See also

11.09.2023 02:00 PM

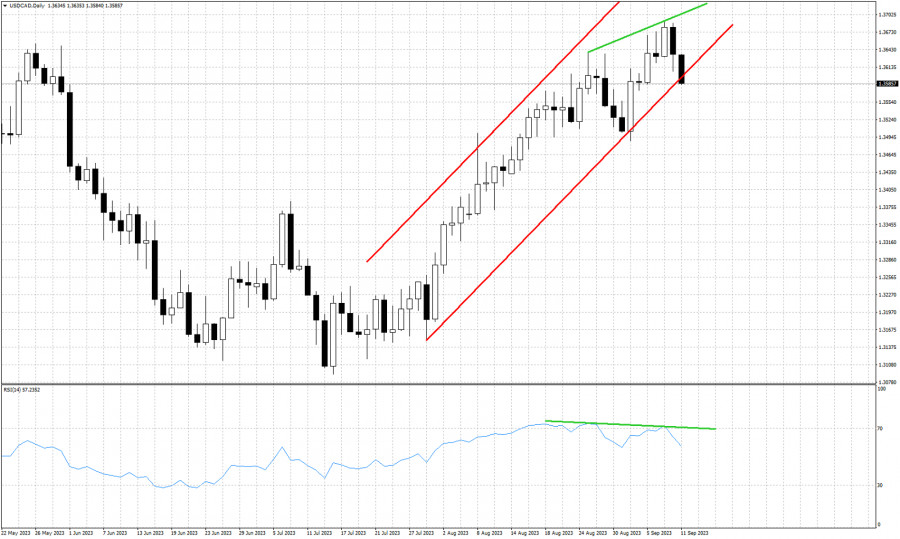

11.09.2023 02:00 PMRed lines- bullish channel

Green lines- bearish RSI divergence

In our analysis on USDCAD last week we noted three things. First was the bearish RSI divergence. Despite the higher highs in price, the RSI did not follow suggesting that a pull back was imminent. Secondly we noted that a pull back at least towards the lower channel boundary was justified and expected. Thirdly we expressed the view that at current levels we preferred to be neutral if not bearish. This week starts with USDCAD under pressure very close to breaking out of the bullish channel it was in since July. Bulls need to be very cautious as there are increased signs that this upward wave is complete. Confirmation of this scenario will come with a break below 1.3488.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.