Vea también

10.06.2025 06:36 PM

10.06.2025 06:36 PMTrade Review and Recommendations for Trading the British Pound

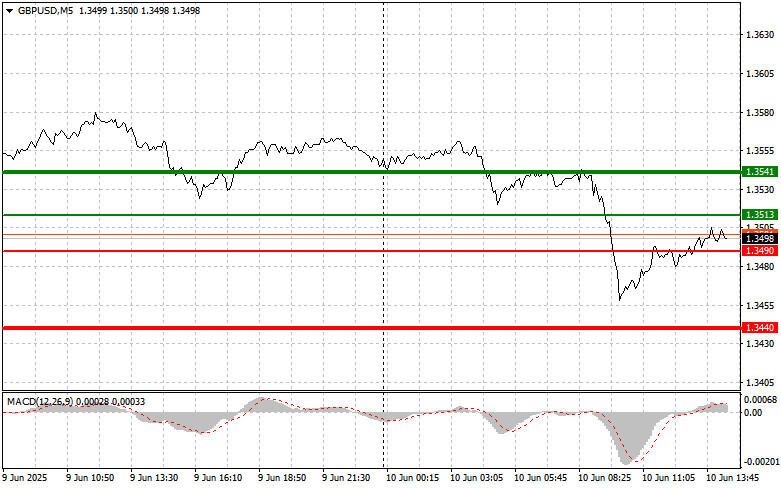

The price test at 1.3530 earlier in the day coincided with the MACD indicator just beginning to move down from the zero line. This confirmed a valid entry point for selling the pound and resulted in a drop of the pair toward the target level of 1.3494.

Rather weak UK labor market data put pressure on the pound. The unemployment rate rose, as did the number of jobless claims. This negative signal undoubtedly prompted investors to reassess their positions on the British currency. The labor market is a key indicator of economic health, and an increase in unemployment and claims for benefits points to potential problems. It could indicate a slowdown in business activity, reduced investment, and ultimately a risk of recession. The pound's reaction was entirely expected.

Today's NFIB Small Business Optimism Index from the U.S. is unlikely to significantly help the dollar rise further against the pound. Current U.S. macroeconomic indicators, even if positive, may be overshadowed by geopolitical factors. Small business sentiment is certainly important for the domestic economy, but its influence on global currency flows is limited compared to the prevailing role of political news. It's best to monitor the progress of U.S.-China trade negotiations before drawing any conclusions.

As for intraday strategy, I'll focus primarily on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1:I plan to buy the pound today upon reaching the entry point around 1.3513 (green line on the chart) with a target of rising to 1.3541 (thicker green line on the chart). At 1.3541, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point pullback). A bullish move in the pound today is more likely after disappointing trade talks. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2:I also plan to buy the pound today in the event of two consecutive tests of the 1.3490 price level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and may lead to a reversal upward. A rise toward the opposite levels of 1.3513 and 1.3541 can be expected.

Sell Signal

Scenario #1:I plan to sell the pound after a breakout below 1.3490 (red line on the chart), which may trigger a sharp drop in the pair. The main target for sellers will be 1.3440, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point pullback). Sellers are likely to show up in the event of strong data.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2:I also plan to sell the pound today if there are two consecutive tests of the 1.3513 price level while the MACD is in the overbought zone. This will limit the pair's upward potential and may lead to a downward reversal. A drop toward the opposite levels of 1.3490 and 1.3440 can be expected.

Chart Legend:

Important: Beginner Forex traders should exercise great caution when making market entry decisions. It is best to stay out of the market ahead of key fundamental reports to avoid sharp price swings. If you decide to trade during news events, always place stop-loss orders to minimize losses. Without stop orders, you could quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear trading plan—such as the one outlined above. Spontaneous decision-making based on the current market situation is fundamentally a losing strategy for intraday traders.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Desde principios de semana, el mercado del petróleo se mantiene en un equilibrio tenso. El Brent, que perdió su tendencia alcista de mayo, solo logró recuperar parcialmente la caída: tras

Ayer se formaron varios puntos de entrada al mercado. Vamos a mirar el gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico de la mañana presté atención

Los futuros del petróleo Brent se acercaron a la zona de resistencia descendente, pero no lograron consolidarse por encima, retrocediendo hacia abajo. El panorama técnico sigue siendo tenso: el precio

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.