See also

07.01.2022 06:47 PM

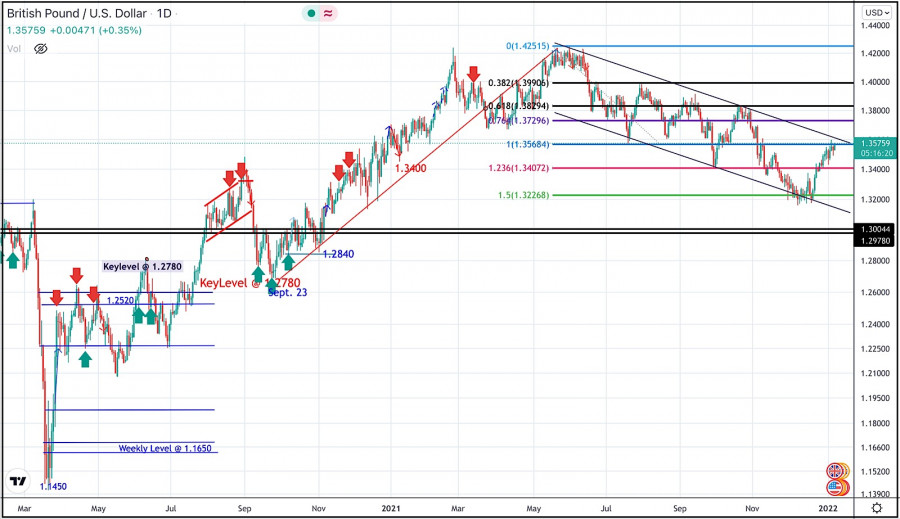

07.01.2022 06:47 PMThe GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline.

Bearish breakout below 1.3700 enabled quick bearish decline to occur towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement.

This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.3720 which was temporarily bypassed.

Shortly after, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market.

More bearish extension took place towards 1.3220 where the lower limit of the current movement channel came to meet with Fibonacci level.

Conservative traders should have taken BUY trades around 1.3200 price levels as suggested in previous articles.

Current BUYERS are looking towards 1.3570 and 1.3600 as the next target levels to have some profits off the trade.

Moreover, the price level of 1.3570 stands as a key-resistance to be watched for bearish reversal if some bearish signs existed upon the current testing.

The short-term outlook remains bullish as long as the pair maintains its movement within the depicted channel above 1.3400.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

USD/CAD – Monday, July 28, 2025 Although the RSI (14) is at a neutral-bearish level, the Golden Cross condition between the 50-EMA and 200-EMA indicates a bullish bias, so USD/CAD

EUR/USD – Monday, July 28, 2025. With the appearance of a divergence between Fiber's price movement and the RSI(14) indicator, although the 50 and 200 EMAs (Golden Cross & RSI(14)

Early in the American session, the euro is trading around 1.1752, bouncing back after finding good support around 1.1718. Last week, the euro sharply broke out of the uptrend channel

Bitcoin is in a correction phase after recently reaching $19,750. BTC is undergoing a technical correction, so the price is likely to drop in the coming hours toward the 21SMA

Early in the European session, gold is trading around 3,331, bouncing back after reaching the key support zone around the 5/8 Murray level. Gold could recover some of its losses

Ferrari F8 TRIBUTO

from InstaTrade

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.