See also

24.08.2023 03:57 PM

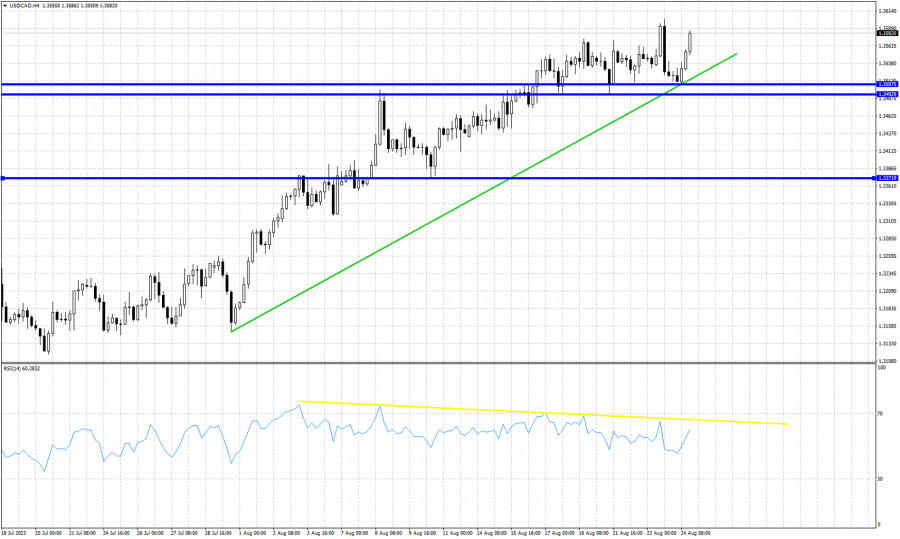

24.08.2023 03:57 PMBlue lines- higher lows

green line- support trend line

Yellow line- bearish RSI divergence

USDCAD is trading around 1.3573 still making higher highs and higher lows. Recent pull back towards 1.3508 almost gave us a bearish reversal signal, but price did not form a lower low. Instead price formed a new higher low and is now bouncing higher with potential to reach 1.36.Support by the trend line is found at 1.3520. Technically trend remains bullish. However the bearish RSI divergence we see for the last few trading sessions suggest that the up trend is weakening and a reversal could start any time soon. That is why we believe that the upside potential is limited and traders should protect their profits, as there are increased chances of a reversal. At current levels I prefer to be neutral USDCAD if not bearish. A break below 1.3508 will confirm a trend reversal.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.