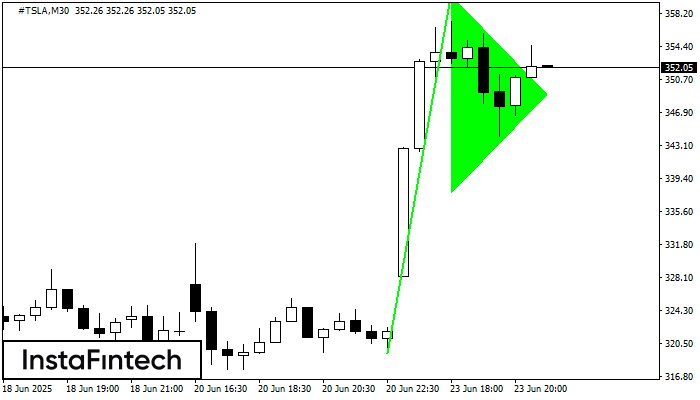

Bullish pennant

was formed on 23.06 at 20:00:05 (UTC+0)

signal strength 3 of 5

The Bullish pennant pattern is formed on the #TSLA M30 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high of 360.27, a further uptrend is possible.

Figure

Instrument

Timeframe

Trend

Signal Strength