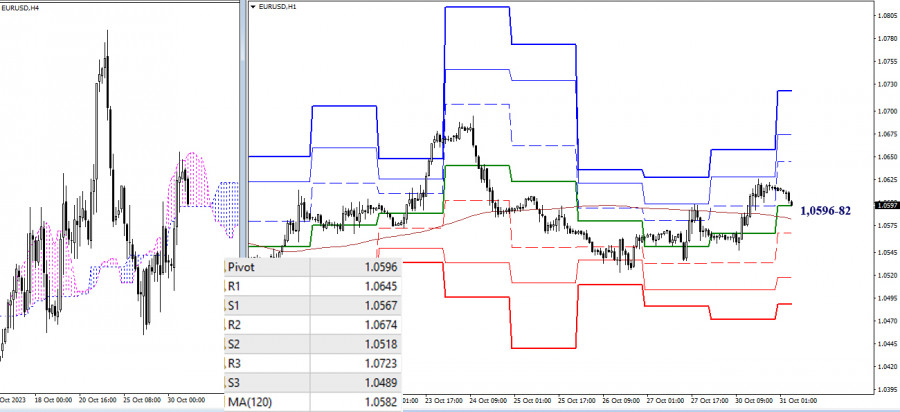

H4 – H1

On the lower timeframes, bulls rose above the key levels, turning them into supports. However, they have not been able to reverse the movement yet. In case of further ascent, the next bullish targets within the day can be noted at 1.0645 – 1.0674 – 1.0723 (resistances of classic pivot points). A change in sentiment can happen very quickly now; it is enough for the bears to drop below the key levels located today at 1.0596 – 1.0582 (central pivot point + weekly long-term trend). The next intraday bearish targets are at 1.0567 – 1.0518 – 1.0489 (supports of classic pivot points).

***

GBP/USD

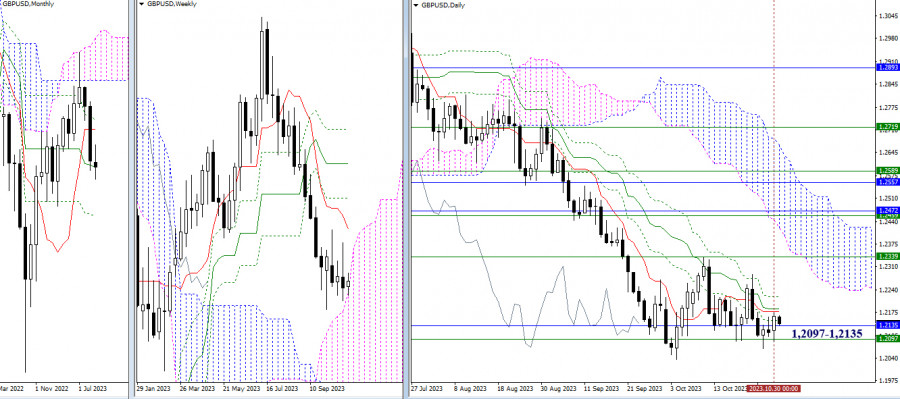

Higher Timeframes

The pound continues to be influenced by the force of attraction of two significant levels in the area of 1.2097 – 1.2135 (upper boundary of the weekly cloud + monthly medium-term trend). Bearish players need an exit from the current zone of attraction and a reliable reversal of the downward trend through the update of the low (1.2036). For the bulls, it is important to eliminate the daily cross (1.2151 – 1.2178 – 1.2186 – 1.2221) and consolidate above the weekly short-term trend (1.2339).

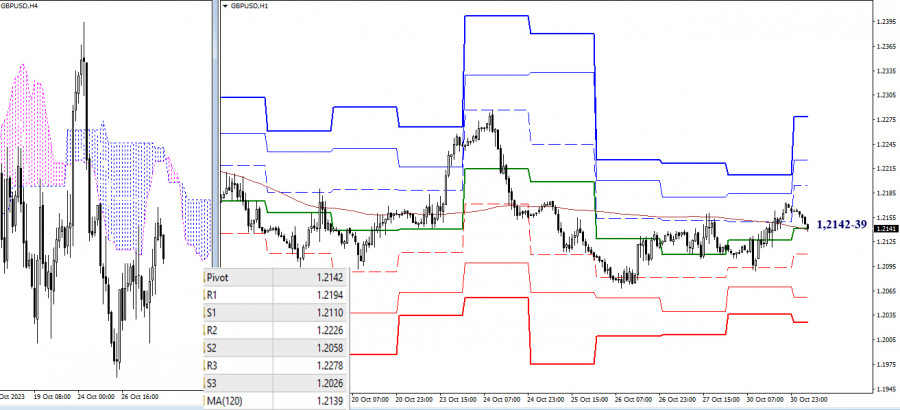

H4 – H1

On the lower timeframes, the key levels today have come together in the area of 1.2139 – 1.2142 (weekly long-term trend + central pivot point of the day). Interacting with the key levels, the market seems to be in a point of balance and uncertainty. Trading above the key levels gives the advantage to strengthening bullish sentiments. The resistances of classic pivot points (1.2194 – 1.2296 – 1.2278) can serve as targets for the development of an intraday rise. Trading below the key levels may create conditions for bearish activity and a decline. Intraday bearish targets are at the support levels of classic pivot points (1.2110 – 1.2058 – 1.2026).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.