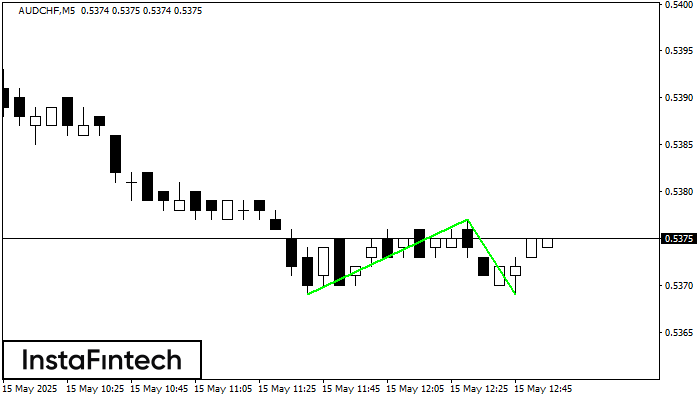

Double Bottom

was formed on 15.05 at 11:55:04 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDCHF M5; the upper boundary is 0.5377; the lower boundary is 0.5369. The width of the pattern is 8 points. In case of a break of the upper boundary 0.5377, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength